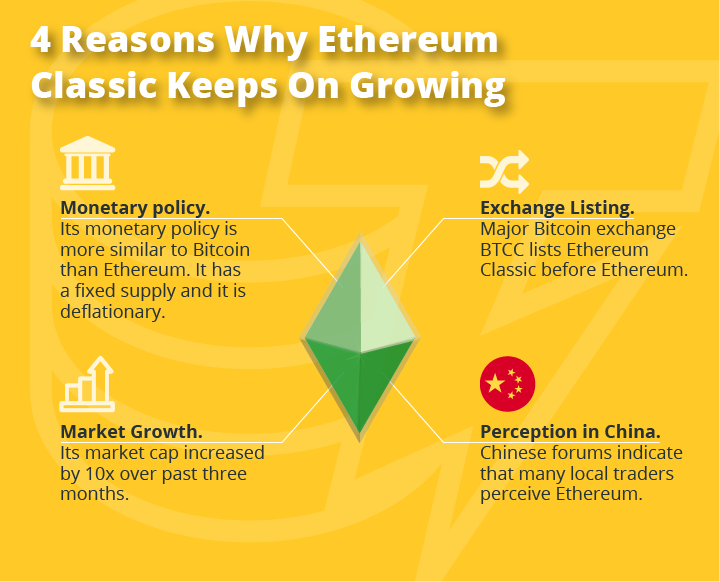

BTCC, the second largest Bitcoin exchange in China and the world, has announced the integration of Ethereum Classic on its newly released digital cryptocurrency exchange BTCC DAX.

High-profile Bitcoin trader and researcher Beetcoin revealed that the integration of Ethereum Classic by the BTCC DAX development team is the first listing of Ethereum Classic by a major Chinese exchange before Ethereum.

Earlier this month, local sources including cnLedger announced that major Chinese Bitcoin exchanges including Huobi and OKCoin have started to offer Ethereum trading support to local investors and traders.

Impact on South Korea, China

As a result, Ethereum trading, which was heavily concentrated in the South Korean market, the largest Ethereum exchange market with 27.6 percent market share, distributed across the Chinese exchange market - the second largest Ethereum market with 18.8 percent market share.

Within the Chinese Ethereum exchange market, OKCoin and Huobi, two of the largest trading platforms in China, are responsible for processing more than 63 percent of the country’s Ethereum trades.

In early June, inaccurate news reports in regard to the implementation of Ethereum Classic by OKCoin emerged. As reported by cnLedger, OKCoin customer representatives denied any plans of integrating Ethereum Classic in the near future.

To this date, BTCC remains as the only major Chinese cryptocurrency exchange to integrate Ethereum Classic and offer support for ETC traders.

According to BTCC, its flagship digital asset exchange DAX will also be opened for users worldwide as a global crypto-to-crypto exchange. In essence, it is similar to ShapeShift, the most widely utilized fiat-less cryptocurrency trading platform on the market.

Why Ethereum Classic?

The value of Ethereum Classic has risen by around 10x in the past three months with its market cap surging from $200 mln to nearly $2 bln. A major factor that pushed the surge of Ethereum Classic’s market cap has been the launch of the Ethereum Classic Investment Trust Digital Currency Group’s GrayScale Investment which has allowed investors in the public market to invest in Ethereum Classic.

However, it is also important to consider the change in Ethereum Classic’s monetary policy which was implemented in March of 2017. Through the execution of a fork, Ethereum Classic altered its monetary policy from an inflationary policy to deflationary, implementing a fixed supply that is similar to that of Bitcoin.

“Platform token is a critical part of blockchain system that aligns economic incentives of key stakeholders, users, developers, investors, and miners. Its monetization makes everything tick and helps to bootstrap the ecosystem. However, it has been shown time and again in economic history that reliable long-term monetization is impossible without two key characteristics; utility and scarcity,” Ethereum Classic movement pioneer Arvicco wrote.

Within a period of three months, Ethereum Classic transformed into a digital currency from a digital asset due to the major change in its monetary policy.