History rhyming

The "Roman Empire" is an absolutely fascinating historical construct. Take a long, focused look at the animated gif showing its history. I am not a history scholar but I imagine that when founded, around 500 BC, the Roman Republic counted a few tens of thousands in population.

How could it become so successful and expand over the next centuries, extending influence and control over an area of more than 5 million sq. km. (that's more than the area of Europe and more than half the surface of the US or China) and with an estimated 20% of the world population of the time? Especially since it didn't possess radically better technology than all the nations that it conquered and fully assimilated.

Beyond conquering, what I contend is actually the true feat of Rome is the assimilation of all those tribes and nations, their seamless integration into one polity, one structure of command and administration.

When I look at this animated history, I see an allegory of the spread of Bitcoin awareness, mining, addresses, trading, usage (where probably 100 years of ancient history are being played out in "fast forward" 10x ou 20x mode today).

What both Bitcoin has today and, I posit, the Romans had in the ancient times, was a system of incentivization. Whereby it was in the best self-interest of the "conquered" to "assimilate" and participate in the new system (Roman empire 2000 years ago, the system of crypto-assets today) than to resist and cling to the "old system". The old system of tribes and small kingdoms with their powerful tribal elders and kings had outlived its usefulness.

The latter were the losers back then, because of course no matter how benefic a change in aggregate, it will always create some losers as well, not only winners.

Who stands to lose most today?

I am afraid that those who stand to lose most, the modern equivalent of the small kings defeated and enslaved by the Roman legions, might well be the current authorities, from the local to the state or national level and beyond. Take a look at these two graphics (source in the image itself), the top and bottom "tax wedge" ranking for OECD countries.

Now imagine the following scenario: you are offered a job by an ambitious Belgian SME, "BeBold" that has perfected a revolutionary new process to manufacture "beezmos", but is up against huge, powerful incumbents which are manufacturing inferiors beezmos and have higher costs but much deeper pockets and long standing political connections.

BeBold has set aside for your job position an annual budget of 100 000€. It then offers you, a young, bright, crypto-savvy, ambitious "civil engineer" the following deal: you could sign for a typical Belgian salaried position. Out of the 100 000€ that BeBold is prepared to pay, you'll see about 35- to 40 000€ on your bank account.

Or you could choose a completely "free" contract where BeBold will be then ready to pay in a "virtual crypto-safebox" (VCSB) the equivalent at face value of 120 000 € of a mix made-up of their own IOUs and BeBold's customer IOUs. You would be indeed accepting some market, liquidity and counterparty risk from both BeBold's customers and BeBold itself, and that risk needs to be compensated (20% in aggregate face-value in this example).

You'll get the private key to the virtual crypto safe-box and be advised to immediately "change the lock", and then hand back the new "public key" to BeBold's crypto-accounting bot.

Every month, the BeBold accounting system will deposit a changing mix of crypto IOUs with a face-value of 10000€ into that VCSB. You would have configured an automatic crypto-trading bot of your own that would search and homogenize that mix by trading those possibly exotic local IOUs against your preferred mix of more established cryptocurrencies, some fiat money to pay the late-adopters selling vegetables in the local market and also some blockchain-based cryptoassets.

Your bot would every month allocate a share of your income toward gradually buying up a title to that coveted underground parking place in crowded central Brussels, in parallel with a title to your dream house on Avenue de Tervuren (or wherever). Your smartphone and its multi-crypto wallet will allow you to pay almost anywhere using bitcoin, dash, monero or whatever other crypto-currency the local deli or shop will be willing to accept.

Soon, you'll notice that mentally converting your income in euros (to keep track) is less and less useful. But by comparing your life with that of your colleagues having taken the "standard Belgian salary" deal you'll notice that you are getting a foot on the property ladder faster than them; that you can afford nicer and longer holidays; bigger and more powerful cars, and generally live a more pleasant life with no apparent drawback.

Whereby you might conclude that the Belgian authorities, at all levels, were giving you a pretty rotten deal and not enough services in exchange for the amount of taxes the citizens and companies pay. A bad deal that everybody else in Belgium was forced to accept because the authorities always enjoyed a monopolistic position in their respective domains and nobody had much choice but to pay up. A bad deal that you had the opportunity and were smart enough to refuse, in order to live the crypto-life.

Think at how that "Ring" (ring-road around Brussels), about which something should have been done years ago, is in a state of uninterrupted traffic-jam at all hours, cruelly eating-up the lives of millions of ordinary Belgian citizens like yourself, stuck in their cars for hours on end every day. Think of the abysmal service of the SNCB (Belgian state-controlled railway company) and its permanent delays and cancelled trains. Think of street cleanliness or security, or any other topic people might gripe about today, and what level of service you and all the Belgian citizens should have been receiving given the record amount of taxes being levied by layer upon layer of authority on the Belgian salaried person.

