We can help the world's poor and gain up to $600 billion in annual volume

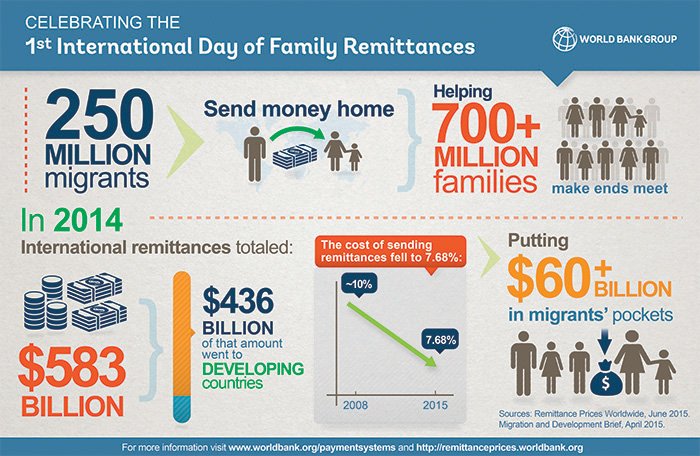

The world has a huge “unbanked” population. In developing countries where there is little opportunity to succeed, many individuals and families depend on remittances (international money transfers) from their relatives abroad. Overall, these money transfers account for $600 billion in annual volume.

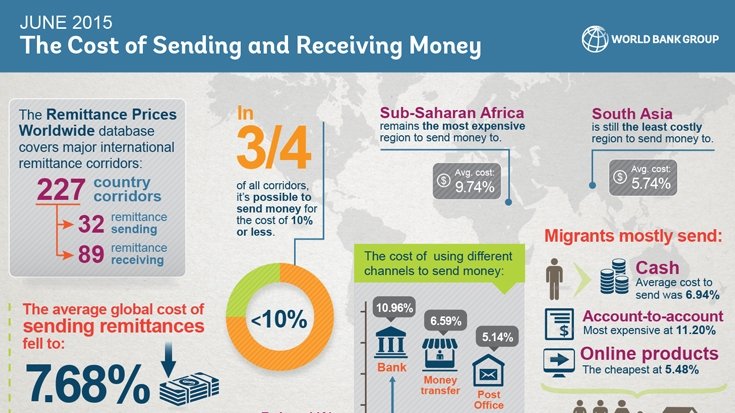

Unfortunately, three large companies have monopolized this money flow to the world’s “unbanked” population. They are conspiring to charge extremely high fees, as much as 5%-12% on the money they transfer. This burden falls heaviest on the “unbanked” who often have no other option to get the money they need.

Western Union, Moneygram, Ria, and their various brand names are pocketing the lion’s share of the $16 billion that this industry rakes in every year. Shame on them for taking so much money from some of the world’s poorest and neediest people.

Fortunately, the world doesn’t need their overpriced infrastructure to send money anymore. Something better has arrived.

How do Remittances Work?

Remittances are cross-border money transfers. Immigrants get jobs in relatively rich countries, earning wages that can seem like a fortune in their home countries. Often, they send money home to their families in developing countries. There is a huge outflow from the wealthier countries like the United States ($56 billion transferred out), Russia ($32 billion transferred out), Saudi Arabia ($36 billion transferred out), and the United Kingdom ($11.6 billion transferred out).

Meanwhile, on the other side, money flows in. In a recent year, people in India received over $70 billion in remittances, people in China $62 billion, people in Mexico almost $25 billion, and people in the Philippines $27 billion. In some smaller countries, the inflow of remittances from abroad makes up a huge share of the gross domestic product (GDP). In Haiti, for example, remittances account for more than 22% of the country’s economy.

Others with a large proportion include El Salvador, Honduras, Jamaica, and Estonia (remittances from abroad account for around 16-17% of the GDP in each country); Kyrgyzstan and Tajikistan (30% and 36% respectively); Moldova, Tonga, and Nepal (all 26%-29%). Way down the list, but still relying on remittances as an important part of their significant economies include Ukraine, Uzbekistan, Egypt, Morocco, Pakistan, and Vietnam (all in the 6-9% range).

Startups to the rescue? Not so fast.

A new generation of startups is attempting to undercut Western Union, Moneygram, and Ria. Though none of them has gained real traction yet, they are posing enough of a challenge that the industry leaders have been lowering their prices for the last year or two. This is excellent news for the world’s poor, but something much better is on the horizon.

