Alchemy

Alchemy is a philosophical and protoscientific tradition practiced throughout Europe, Egypt and Asia. It aimed to purify, mature, and perfect certain objects.[1][2][n 1] Common aims were chrysopoeia, the transmutation of "base metals" (e.g., lead) into "noble" ones (particularly gold); the creation of an elixir of immortality; the creation of panaceas able to cure any disease; and the development of an alkahest, a universal solvent.[3]

Alchemy is viewed today as a pseudo-science especially of which the practitioner seeks to do something science deems impossible, for example, trying to turn different materials into gold. But not long ago even some of the brightest minds were devout alchemists:

Isaac Newton devoted considerably more of his writing to the study of alchemy (see Isaac Newton's occult studies) than he did to either optics or physics.~https://en.wikipedia.org/wiki/Alchemy

What is interesting about Newton in regard to Gold is something John Nash points out in his lectures on the subject of Ideal Money:

It is easy to illustrate cases of “revolutionary” reform or change in systems of money. A good example came in 1717 when Isaac Newton, supported by George II, fixed the value of the local UK currency to a precise amount of gold that defined the value of the currency (the “pound”) in such a way that it was immediately recognizable throughout the Continent (of Europe) as of a fixed value in relation to generally accepted standards (of the time). (And this was the origin of the “gold standard”.)~Nash Ideal Money

Newton spent his life seeking to understand that nature and value of gold for seemingly good reason. At his time, gold became the crux of global social reality.

The History of the Value of Gold

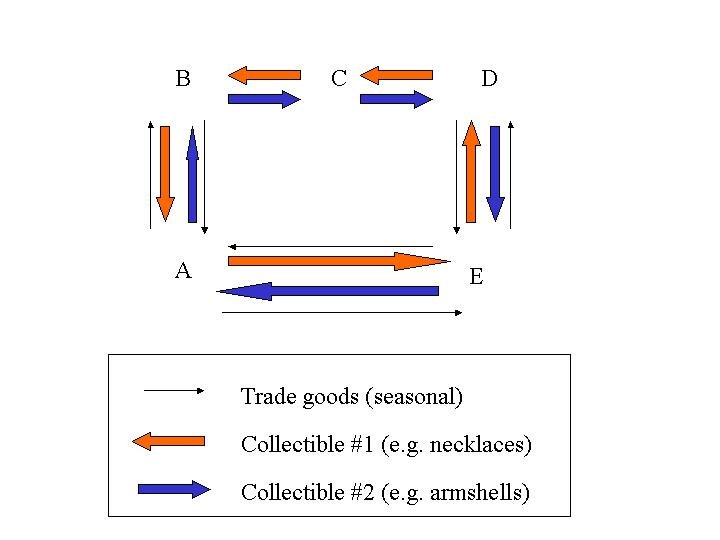

To understand the history and relevant evolution of Gold on its quest to become so valued and sought after we might turn to Nick Szabos essay on the origins of money. Szabo shows that money natural arises necessarily to solve a coincidence of wants. Before gold was minted into coins it seems jewelry money or “proto-money as Szabo calls it used different mediums and metals in order to represent accounting systems.

Eventually these systems of money and coinage arose to form the institutions and systems we have today. The most indepth account of this evolution was given by Adam Smith in his treatise on The Wealth of Nations.

The value of gold eventually arose as a settlement solution among Nations in order to solve a global coincidence of wants and bargaining problem.

Why is Gold Valuable Today?

Since the world officially broke from the Breton woods/gold standard in 1971 (Nixon shock) gold has played a different role than its traditional role as it now has to relate to a floating currency system.

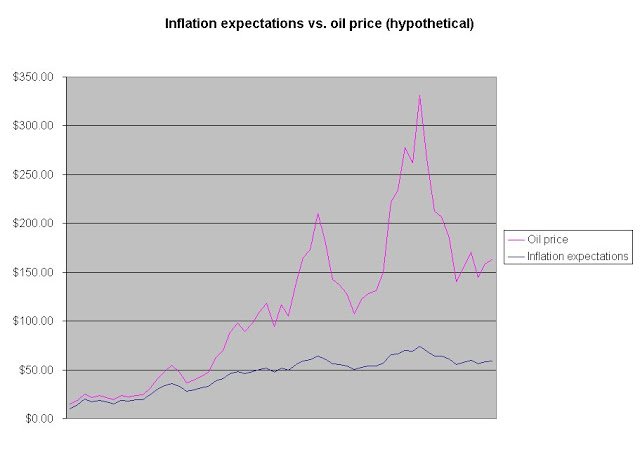

Nick Szabo gives his understanding of the nature and value gold (and other such “liquid commodities)” in his writing Simulations of inflation expectations and oil prices

The basic point he makes is that the value of gold and other commodities used to hedge versus inflation is such that it increases during times of instability and poor quality money, whereas gold’s value decreases in times when the monetary system is more stable and well kept.

