SUMMARY

This is a simple trend following strategy. I have found the following biweekly rebalancing strategy to be very profitable, easy and a departure away from losses! The following ETFs are used:

SPXL: 3x S&P 500 Leveraged ETF

ZIV: VelocityShares Daily Inverse VIX Medium-Term ETN. This fund takes advantage of the contango of the midterm Vix futures which the etf shorts.

TMF: Direxion Daily 20+ Yr Trsy Bull 3X ETF

Every two weeks, identify the ETF with the largest % gain and rebalance 80% of funds into that ETF and rebalance 20% of total fund to the TMF fund. That's it!

- This has averaged about 54.6% annualized average return since 2010. Go ahead, do the back tests.

- By rotating into the best performing ETF, this strategy prevents you from day trading!

- Less stress and more time away from the computer charts

- Should there be a market correction or a crash, this method will take you out of SPXL and into the safety of an inverse correleated ETF like TMF which is long term treasuries.

- The NIV etf is complex to understand but simple to know that back tests have shown simple HODL of this ETF generates about 34% annual return. Not too shabby.

- The SHARP ratio is 12.2, acceptable, and can be lowered to 4.2 if you replace SPXL with SPY.

- Draw Down is about 18% but lower if SPXL is replaced with SPY.

You can also modify this portofolio with any other ETFs. For instance, if you want to be be less agressive, then SPY, TLT, and ZIV would be more suitable and still attain annualized returns of >34%.

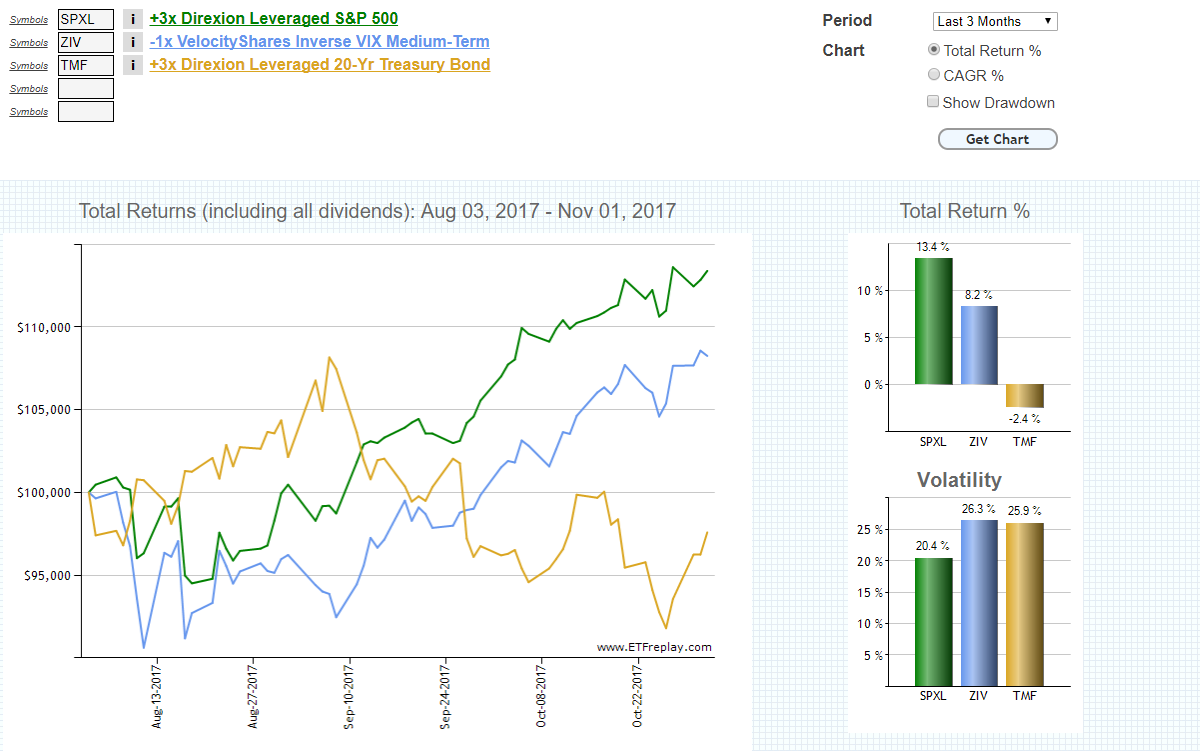

Let's run through an example. I use https://www.etfreplay.com/charts.aspx to generate a rolling 3 month chart of the three ETFS. The below shows the past 3 month total returns and volatility and SPXL has the highest % gains. So, very simply, I would allocate 80% of funds into SPXL and 20% into TMF. If in two weeks, ZIV has the highest % increase, then it would have 80% of funds.

The volatility is 20% to 26% which is acceptable for an agressive portfolio. Drawdown is also acceptable at -15%.

The beauty of this portfolio is that you follow the trend. There will be many biweekly times when you make zero changes because the same ETF will sustain the highest % gains because of the trend it might be in.

This is not a blind strategy, it is an effective strategy that is a clear departure away from the traditional mutual fund based option. This strategy also takes you OUT of the equities and into the safety of treasuries should there be a market crash. This is because TMF will show as the highest % gainer and thus receive 80% of funds.

You can also modify it by going 100% into the highest gaining ETF. You can add additioanl ETFs, it need not be limited to only three.I wouldn't mix individual stocks with ETFs as they will wallop your SHARP, Drawdown and Volatility values.

I wish you MASSIVE profits!

PS: I am experimenting this method with Cryptos...more to come on the results!

--

If this blog post has entertained or helped you to profit, please follow, upvote, resteem and/or consider buying me a beer:

BTS Wallet - d2e60e9856c36f34

BTC Wallet - 15ugC4U4k3qsxEXT5YF7ukz3pjtnw2im8B

ETH Wallet - 0x1Ab87962dD59BBfFe33819772C950F0B38554030

LTC Wallet - LefeWrQXumis3MzrsvxHWzpNBAAFDQbB66

Legal Mumbo Jumbo: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.**