The problem with these startups is that each of them relies on a system that is inferior to Steem. WorldRemit, for example, aims to let people transfer money digitally using mobile phones. TransferWise, which is probably the furthest along of any of these startups, has been carving out a market share as the first remittance company that enables true peer-to-peer transactions. While both of these would be an improvement over Western Union-style transfers, any system that does not use cryptocurrency is already overpriced and outdated. The blockchain will always be cheaper.

Ripple Labs created the first real cryptocurrency network. Its concept of using third party gateways for exchange and transfers has been a pioneering vision and it’s provided a blueprint for others to follow. But in the end, the currency has failed to catch on because of its cost and the perception that it is over-centralized. A network with so little community buy in would simply become a cryptocurrency version of the money transfer system that banks use now. The same goes for any other back-end blockchain that the banks may create for themselves.

Other startups such as ZipZap and Remitly have worked to integrate Bitcoin, either explicitly or as a back-end method of transferring value. But Bitcoin’s problems have only accelerated in recent months, making it a less than ideal choice. The mining is expensive and a huge waste of energy. There are governance issues. The Bitcoin network can barely handle its own transaction load, let alone a huge increase in use. Transactions are slow and they do cost money, even if it isn’t much. Bitcoin blazed a trail as the first generation cryptocurrency, but there are far better alternatives today.

We have a solution in the making! “No fee” transactions and more.

Steem and Steem Dollars provide a way to transfer value without paying transaction fees. Steem applies a 21st Century blockchain solution to a problem that has plagued the world for decades….no, for centuries. Millennia? I’m not religious, but moneychangers were mentioned in the Bible (try Matthew 21:12, where Jesus threw them out of the temple). So that goes back at least 2000 years.

Throughout our history, when people have needed to change and move money, others have been there to profit from that exchange. There is nothing wrong with capitalizing on a good business opportunity. But when you are making billions of dollars by squeezing some of the poorest people and countries on the planet, then it’s time for you to go.

A better model: Click, click, money received!

Steem and Steem Dollars are free to use, instant to send, tightly secure, and backed by their own economy: NO OTHER alternative can offer these features. Together, these advantages make Steem and Steem Dollars the best possible basis upon which to build a money transfer framework.

Hopefully, some of the promising remittance startups will consider building around Steem or Steem Dollars. If they don’t, then someone else will. There is big money potential for the one that is ‘first to market’ with an app or network built around Steem. Perhaps it will be someone from the Steemit community who rises up to take on this challenge.

However, there is far more demand than any one company can meet, especially given the unique business climates in each country. There is room for many remittance companies in this space, all operating in different regions or with different niches. If they partner with one another and cooperate on technology, then we could help the world’s poor much more quickly.

The catch is that we are just getting started. The Steem economy is young. There are very few merchants and gateways that can accept Steem or Steem Dollars yet. Until we have more user-friendly off-ramps, people who are undereducated and not technology savvy will have a hard time going through the steps needed to “cash out” into fiat currency.

Of course, there is no need to wait. At least SOME of that $600 billion per year is being transferred to people who know how to use computers. They may not be the poorest of the poor, who need to cash out every cent to buy food, shelter, or medical supplies. But they may well need money for other important reasons: buying an airplane ticket, paying for a wedding, or completing college. We can start with them.

Steem and Steem Dollars are tools to help the world

We have Steemit community members in dozens of countries. So let’s encourage everyone we know to begin using Steem or Steem Dollars to transfer monetary value. They can use STEEM if they want something liquid and easily convertible, or Steem Dollars if they prefer the price stable feature.

Your friends and family members do not need to be bloggers or voters to have a Steemit account. The wallet on Steemit is well built. You can use it to send and receive currency with a few clicks of a button.

With Steemit getting all the attention so far, it’s easy to forget that we are supported by these truly revolutionary currency tokens. Steemit’s growth can help a lot of people, but Steem’s growth will help even more. While we enjoy the Steemit platform, let’s start using its currencies to make the world better.

Sources:

Global Remittances by amount and as percentage of GDP: http://www.migrationpolicy.org/programs/data-hub/global-remittances-guide

Startups in Remittance Field: https://www.cbinsights.com/blog/disrupting-western-union-moneygram/

More on Startups: https://www.saveonsend.com/blog/money-transfer-startups/

TransferWise CEO’s Reddit AMA: https://www.reddit.com/r/IAmA/comments/32pofj/i_was_the_1st_employee_of_skype_now_im_fighting/

Battle for Int’l Money Transfers: https://bitcoinmagazine.com/articles/transferwise-on-bitcoin-and-the-battle-for-international-money-transfers-1453996516