Power Down Delay Slows Price Discovery

Price is the balance point between supply and demand at any given point in time. The Power Down restrictions have the impact of holding Supply off the market. Much of this supply wants to sell at today's price, but cannot. The reason it wants to sell is because those doing the selling have earned a massive profit in a short period of time. Their costs are next to nothing. They will continue to sell until the price falls low enough that it isn't worth selling.

If Steem Power were liquid, then the price would fall toward this equilibrium faster in a race to the exits. The people that dump first win (in the short term) and the rest lose (in the short term). There will always be a market value and the price will never go to 0 so long as there is at least one person who believes in the potential value of the platform. My experience with BitShares and dozens of other cryptocurrency projects is that nothing with any community behind it will fall to 0. Even simple Bitcoin clones that have been around for years and offer relatively little innovation with non-existent development teams (Doge, Peercoin, Namecoin) continue to be traded with $100K+ in daily volume with marketcap in the millions.

Power Down makes Cashout more Fair

With a power down system, everyone is forced to "dollar-cost-average" their selling over 2 years. This means that whales that might have cashed out $1M dollars at the height of the bubble were only able to cash out $50,000 at the high prices while they have watched their remaining Steem Power fall in value to $200,000. Their average "cashout" price will not be the height of the market, but the market average over 2 years.

This has pros and cons. In some sense it limits the ability of speculators to buy and sell over periods of a couple of months. Anyone speculating over more than a couple of days is paying a very large inflation tax. The loss of this speculative capital impacts the liquidity and potentially the price. We live in a world where traders want the ability to move to the next big thing and having capital tied up in the last big thing is a much riskier proposition.

Author Rewards

Author Rewards are also designed to delay cashout by paying in Steem Dollars. You could sell immediately at a loss, or you could "trust and wait" and make more. As the price falls, the market value of the immediate author rewards also falls, but this is OK. Authors looking for a quick buck need to go elsewhere. Meanwhile, those who stay and work to grow the long-term value of the platform will gain in Steem Power. When the value of the platform finally grows as a result of years of effort they will be the new whales.

You may only get $10 worth of Steem Power for a post today. It might not even seem to be worth your time, but if you and others stick around and grow the value of the platform then one day your $10 will be worth $400 if we grow the platform to Bitcoin scale. If we grow to Facebook scale it will be worth $4000.

Starting a Company

Those who start a company are paid in shares that are worthless. They cannot be sold on the market until one day in the distant future the company is successful and has an IPO. The present value of the shares isn't what the entrepreneurial employees care about, it is the future value.

Likewise, a farmer who spends millions of dollars on land, equipment, and seeds works day in and day out in the hope that his farm will eventually produce a crop worth enough to justify his time and effort. The farmer is in the red clear up until the day he brings his harvest to market.

Don't join Steemit for the quick buck. Be glad there is someone willing to pay such high prices for a stake in Steem today. Don't fear the fall in market value, look at the incredible amounts people are still earning. Don't look at what you have today, look at what you could have in the future.

Steem is in the early adopter phase, those who work hard and help pull this platform forward will reap what they sow.

Changing the Power Down Period

If we were to reduce the Power Down period from 2 years to 1 year or even 6 months, this would dramatically increase the net present value of Steem Power while simultaneously increase the amount of liquid Steem on the market in the short term. The end result would be faster price discovery, but no one can say whether the new price will be higher or lower than the old price.

Some people speculate that value that is 2+ years in the future is discounted to near 0 value today (especially in the world of cryptocurrency). This means that longer time horizons have diminishing marginal utility when it comes to encouraging voters to behave in the long-term best interest of the platform.

Emotional Response

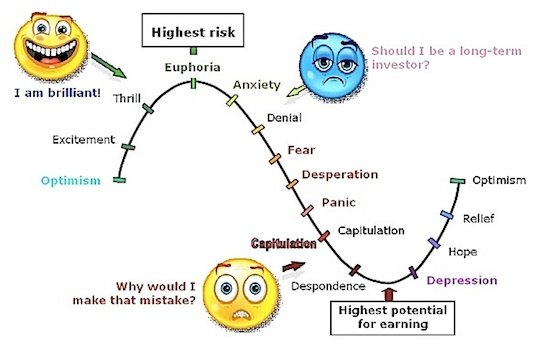

Despite all the logic in the world, humans have irrational feelings with respect to profit and loss. Slow steady growth feels much better than rapid rise followed by slow steady decline even if both curves end up at the same final value (long term growth). I for one prefer a slow steady rise, but that isn't possible until after the rapid rise has fully corrected and realigned. This will take time and won't happen until after fear, desperation, panic, and despondency set in.

Those who know about this emotional roller coaster can ride the waves and maximize their profit, but most people give in to their irrational emotional side and buy high and sell low. My preference is to sell high and buy low.

Don't let the market price set your opinion on the value of a platform, instead make rational buy / sell decisions that factor in both short-term trends and long-term value. This applies to any investment you might consider.