Indian government is yet to consider Bitcoin as a legal tender. Under the current framework you can buy and sell virtual currencies but the government hasn't made any official statement saying that says it is legal to use it. Any news to this effect that you may have read anywhere is essentially incorrect. The most that has happened in the past few months is that the Indian government is considering a regulatory framework around Bitcoin and cryptocurrencies in general.

It's in a grey area currently and that's the truth.

Refer to this URL for more information on Bitcoin's legal status in India: https://cis-india.org/internet-governance/bitcoin-legal-regulation-india

It's no doubt that India has played a small role in driving up the BTC prices ever since demonetisation of Indian currency notes in Nov, 2016. Even today owing to devaluation of the rupee against BTC, the prices are generally on the higher side in India.

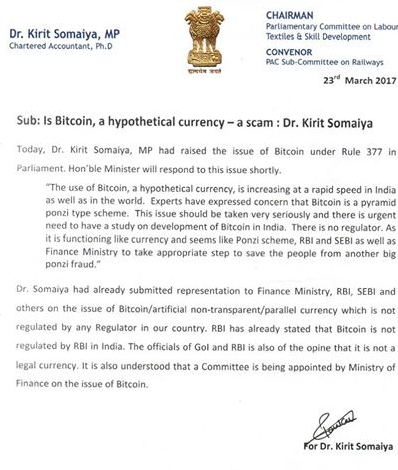

Many members of the Indian parliament are largely clueless about the nature of cryptocurrencies and their use. India is a financial risk-averse country with respect to it's current monetary policies, which makes it difficult to implement a pro-crypto policy in the short-term.

However, the Indian government recently invited public opinion on Bitcoin and other cryptocurrencies. Many Indians used this opportunity to express their desire to make BTC part of the everyday financial systems. But, reports such as 'Bitcoin from now on is considered fully legal' can cause confusion. It might build up hype amongst Indian users but unfortunately our market and regulatory framework is still at a nascent stage for mass adoption of Bitcoins.

We are far from seeing BTC as legal tender in India and it's highly unlikely that we'll see that happen in the near future. At best, we can expect to see a framework that allows the government to form reasonable laws for taxing the public on any capital gains, personal income or perhaps a corporate income tax for any BTC transactions or income generated through BTC/INR trades.

Currently there are no specific taxation laws that determines how to file your taxes when you are dealing in cryptocurrencies and every auditor is clueless about this aspect.

Framework might be built under the Indian Foreign Exchange Management Act to curb use of the cryptocurrencies as well. But, fortunately the government realizes that it cannot stop it's people from using Bitcoins. This might actually drive them to make a pro-crypto policy that can yield positive economic results in the long run.

The current official stance of the Indian government is that they have repeatedly cautioned everyone against use of cryptocurrencies such as Bitcoin and it is largely viewed with suspicion as it is beyond the 'control of the government's monetary policies.'

Let us not jump the gun on Indian government's monetary policies around Bitcoin. It would be wise to remember that Indian government monetary policies take years to form shape.

Even as a Indian business owner has begun accepting Bitcoins at his restaurant in India, we are far from seeing it as a legal tender which anyone can buy/sell groceries with!

Personally, I would like see the Indian government to rope in Indian Bitcoin exchanges or experts like Andreas M. Antonopoulos when forming their policies that should ideally have a positive impact on our economy in the long run.

But my expectations from my country's government aren't nearly as high!

1st Image: Pixabay

Thank you for your attention and support.

You may also continue reading my recent posts which might interest you:

- TheQuint Features My Story as an Early Adopter to Bitcoin, Steemit & More!

- Let's Talk—Importance of Being Charitable from a Young Age!

- Let's Talk—How To Deal Effectively with Steemit Skeptics on Facebook and Reddit!