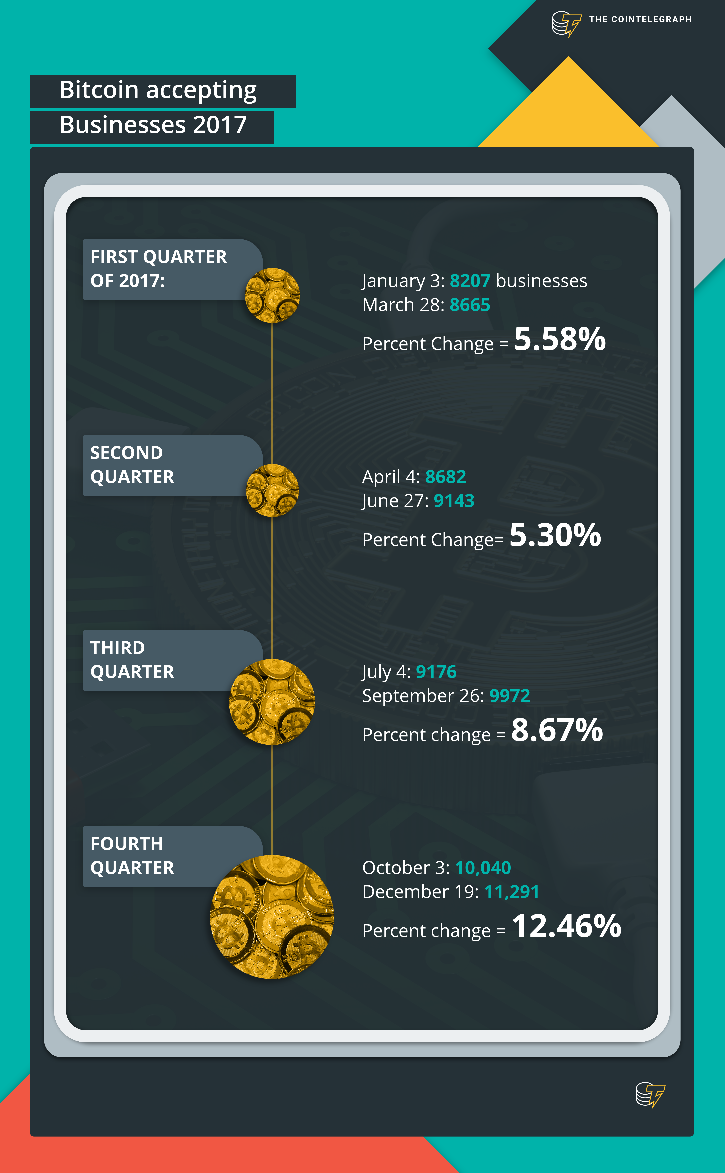

2017 was a big year for Bitcoin. CBOE launched the first Bitcoin futures market, the NYSE filed for two Bitcoin ETF’s, and Bitcoin price rose over 1,300 percent. In 2017, Bitcoin became too big to ignore, as Bitcoin became more valuable, there were sizable increases in the amount of brick and mortars that accepted Bitcoin all over the world. Let’s take a look at the data.Q1/17: Slight growth - 5.5%According to Coinmap.org, on Jan. 3, 2017, 8,207 brick and mortar businesses accepted Bitcoin as a payment method for their goods and services. On March 28, 2017, three days before the end of the first quarter, 8,665 businesses accepted Bitcoin. For the first three months of 2017, there was a 5.58 percent increase in Bitcoin accepting businesses. BTC Price Data: Calm growth - 7%On the first day of the year, Jan. 1, 2017, Bitcoin was worth $979.5, roughly 13 times less than what Bitcoin is worth today - $13,390. On March 31, the last day of the first quarter, Bitcoin’s price was $1,045.03. The Bitcoin price rose 6.9 percent within the quarter. Q2/17: Steady growth - 5%On April 4, 2017--8,682 businesses accepted Bitcoin. On June 27, 2017, three days before the end of Q2, 9,143 businesses accepted Bitcoin - all in all, an increase of 461 brick and mortars that accepted Bitcoin, which represents a 5.3 percent increase in the amount of businesses that started accepting BTC in the spring of 2017.BTC Price Data: Boost - 135%On April 1, 2017, Bitcoin’s price was $1,069.78; on the last day of the quarter--$2,519.27. Bitcoin’s price increased by $1,449.49; equivalent to a 135 percent increase in price.

First Half of 2017: 11% more businesses accept BTC while BTC price increased by 147%

When combined, the data from Q1 and Q2 represent the first six months of 2017. In the first half of 2017, there was an 11.4 percent increase in the amount of Bitcoin accepting businesses. 936 brick and mortar businesses added Bitcoin as an acceptable payment method for their goods and services. The average quarterly increase in the amount of brick and mortar businesses that accepted Bitcoin was 5.44 percent. And from the first day of Q1 to the last day of Q2, the Bitcoin price climbed a total of $1,501.1--a 147.43 percent increase in price.

