-August 5, 2017. Less than 4 days after the Bitcoin Cash fork-

As I write this, the price of Bitcoin Core is 3289 USD. A new all time high was reached last night and passed again a few hours later. This trend will likely to become the norm for the coming months.

You’ve probably heard of estimates for the price of Bitcoin at 5000 USD by the end of the year. Even higher. I’ve said this before in various channels, 5000 USD by 2018 seems to me a comfortable target. Only now, that a major breakthrough has happened in Bitcoin’s scaling and consensus.

The events of August 1st have been a great breath of fresh air for a lot of Bitcoiners. Bitcoin Cash, the competing scaling roadmap that was hard fought over for the past 4 or so years has finally decided to fork, and go their own way. Or so it seems.

As I mentioned before on various mediums, It is that internal conflict about the future of Bitcoin that was holding back its growth.

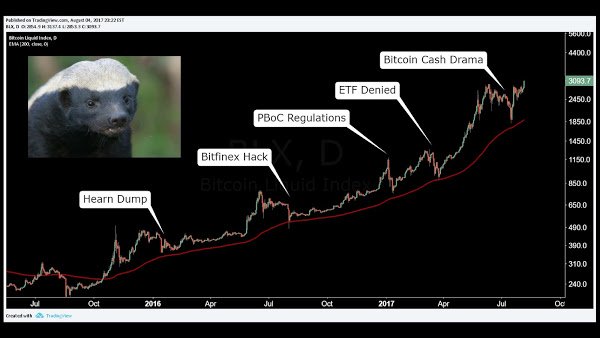

Closely analogous to the price behaviour of Ethereum during the DAO crisis, the price of Bitcoin stagnated and bounced in uncertainty for weeks, only to see a massive rise after both competing factions gave up on collaboration and decided to go their own ways.

(

)https://twitter.com/CarpeNoctom/status/893690960563118081

- CarpeNoctom

With both development communities officially on their own chains. Core and Blockstream are free-er then they have been in years to pursue and implement all they wish for Bitcoin.

Bitcoin Cash on the other hand no longer have to fight the highly conservative Bitcoin Core community on every potential upgrade and can explore more advanced consensus games on their own realm.

This long term could also be very bullish for Bitcoin Cash, but they’ll have to prove their technical competency at a level that they as far as I can tell have yet to prove.

It’s not that I can code remotely as well as any of them. It’s that they are not just competing with Bitcoin, but with thousands of altcoins behind them. DASH being one of the strongest players in the digital cash market, for what little ground they’ve covered.

Segwit and lightning networks also have an eye on the retail and currency space but will have significant infrastructure to build for their solutions to be simple and usable. Both strategies still have much to prove. It’s still very early on.

So what do you do with your Bitcoin Cash?

Well, if you were lucky enough to have some Bitcoin in one of the exchanges that within the days before the fork decided to enable BTC/BCH trading, like Bittrex, then you’ve probably already sold.

If you are late to the pump and are holding onto your BCH, then you have a difficult choice.

Do you believe in the Bitcoin Cash vision? Of emergent consensus, with dynamic block size growth determined by miners?

Do you believe that there are sufficient incentives for non corporate users to host blockchains that could grow at 8mb or more every 10 minutes?

Do you believe that the Bitcoin Cash development community have the development competency to pull it off?

My bet right now is simple. As far as these two coins go, I’m about 70% Bitcoin, 30% Bitcoin Cash.

The reason being that I’ve seen altcoins struggle for years to implement theoretically sound visions. This is a very difficult space to create on. It’s the cutting edge of economics, IT, distributed systems, cryptography and finance, among others. The talent and planning required to not make major mistakes while trying to modify a ship worth billions of dollars is of heroic caliber.

Meanwhile, Bitcoin core has retained what many believe are top engineers in the industry.

Who’s right? time will tell.

Bitcoin Cash Price

On August the 2nd I posted on my Facebook.

“Just FYI. Bitcoin Cash prices are very distorted right now.

Kraken and Bittrex, top volume exchanges are not accepting deposits not withdrawals of BCH, for network stability and security reasons.

The only tokens trading on exchanges right now are those split from exchange BTC holdings and delivered to customer accounts.

Since you can deposit other cryptos and buy BCH, then you see high demand and short supply.

Meanwhile those with BCH off exchanges are stuck out of the market, unless they sell OTC to high trust buyers.

It'll be a month before we see higher quality price discovery in BCH. The dump probably has not happened yet.”

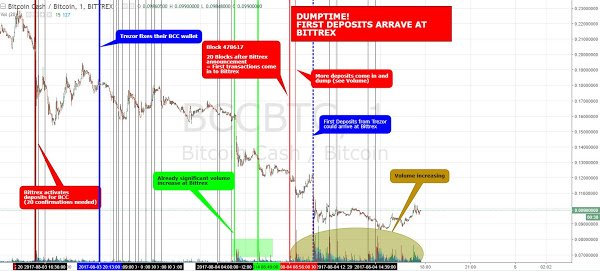

Since then we saw the price of BCH on Bittrex go near 0.5 BTC a piece, only to go down 0.067 BTC a piece or 220 USD as of time of writing.