Exit, voice, loyalty, neglect

Such a scenario fundamentally redistributes power in any society. Most western societies have a rather fossilized system of "voicing" discontent or dissatisfaction. The democratic channels are gummed up and citizens have to scream louder and louder, every 4 or 5 years in elections, in order to express their concerns.

Because the balance has over the decades tilted, those who had reason to stay loyal to the system (because they had managed to come out on top) became even more loyal. On the other hand, all the rest were offered a rough choice between passive resignation ("neglect") and "exit", which basically meant physically leaving the country.

A significant amount of prosperous or wealthy French people migrated to places taxing capital more lightly when the government of François Hollande jacked-up the taxes in 2012-2014. Similarly, a young Belgian "civil engineer" working for one of the Big 4 accounting companies (Deloitte, Pwc, E&Y, KPMG) cannot miss the difference in earnings that their colleagues working for the same company in nearby Luxembourg command.

The upcoming blockchain revolution will in the future offer a "virtual escape" - "exiting the system" without the drawback of having to physically uproot oneself. Exiting by choosing something resembling the above scenario.

Of course between the two extremes illustrated above (current style salary and going it "all-in crypto" as exemplified above, a continuum of combinations is possible, as many Romanian SMEs playing a "too-clever-by-half" game between "declared salary" and "cash-stuffed envelope" know very well already. Most western countries have better administrations which managed to control the "black", cash-based economy.

The difference with crypto is that tracking and controlling hundreds or thousands or even millions of different crypto "UAMESV" ("unit-of-account + medium of exchange + store of value"), most of which incorporate strong privacy and secrecy safeguards will likely prove impossible.

At first you'll feel smug as there will be few people like you but inevitably the news will spread: a new way to increase one's labour income in a country that taxes labour with abandon ... There will be a trickle of people gradually moving toward living the crypto-life (and in the process depriving the authorities of revenue) but pretty soon, as it always happen with herd movements, it will turn into a stampede and the local and state budget will notice the bleeding. What will happen then (assuming nothing much had happened before it was too late) is anyone's guess ...

Shape up, get fit or disintegrate ...

Local and state budgets might well enter into a never-ending spiral of lower and lower revenue ... As software tools proliferate and make "crypto-life" easier and easier, more and more people (the rebel young, the discontent but honest people who find no other way to cope, but also the basic cheaters and crooks) will divert ever-more "value" (expressed as crypto) from the taxable base. Shaping up and getting fit before, managing to somehow earn the trust of the citizens before it happens might help. But it might not be enough ...

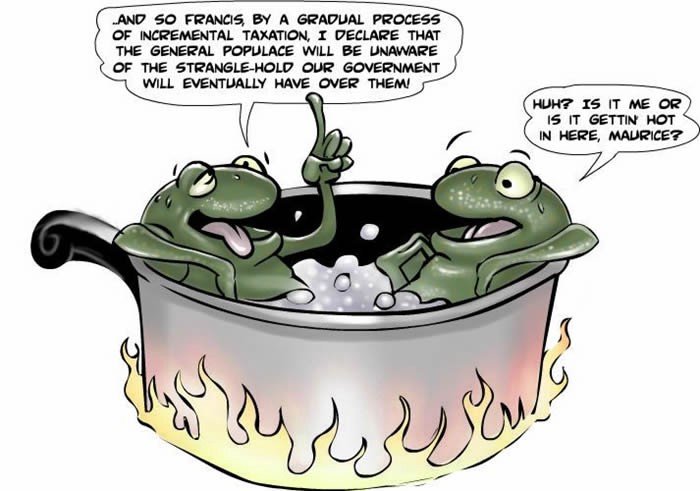

The tables will be turning, slowly at first but then accelerating like the flow of a river toward a waterfall. If the administrations do not take notice in time, they risk sharing the faith of the famous "boiled frog"

Conclusion: who's the Barbarian?

At the beginning of this article I compared Bitcoin and the blockchain revolution to the Roman Republic and the current western administrations to the tribes and kingdoms that the Roman legions subdued. But what if this is not the correct analogy? What if the current Western Civilization is the modern day equivalent of the Western Roman Empire in the 5th century AD ? What if Bitcoin and the cryptos are the Visigoths, the Vandals, the Huns and the other barbaric tribes that descended upon and obliterated the Roman Empire, plunging the Western world into the Dark Ages?