Q3/17: Cryptomania begins - 8.5% growthOn July 4th, 2017, 9,176 businesses accepted Bitcoin; while on Sep. 26, 2017--the number grew to 9,972 entities; an increase of 796 brick and mortar businesses that accepted Bitcoin as a payment method, which is equivalent to an 8.67 percent increase.BTC Price Data: Another boost - 74%On July 1, the first day of Q3, the Bitcoin price was $2,458.14, by the end of September it reached $4,286.64. From July 1 to Sep. 30, 2017, Bitcoin price increased by $1,828.5 which is equivalent to a 74.38 percent increase in price.

Boost and buzz, made by Bitcoin

In Q3 we began to see the Bitcoin price and the amount of Bitcoin accepting businesses increase at a larger rate than in previous quarters. A rise in price means that there is a rise in demand, and a rise in demand should be no surprise for the Bitcoin market considering the events that took place in Q3/17. The media began to cover the astronomical returns that investors were receiving from ventures in digital currencies; Bitcoin began to receive worldwide media coverage, and for the first time, Bitcoin was presented in a positive light opposed to its precedented association with money laundering and illegal drug purchases. Additionally, when Bitcoin hit new all-time highs, the news spread like wildfire, this may have influenced a number of people who felt as if they were missing out on massive returns to invest in the Bitcoin themselves so they would not miss out on the generous return on investment.Q4: Always more BTC for business - 12%On Oct. 3, 2017, three days into Q4/17, 10,040 brick and mortar Businesses accepted Bitcoin. On Dec. 19, 2017, 11,291 businesses accepted Bitcoin. A 12.4 percent increase in the amount of businesses from the beginning of the quarter.BTC Price Data: Roller-coaster - 224%Q4 experienced the largest increase in Bitcoin accepting businesses with an increase of 1,251 brick and mortar establishments accepting Bitcoin for their goods and services. At the beginning of Q4, Bitcoin’s price was $4,317.24. Around Dec. 17, Bitcoin hit an all-time high of $20,000, but in the last days of December, the cryptocurrency market experienced a correction in price--Bitcoin dropped to $14,000. Regardless, Bitcoin’s price rose $9,685.7900 a 224.35 percent increase from the beginning to the end of the quarter.

Second half of 2017: Nearly twice as many new BTC-friendly businesses compared to the first half of 2017

In the second half of 2017, the amount of businesses that accepted Bitcoin as a payment method increased by 2,115 establishments. This is equivalent to a 23 percent increase in Bitcoin accepting businesses from July 4, 2017 to Dec. 19, 2017.The amount of Bitcoin accepting businesses increased by an average of 10.57 percent per quarter, almost two times the average quarterly increase in Bitcoin accepting businesses from the first half of the year (Q1 and Q2).Price data: BTC is a record breaking currencyOn Jan. 1, 2017--Bitcoin price was $979.53, and by the end of December, Bitcoin’s price was around $14,000; from the first day of Q1 to the last day of Q4 the overall price increase was around 1,329 percent and the priced increased by over $13,000 overall.

Crypto-mania and BTC adoption

It is possible that Bitcoin’s price dropped recently because retail investors who were new to the cryptocurrency market were not aware that cryptocurrencies have a much higher Beta--systematic risk--than the NASDAQ or the NYSE. As Bitcoin’s price dropped significantly, the market began to shake out the weak hands and many retail investors who were new to investing panicked and sold their coins.Those who hodl’d obviously knew not to be worried, be scared, or feel the need to sell when the price shifted downward by a significant amount, because those who are not new to the crypto-community know Bitcoin’s price moves like the best roller coaster at your favorite theme park. The ups are astronomical and may even make you feel as if you have left earth’s atmosphere, but the downs are terrifying, leading you to believe the coaster is going to plummet straight through the earth and travel into the depths of hell, inducing anxiety, restlessness, and pumping up your adrenaline levels.The data shows us that Bitcoin’s price is correlated with the number of businesses willing to accept Bitcoin as a payment method at a 0.7994 Pearson Correlation coefficient. This means that when there is an increase in Bitcoin price, it is highly likely there will be an increase in the number of businesses that accept Bitcoin.The best part is, the Bitcoin fun is just beginning. We could call it “crypto-mania;” however, the fun also could end anytime soon.Although interest in digital tokens is increasing at a rapid pace, the market capitalization of all digital assets is $560,456,007,471, and is still far below the market cap of the NYSE: $19.6 tln.2017 was a great year for Bitcoin. Not many assets can boast of having returns of over 1,300 percent, there was an overall increase of 3,084 Bitcoin accepting businesses, and the overall increase in Bitcoin’s price was $13,023.53.In 2017 we began to see institutional investors incorporate digital asset investing options into their platforms for their clients, but the support from the largest institutional investors has not even become a market factor yet. Institutional investors--the ones on wall street with the big money-- are looking to get into the crypto game in the first half of 2018 with a number of Bitcoin ETF’s that they have proposed. Furthermore, the retail investor and the layman are beginning to learn of digital currencies, and are becoming interested in incorporating digital assets into their portfolio.It will be interesting to see what Blockchain technologies, especially Bitcoin, the first Blockchain technology, have to offer in 2018. But at this point in time, with Bitcoin being talked about daily on our local news channels, in our local supermarket, at our nearest barber shops and inside of classroom settings, it is safe to say we have entered a bull market.

Source: https://cointelegraph.com/news/bitcoin-adoption-by-businesses-in-2017