Are you interested in what the probability of Bitcoin going to 1000$ is? In this article series I will try to calculate it. My previous article was successful where I've talked about using Statistical Analysis to calculate risks in the market, based on the same theory we will try to calculate now the probability of profits here. This is a spin-off of the Portfolio series, involving Quantitative Analysis and more.

So make sure you read my previous one to know what I am talking about here:

@profitgenerator/how-to-setup-and-manage-a-portfolio-pt-4-5

Calculate Probability of Price over 1000$

- Again we go to Blockchain.info, download the

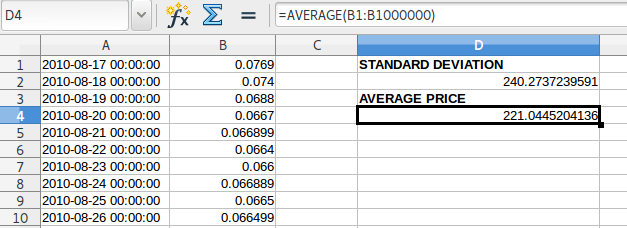

.CSVfile, import into Excel or LibreOffice Calc, then remove the rows with 0 price data, up until 2010-08-17. - Calculate quickly the

=STDEV(B1:B1000000), and=AVERAGE(B1:B1000000)of the entire price set in the cells next to the data:

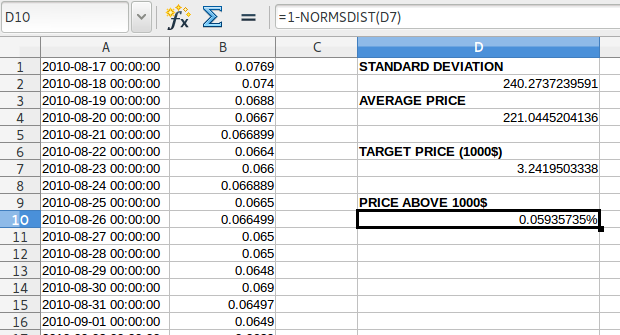

- Calculate the

Z-scoreof the 1000$ value=(1000-D4)/D2and integrate it into the area of the curve with=1-NORMSDIST(D7), where that would give us the left area from 1000$, but we subtract it from 1 to give us the right area of the curve from 1000$.

- This gives us

0.05935735%

So the probability of the Bitcoin price going to 1000$ and above is: 0.05935735%

Now hold on a second, something is not right, as you might say. And you are right, something is fishy here. Why only 0.05%? That doesn't seem logical. Is it incorrect?

Well yes and no. The probability itself was calculated correctly to my knowledge, however the methodology is problematic since the price is not Homoscedastic.

While the statistical analysis is true, it is not very accurate, due to the Heteroscedasticity of the price. In English this means that the price has multiple convergence points, with multiple means, which can be easily seen in the chart.

So the mean approximation is not accurate, because we used AVERAGE which weights equally every single element, but we are talking about a Timeseries here, where we have a 2 dimensional distribution to analyze. So we can do it this way, but if we want an accurate estimation then we must treat the price as a timeseries and not as equal-weighted random variables.

Statistical analysis only covers element analysis and ignores time, but in a price series, we cannot ignore time. So we have to use Time Series Analysis!

We need to weight the price by time, and give more weight to the recent price versus the older price, because we can all feel that the 221$ average price is not that accurate for Bitcoin anymore. Quants know this, that is why ARMA was invented.

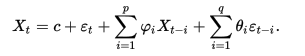

ARMA = Autoregressive–moving-average model

(Source: Wikipedia)

The ARMA model consists of 2 parts the AR (autoregressivity) and the MA (moving average). It is a way to tune into a heteroskedastic mean that is constantly shifting. It's not that simple to use, since we have to find the optimal parameters to be accurate, and that takes time (and of course the parameters themselves could shift too, so there are even more superior tools that exist in the Quant world). I used to experiment a lot with these models a while ago, and I will bring some of my experience to Steemit!

In the next article I will calculate some probabilities on ARMA, show how to optimize it, and how to use it in trading. Of course we are only scratching the surface of Quantitative finance, there are many more interesting models like GARCH, ARIMA, Kalman Filter, Bayesian Filters, Noise Reduction and of course the Holy Grail of Quantitative Finance: NEURAL NETWORKS.

So if you want me to talk about them, and show you how they work, then upvote my article! Also you can spend 1-2 SBD to Promote my article so that every investor and trader can see this!

Disclaimer: The information provided in this article might be incorrect. I am not responsible if you lose money from the information you've read on this page! This is not an investment advice, just my opinion and analysis.