This is a followup to a post that @dollarvigilante wrote on banks and the recent Wells Fargo scandal.

What Happened

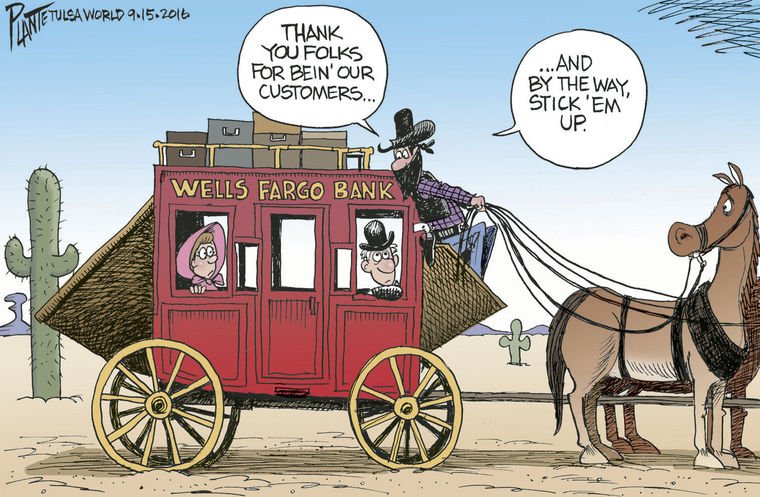

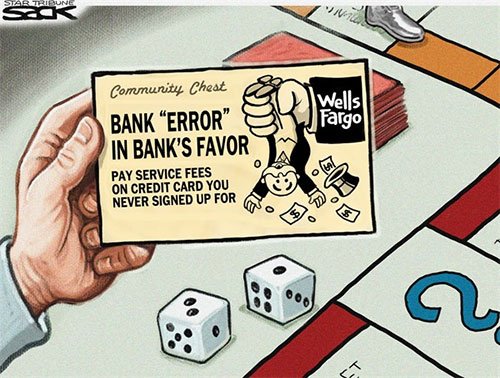

To recap - Starting in 2011, bank employees opened roughly 1.5 million bank accounts and submitted applications for 565,000 credit cards without customers authorization and using false email accounts. This was done so employees could hit sales targets and receive bonuses which also led to the bank earning extra fees from unwitting customers, as well as artificially inflating its sales figures.

The way it worked was that employees moved funds from customers' existing accounts into newly-created ones without their knowledge or consent. As a result, customers were being charged for insufficient funds or overdraft fees because there wasn't enough money in their original accounts. Of the 565,000 Credit Card accounts applied for, 14,000 of those accounts incurred over $400,000 in fees (a mixture of annual fees, interest charges, and overdraft-protection fees.)

Aftermath

Aside from the number of fines that Wells Fargo has incurred

$100 million will go toward the CFPB's Civil Penalty Fund, $35 million will go to the Office of the Comptroller of the Currency, and another $50 million will be paid to the City and County of Los Angeles.

Really?!?! Does the government really need more money?

The bank has also fired about 5,300 employees over the last five years who were said to have been involved in the scams and has also agreed to refund $5 million to impacted customers. What does this mean for CEO John Stumpf and what about his career? Absolutely nothing - He simply said "sorry," but he has no plans to exit. As for the bank itself - the fines are just small change given Wells Fargo has the highest market valuation among any bank in America, worth just over $250 billion.

According to CNN, the U.S. House Financial Services Committee announced it would launch an investigation into the bank and hold a hearing in later September where John Stumpf will testify. Let's see what else is uncovered during the investigation.

What about the customer

According to Wells Fargo, they have already refunded about $2.5 million to customers. On top of that there are several class action lawsuits underway against Wells Fargo.

What does this mean for you

Because of the continued issues we face with governments and the banking system, I don't believe that this will be the last time we here about scams such as this. The financial system as we know it will eventually collapse and we all know that it will be us left holding the bag. I continue to believe that the support and the need for alternative decentralized currencies will continue to grow.

Hold onto your Steem, your Bitcoin, your Ethereum, and any other cryptocurrencies you have. I have a feeling that one day you will need them and that all of them will increase in value.

Thanks for reading. Let me know what you think!