As the crypto-currency Bitcoin reaches spectacular new highs on dramatically increased levels of volatility, traders and investors alike are questioning whether it’s a good idea to trade this asset or whether now is the time to stay to the side before it devalues. Most of the debate is focused on whether Bitcoin is in a bubble, and whether it is viable as a long-term investment. I ask whether it is possible to put a fair value on Bitcoin, what factors will affect its market price, and what traders should be looking at before they decide to get involved in trading Bitcoin.

What is a Bubble?

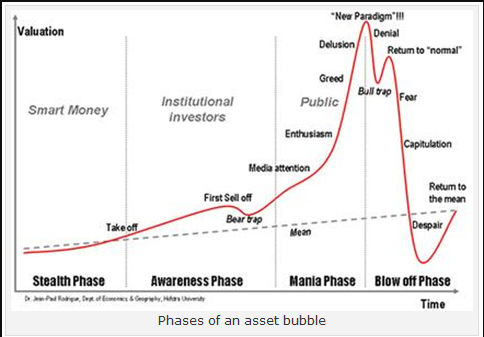

My preferred term for what is often known as an “asset bubble”, “price bubble”, or “investment bubble” is “speculative bubble”, because invariably, the peaks of these bubbles are caused by very intense speculative activity. A speculative bubble occurs when an asset is far, far above anything close to what its real (it might be better to say “sustainable”) value might be. A better way of describing it might be to note that because all speculative bubbles burst, a bubble can be defined as an asset rising exponentially to extremely inflated prices and then crashing down and settling at a level which is far less than its original price (typically a fall of 75% or more). A speculative bubble is characterized by both the rise and fall, particularly the fall, taking place over brief time periods. The economist Dr. John Paul Rodrigue produced an excellent diagram (shown below) illustrating the typical progress of a speculative bubble, not only by time and value, but in terms of the psychological state of actual and potential market participants.

Let’s compare the above diagram to a current daily price chart of Bitcoin in U.S. Dollars:

A case can be made that, at the time this article was written, Bitcoin is somewhere around the “Denial” stage just after “New Paradigm” from Dr. Rodrigue’s diagram, which the chart seems to match closely. It is a case worth considering, as if incorrect, Bitcoin might still be worth buying, while if it is true, a short sell could be a great trade. Of course, a better option for you might to be not to trade Bitcoin at all, but what Bitcoin is and how it works is something that must be fully considered before any call can be made on whether it is in a bubble.

What is Bitcoin?

Bitcoin is a digital currency which may be freely purchased. The hallmark of a currency is whether it is considered legal tender. Bitcoin is not there yet by a long way, but is being accepted by more and more nodes within the global economic matrix, including major companies such as Microsoft, Bloomberg and Virgin. Most currencies are backed by the central banks of nation states, who have the power to determine supply to some extent, and therefore can affect the exchange rates of their currency. Bitcoin is backed by no central authority. More importantly, new Bitcoins can only be created by computers after they have probabilistically spent a similar amount to the “real value” of a bitcoin. Creating a Bitcoin requires creating and running computer hardware with an internet connection. If it can be calculated how much it costs on average to generate a Bitcoin, that value to may be used to estimate Bitcoin’s “fair value”.

”Fair Value” of Bitcoin

It is known that Bitcoin’s generation software, worldwide, allocates a block of 12.5 bitcoins every 10 minutes on average. An academic study conducted in 2016 estimated that approximately $8,333 is expended on electricity alone by Bitcoin miners every 10 minutes, which suggests that the opportunity cost of a Bitcoin is at least $667. Factoring in the amortized value of all the hardware and software used in Bitcoin mining is a more challenging estimation, but the same academic study found these costs bring the total amount expended per new bitcoin to $800. The Bitcoin generation process has another feature which makes it impossible to call $800 a “fair price”, though: after a certain number of Bitcoins are generated, the number of bitcoins awarded per block will halve, doubling the “fair value” per new bitcoin. It is expected with a high degree of confidence that this halving will occur in 2021, and that the last bitcoin will be mined in the year 2140. This means that the “fair value” of a new Bitcoin will double to approximately $1,600, and as interest rates are very low and are expected to remain so, the discounted future value of a new bitcoin is arguably about the same amount today. When the study quoted was conducted, the price of Bitcoin was well below $1,600, and at a current price of $2,265 would be about 42% overvalued. Interestingly, the chart shows a clear pivotal point which has acted as resistance and support at $1,600 which might not be a coincidence, as the study I have quoted is probably the most publicized credible attempt at calculating a “fair value” for Bitcoin.

Monetarism, Bitcoin, and the Dream of the Gold Standard

Once 21 million Bitcoins have been created (“mined”), it will become impossible to create new Bitcoins. Bitcoins may be destroyed when owners of bitcoin misplace their passwords, but bitcoin, if it becomes de facto legal tender throughout most of the global economy and remains under the same decentralized and fixed regime, will be a currency that the world has never seen: one that will be completely impervious to inflation, and whose supply will remain forever finite. Bitcoin is often compared to gold and silver, which have historically acted as the primary stores of value, and are cited now by monetarist and libertarian economists as an eternal answer to the endless debasement of fiat currencies. In fact, Bitcoin will be firmer: gold and silver can be mined and hoarded, and their relative values in real terms sometimes fluctuate. In theory, bitcoin will not suffer from this problem.

The Bitcoin Bubble Answered

It seems logical to assume that provided Bitcoin survives in its present uncontrolled and fixed state, it will inevitably appreciate against all fiat currencies, with the only discounting arising from the question of whether it will become fully accepted as a convenient, usable legal tender. A factor within this is whether other crypto-currencies could eventually usurp Bitcoin’s leading role: it is worth noting that the capitalization of other crypto-currencies has begun to exceed Bitcoin’s capitalization. If you believe that Bitcoin will maintain its dominance over other individual crypto-currencies and eventually become widely accepted, then there is every reason to believe that a Bitcoin is worth at least $1,600 right now. If this is true, then Bitcoin might be overbought and due a substantial correction, but it could not be said to be in a bubble comparable to Tulip Mania or the first British joint stock companies of the 17th century. This case also supports Bitcoin as an attractive medium to long-term investment. Unfortunately, I see a dangerous overreach in assuming that Bitcoin is going to be a freely convertible and fungible currency, i.e. that it will be available to everyone who wants it and will be generally accepted as payment. This is far from assured, and with governments finding considerable value in maintaining fiat currency systems which may be inflated to write off debt, why would they sit back and allow bitcoin to usurp national currencies as a medium of exchange? If Bitcoin is going to remain the preserve of bohemian tech enthusiasts, much as it is today with less than 6 million individual users, then it is in a bubble and is enormously overvalued.

Trading Bitcoin

If you are trading Bitcoin with a short-term time horizon, keep position sizing very small, as volatility is dramatically high. The 30-day ATR (Average True Range) has more than tripled over the past 6 weeks. Although the chart still looks quite bullish technically, we might already see the beginning of a major first lower high just above $2,600. It can also be expected that there will be support at $2,000 and within the area just below that price. A major correction should be expected, as in a huge appreciation of any asset when people who know nothing about it are starting to buy it. Long-term investors would probably do well to wait a while before buying at least part of their intended position, ideally to a level below $2,000 or, even better, $1,600.

Found this very interesting to share, Source: http://www.dailyforex.com/forex-articles/2017/06/is-bitcoin-in-a-bubble/80966

I believe that Bitcoin will Rice up very high! But till then it might fall few times and rise back again as usual :)