Is Japan Going to Become the New Cryptocurrency Powerhouse?

With the recent hard stance by China and South Korea on Bitcoin exchanges and Initial Coin Offerings, the markets have endured an extremely rough September. Many are now wondering what the next step is and whether or not Chinese exchanges will actually cease trading permanently.

In contrast to this, Japan has moved to capitalize on the rejection led by the Chinese authorities. Since the withdrawal freeze on the largest Chinese exchanges in early 2017, Japan has moved rapidly towards embracing not only Bitcoin as an accepted payment option in many popular retailers, but blockchain technology itself, with the majority of Japanese banks working with Ripple and its solutions to revolutionize the banking sector.

Eleven Exchanges Approved By Japan's Financial Services Agency

Cementing the warm embracement of cryptocurrency, Japan's Financial Services Agency (FSA) endorsed eleven cryptocurrency exchanges, providing them with official licences to trade flagship coins, such as Bitcoin, Ethereum, and many others, bringing another major step towards mainstream usage led by Japan.

Despite Mt Gox being the largest Bitcoin exchange in the world at one time, the FSA has made it extremely clear that they will not allow a repeat of the incident, where 850,000 bitcoins were stolen. It seems that the FSA is taking these steps to help bring safety to users and investors due to the severity of the Mt Gox incident.

Not Just Any Exchange Can Be Endorsed!

As usage in cryptocurrencies has surged worldwide, governments are starting to take notice, whether it's to legalize or demonize the industry.

Japan's financial authorities are taking cryptocurrencies seriously, requesting that exchanges meet a certain criteria if they wish to be endorsed. Despite eleven exchanges being given the green light, another seventeen are still being reviewed by the FSA.

Mt Gox may have been a bitter blessing in disguise, helping the Japanese protect investors but still acknowledging the importance of innovation and the advancement of technology.

How Could This Affect the Markets?

Japan embracing Bitcoin earlier this year triggered an even stronger price push, including the price spikes Ripple and NEM experienced, which many believe are due to huge investments by the Japanese.

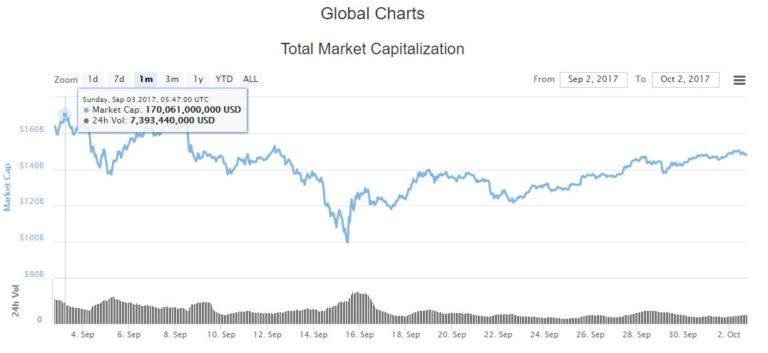

Despite their recent hard stance on cryptocurrencies, South Korea is mainly following Japan's upbeat mentality, with early September bringing all-time highs for Bitcoin and Litecoin and the cryptocurrency market cap peaking at $170 billion just before the barrage of bad news from China.

The added volume could trigger further returns to previous highs. It will be interesting to see other nations begin to show their stance on cryptocurrencies in the wake of China's regulations.