Gold is valuable when the economy is unstable, and not so much when the economy is stable.

How to Create a Stable/Valuable Asset

Silver Thursday was an event that occurred in the United States in the silver commodity markets on Thursday,

March 27, 1980, following the Hunt brothers attempt at cornering the silver market.

The Hunts lost over a billion dollars through this incident, but the family fortunes survived. ~https://en.wikipedia.org/wiki/Silver_Thursday

Going about creating wealth from thin air is a delicate endeavor.

If we understand the driving force behind TODAY’s valuation of Gold we might gain a different perspective when it comes to turning something into gold formulaically. The question that arises is 'How can one create an asset that is stable in the same way that gold’s stability is valued so highly?’

Here are some of Nash’s sentiments on what causes gold to be valued for its “stability”:

It is a coincidental fact that the inherent nature of mining and mining technology makes it possible for the prices of certain commodities that are produced as a result of the devotion of labor and capital to the effort of mining to increase less (or decrease more) than might be expected. There is a “dimension paradox”: Agricultural products are produced by using the two-dimensional resource of the earth surface, so the “disappearing frontier” creates a limitation. In contrast, some mining, particularly for elemental metals, can essentially be done in three dimensions, although, of course, there are increasing costs for deep digging.

If we then consider which commodities would be optimally suitable for providing a basis for a means of transferring utility, and if we specifically consider the possibility that the trading partners may be located in different nations and perhaps on different continents, than the suitability of such commodities with regard to the ideal function of facilitating utility transfer depends on the extent to which such a commodity seems to have a value independent of its geographical location.

Clearly, in terms of this geographical perspective, gold has historically been optimal, largely because the labor cost of moving it over great distances is so small relative to the value of what is being transported. Thus, gold formed a very efficiently movable medium for the transportation of a value exchangeable for other values, ultimately deriving, in one way or another, from human labor (with the achievements of warriors here also being viewed as involving labor).

Gold is mined at a certain, reasonably steady, and predictable rate. Nash notes that part of the reason for this is that the cost of digging deeper increases. So there is a sort of limiting factor in regard to the cost of production. If the cost of digging deeper (or mining comets) did not increase, we would expect their to be more gold mined.

So there is a sort of natural limitation here to the gold being produced even though there is 'lots and lots of gold' to be found.

On the Evolution of a Valuable Gold Standard

Satoshi once made a significant point about the valuation of commodities (sans inflation hedging):

The price of any commodity tends to gravitate toward the production cost.~Satoshi Nakamoto

Nash makes a few relevant points about why gold might be falling out of flavor:

Nowadays, however, few would propose a return to the actual use of simply the metal gold as a standard, for the following reasons.

(i) The cost of mining gold effectively does depend on the technology. Recent cyanide leaching techniques have made it possible again to profitability mind gold at formerly abandoned sites in the U.S. so that it is now a big producer. However, the unpredictability of the cost is a negative factor.

(ii) The location of potential gold-mining locations may not be “politically appealing.” so it would seem undesirable to make a political choice to enhance the economic importance of those particular areas.

(iii) There is some negative psychology about gold such that even if it were the most logical choice after all, the unpopularity of the idea could be very obstructive.

Bitcoin, it seems, does not have these unfavorable characteristics.

Satoshi the Alchemist

If we believe Bitcoin can evolve to become a settlement system for nations and/or a fairly stable metric for valuation over time these are the considerations that Satoshi might have pondered while coming up with the implementation for Bitcoin. He certainly would have wanted his project to be valuable.

For most people what it means to formulate bitcoin to be the next digital gold means something DIFFERENT than what Nash alluded to and what Szabo seemed to be designing.

Bitcoin as an e-cash would function similarly as a digital gold. But the ultimate evolution and the implication of the initial setup and parameters would evolve to be quite different from each other.

In order to create the most relevant transmutation of our recent historical(ly high) valuation of gold into a digital equivalent you would design bitcoin to function in the exact way it does today-and you would want that function to remain unchangeable for ALL time.