SUMMARY

Bitcoin (BTC) overnight price action shows it to be below the Neck Line. IF this count continues, a brief rise for white wave 2 of C is expected. This pathway is not calling for a lower low but a wave an ABC retracement.

The target is set to the 0.786 Fib zone as the minimum travel for the H&S shows $7,670; beyond the 0.618 Fib level.

I'm keeping an eye on this wedge pattern as well; given how BTC has the trait to form these repeatedly. IF a breakout occurs, then the wedge could serve as the wave 2 and no travel towards the 0.786 Fib level would be required.

The wedge would still deliver a 0.5 Fib level retracement which is a common retracement zone.

Meanwhile, teh larger Inverted Head & Shoulders pattern is still in play and has not been invalidated. I've angled the Neck Line to reflect the fractal with the smaller inverted H&S that was completed.

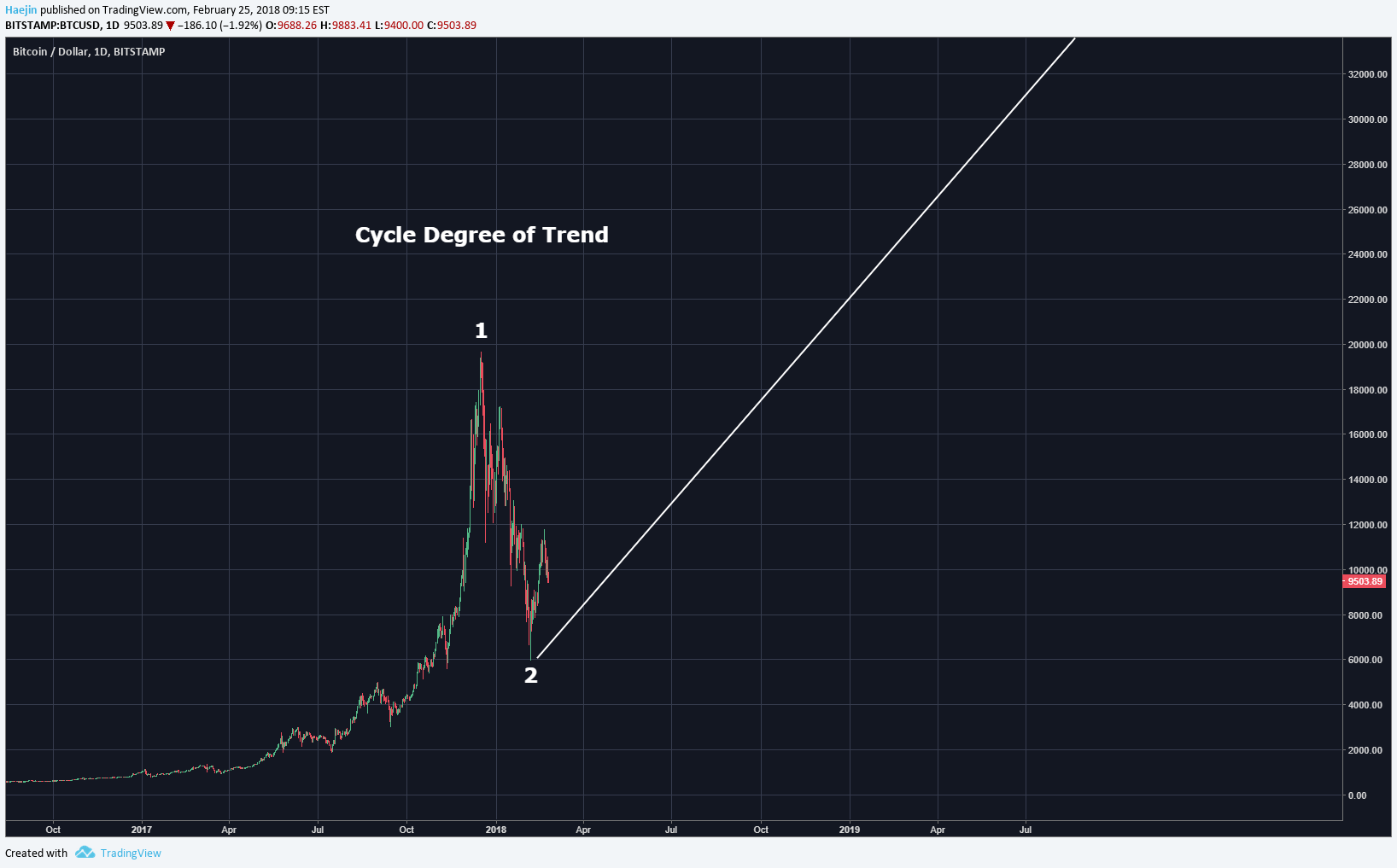

The video has more details on this; but here is the Cycle degree of trend for Bitcoin showing that from the genesis to about $20k; it was wave 1 and the current correction is fulfilling the role of the wave 2 correction. What comes after wave 2? Wave 3 and the distance it can travel will be jaw dropping and the speed at which it can deliver such 5x, 10x, 20x; 30x; 40x rates of rise will be a sight to behold. So, what matter does it make if Bitcoin makes a lower low? Of Bitcoin, at such levels I would be an aggressive buyer!

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--