The price collapse seems to happen in batches every time a BCH block is mined, which is when deposits into exchanges can happen. As revealed by this chart. A dump was to be expected.

(

)https://twitter.com/altcoinmann/status/893528156442943488

- altcoinmann

Can the price of Bitcoin Cash recover?

I would not rule it out. Everything bottoms at some point and this is no ordinary altcoin.

One of the things it has going for it, is the millions of dollars worth of free advertising that is has received. Negative or otherwise, even CNBC is publishing about it, alongside thousands other who are discussing it all over the world.

The people behind Bitcoin Cash are also deeply connected into the Bitcoin ecosystem and it should be relatively easy for platforms like exchanges and some payment processors to add Bitcoin Cash to their platforms.

Wallets in general are sticking to Bitcoin. That could change but it would require serious user interface redesign and thus serious investments.

There’s also a fierce war being fought over the Bitcoin brand. This will likely become more and more visible over the coming months.

Is Bitcoin Cash the original Bitcoin? Is it Core’s open source product? Is it the Bitcoin like blockchain with the most hashing power? Or the one with the longest chain?

(

)https://twitter.com/gavinandresen/status/892717872442683392

- gavinandresen

Bitcoin’s brand is being fought over as we speak and will likely be the source of drama and future battlegrounds as both chains move further away from each other's common ground.

Bitcoin Cash, The Big Blocker’s Insurance Policy

There is however an alternative theory as to what is going on. And it is that this scaling conflict is not over yet.

Jihan Wu, Bitmain, Roger Ver, the Bitcoin.com mining pool among, Barry Silbert’s Digital Currency Group and other Big blockers, are still pushing forward the ‘Segwit2x’ New York agreement. An agreement that I’ve seen Core and Blockstream say they were not invited to partake in or give input on.

This agreement puts forth a 2 mb hard fork of Bitcoin set in November of 2017.

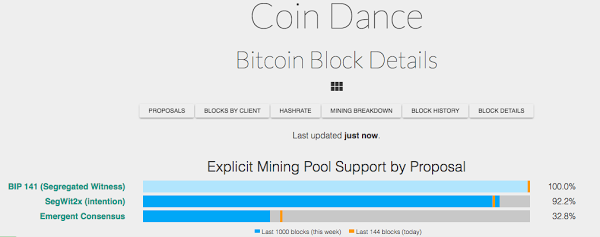

The fascinating thing about this is, Segwit2x has a lot of miner support. 92% is nothing to balk at. Strange given that Segwit2x supports the Core dreaded Asicboost.

If Core does not support Segwit2x, they will be shown as the unreasonable ones, the ones against miner consensus. Miners who to a serious degree are independent users pointing their power to specific pools and using their influence however possible to direct the pool’s behaviour on these crypto consensus decisions.

If Core rejects this Segwit2x, which whispers and market sentiment from my experience is that they want to, then the big blockers now have Bitcoin Cash to point their hashing power to. And they’ll have a very strong ethical argumentation behind them. After all, if 90% of miners support a particular change, who are the developers to oppose that? Who do the developers work for?

They got Segwit in, after all. And the markets are signaling confidence, so users are in general happy.

As we speak, Core is probably trying to figure out where they stand on this now and whether this is a fight worth fighting. Update: They've committed to rejecting Segwit2x

In the event of Segwit2x not going through, there’s a very real possibility, that Jihan Wu’s Bitmain, Roger Ver and other big blockers will point their hashing power to Bitcoin Cash, a move which Big blockers as well as some neutral players are likely to follow.

This could slice Bitcoin’s hashing power in half, maybe more. And with the right media support, could pass on the Bitcoin brand finally to Bitcoin Cash, as they would be as close as ever to having the greatest hashing power and soon the longest chain.

Granted, miners could change their tune by then. And there could be a third fork in a worst case scenario, one that specifically supports Segwit2x but that seems to make little sense. More on that some other time.

This theory was revealed to me in an anonymous pastebin ‘leak’ that’s been going around. At first I didn’t believe it, but now it is making sense of a lot of things.

In fact. I just received indirect but very clear confirmation that this indeed is the intention. At least as things stand.

I will not reveal the source in order to protect it. But it’s enough to make me want to hold the BCH I have and look for a bottom to get in on, as insurance in the upcoming November Scaling deadline.

Redirecting all or most hashing power big blockers have to BCH would be a very expensive thing to do. For this stunt to win over Bitcoin, they’ll have to play their cards very well. It is not clear to me, for what that is worth, that they have the development talent or the community support to deploy the Bitcoin Cash vision as they wish it.