Hey everyone!

Short introduction

I've been a believer of Eth for as long as I can remember. I'm not saying this cause I want you all to buy it up now for my own gain, there is plenty of proof on the internet of me believing it would at one point pass Bitcoins marketcap. That was not cause I hate Bitcoin, it is after all the currency that started everything with one of the biggest innovations, but its mainly cause I hate their development and the way they keep censoring people who are legitimately concerned about its future.

With that being said, Eth is not my favorite blockchain, I wouldn't be spending most of my time here on this platform if it was. The flippening has sure been interesting to follow, though. I'm glad a few of my friends have trusted my judgement and advice not to hold all their crypto assets in Bitcoin only over the past couple years. Wish others were open-minded about alternative currencies as well, thus I thought I'd start this news series where I bring up various news on different currencies and what is going on with them.

Visa are now looking for an Ethereum Blockchain Engineer.

It feels sort of surreal that the time has come where one of the most popular payment service providers are looking to upgrade their systems with blockchain, for many believers it was only a matter of time and now we are finally here.

This screenshot is from their open recruitment application which you can find the full version in this link.

Ethereum had a Flash Crash on one of the biggest exchanges GDAX (a.k.a Coinbase)

For many traders this is a complete nightmare. When the EOS website was announced I made a comment jokingly to "long ETH" which usually refers to margin trading. That's where you loan more assets than you have because you believe the price will go up thus profit more from it than what you can afford to trade normally with. This is something that is definitely not recommended for newcomers, the added fees and usual price manipulation make it very difficult for you to profit from it - the risk is even bigger when in volatile markets and this is not the first time something like this has happened. The opposite of long is shorting - where you loan the assets in hopes to buy in cheaper later if you believe the price will drop short-term.

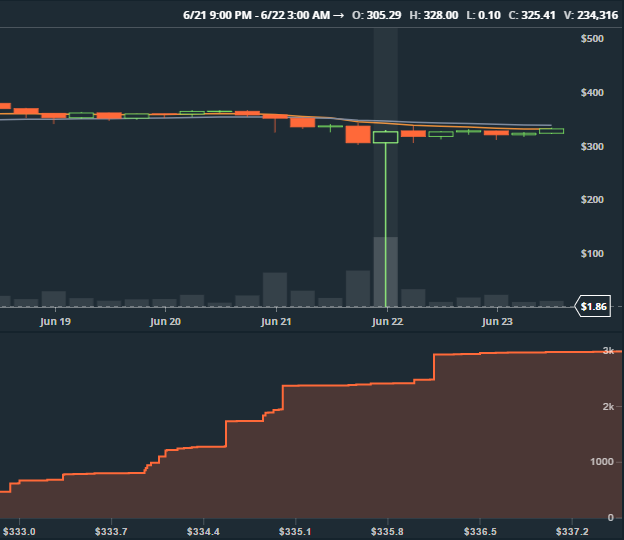

For those who were margin trading on GDAX last night - this means that they all have been liquidated of their funds, depending on the loan (on poloniex its 2.5x - probably the same on GDAX) this means that everyone who was long on ETH has lost over 60% of their funds cause of the Flash Crash. This is what it looked like on the charts.

Apparently it dropped down to a whopping 10 cents USD each. Some traders who have placed buy orders expecting something like this to happen may have woken up today to a very nice surprise. One trader on the Ethereum subreddits felt like sharing some of his trades after this event.

I stumbled upon this hilarious video that explains Blockchain in a short and funny way. I think this will be my go-to video from now on when newcomers ask me what it is I'm doing when I tell them I'm into Blockchain Tech. Take a look!

Credit to SuperDeluxe

Hope you enjoyed this read, now that I might have more time to spend on alt-coins and their developments I've been thinking of doing these news posts more often and slowly also getting back to my online portfolio @cryptochannel where 10% of the funds go to Steemians who are active and interact on the posts - so make sure to follow it if this is something that interests you.

The whole point with the account was to introduce newcomers to more currencies and have them hold a share of them without needing to make the risky jump of having to invest in them themselves.

Disclaimer: What is posted on these news articles should not be considered as trading or investment advice. Please do your own re-search and as always don't place more funds than you can afford to lose.