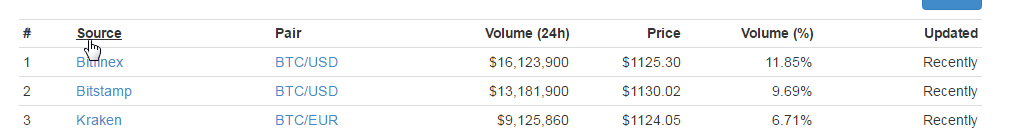

BitFinex is currently main price mover of Bitcoin.

Since March is going to be really hot for Bitcoin if you never did such trades its worth trying now so i will try to give a bit of tips.

I will explain main order types on margin and futures trading sites using BFX as the example.

Please check articles on the end that i have previously posted which will fill gaps you may have from this text alone.

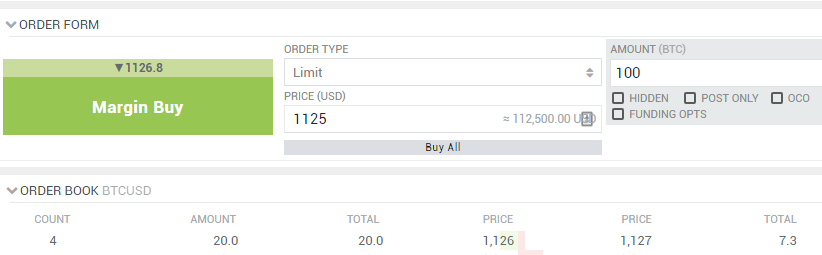

Limit Orders

Means you choose price at which you want order to execute. Price has to be lower than current market.

So lets say price is 1100 USD now, yet you want to buy at 1050 USD. So this is what you set.

Stop Orders

Means an order that will sell your BTCs or close position at certain price.

Current market price is 1100USD if it falls to 1050USD i want to sell my BTC and cut stop the losses.

If you believe price is going to go down from 1100 and you open short here, but the price goes up then you make a stop at 1150 to stop your short.

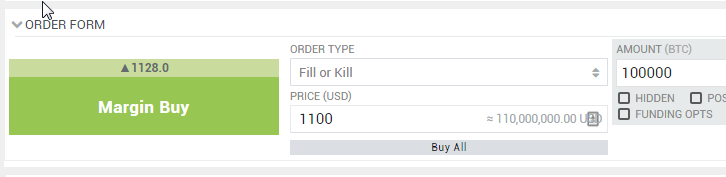

Fill or Kill

Its an limit order which has to be 100% filled or cancelled. If you want to buy 1000 BTC then you either get all of them on chosen price or none.

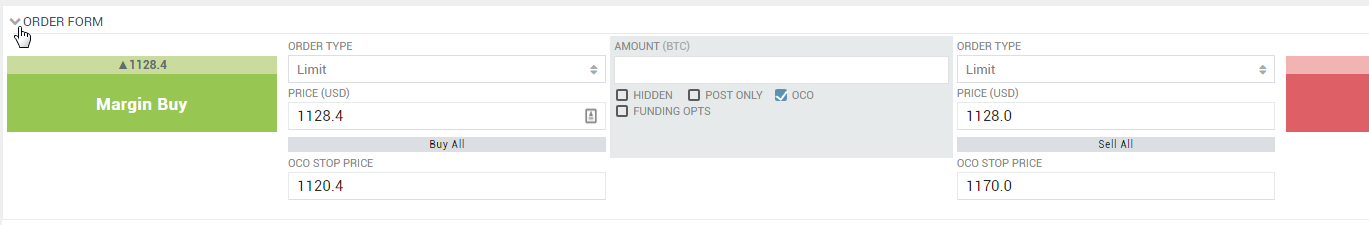

OCO (One Cancels Other )

This are 2 orders on different sides of the market. One if to long and the other is to short. If one of the orders get filled, the other one is cancelled automatically. Its one of most secure ways to bet when you dont know where market is moving.

Usable Articles

@kingscrown/the-biggest-volume-btcusd-market-margin-trading-guide-bitfinex

@kingscrown/my-review-of-bitcoin-leverage-trading-platforms-choose-best-one-for-your-needs