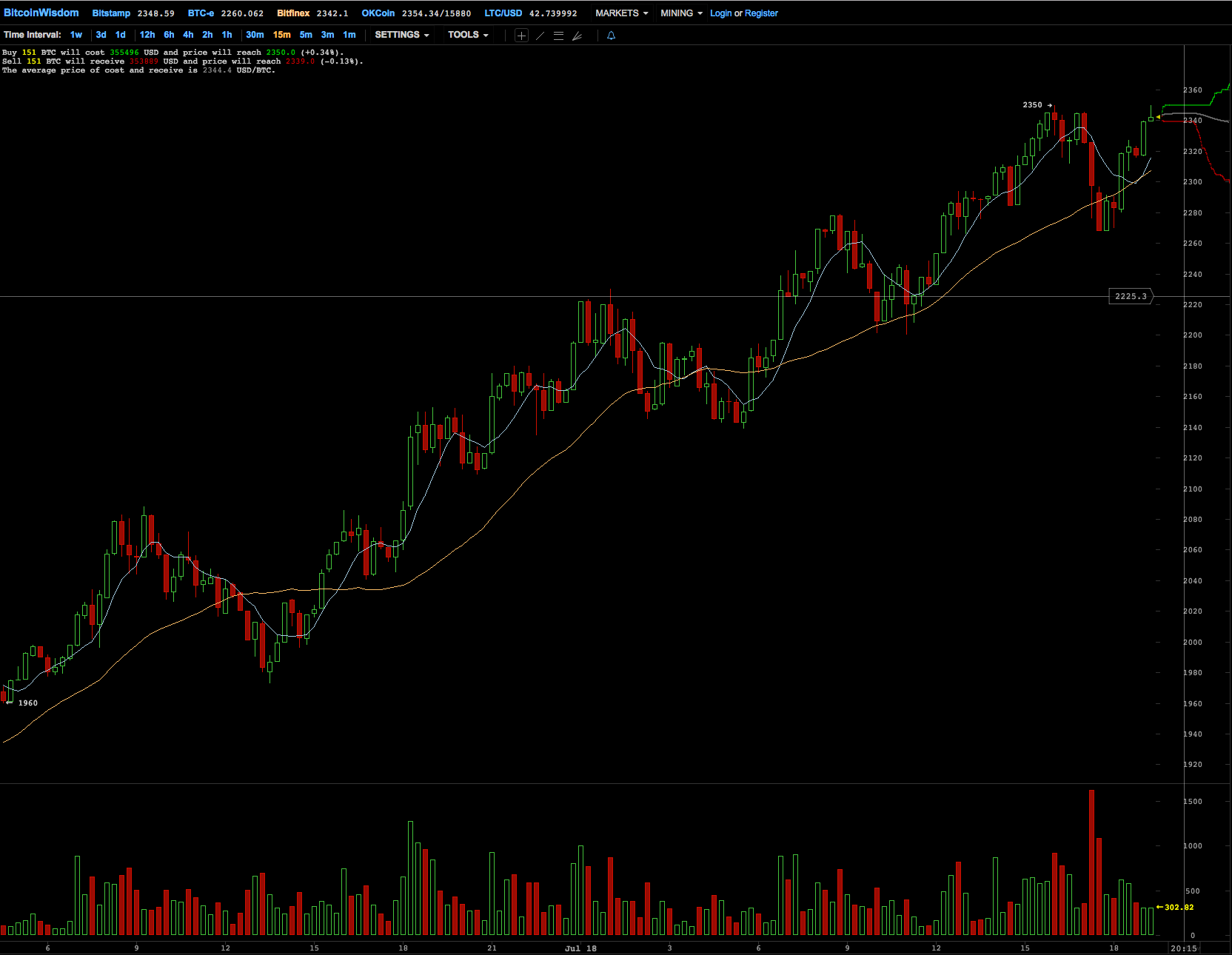

BTC/USD chart from Bitfinex for the last day shows a significant recovery - is it due to BIP 91 signalling? - Chart Source: BitcoinWisdom.

Introduction

Just a quick post today as I wasn't planning on posting, however I thought this issue was interesting and important enough to share.

A couple of days ago I spoke about how there was uncertainty over bitcoin due to the possibility of chain splitting if BIP 148 activated.

This may have combined with other factors to create the fall in bitcoin price.

We have seen a partial recovery over the last few days and this may be at least partly due to increasing support for BIP 91.

What is BIP 91?

BIP stands for Bitcoin Improvement Proposal and is the title (along with a number) given to proposed changes to the bitcoin blockchain.

As I understand it BIP 91 came about as part of the Segwit 2X proposal.

It is a an addition/modification to BIP 141 (the original Segwit proposal) that reduces the previous 95% miner support requirement to 80% and also reduces the period needed to signal support from 2 weeks to 56 hours.

In addition it will also prevent BIP 148 from activating and greatly reduce the risk of a chain split.

(BIP 148 is the very controversial user activated soft fork (UASF) that could potentially result in a split in the bitcoin blockchain and lead to people losing money).

Frankly the specific technical details of how BIP91 works are beyond my understanding, however there is a Coindesk article which goes into some detail about it here.

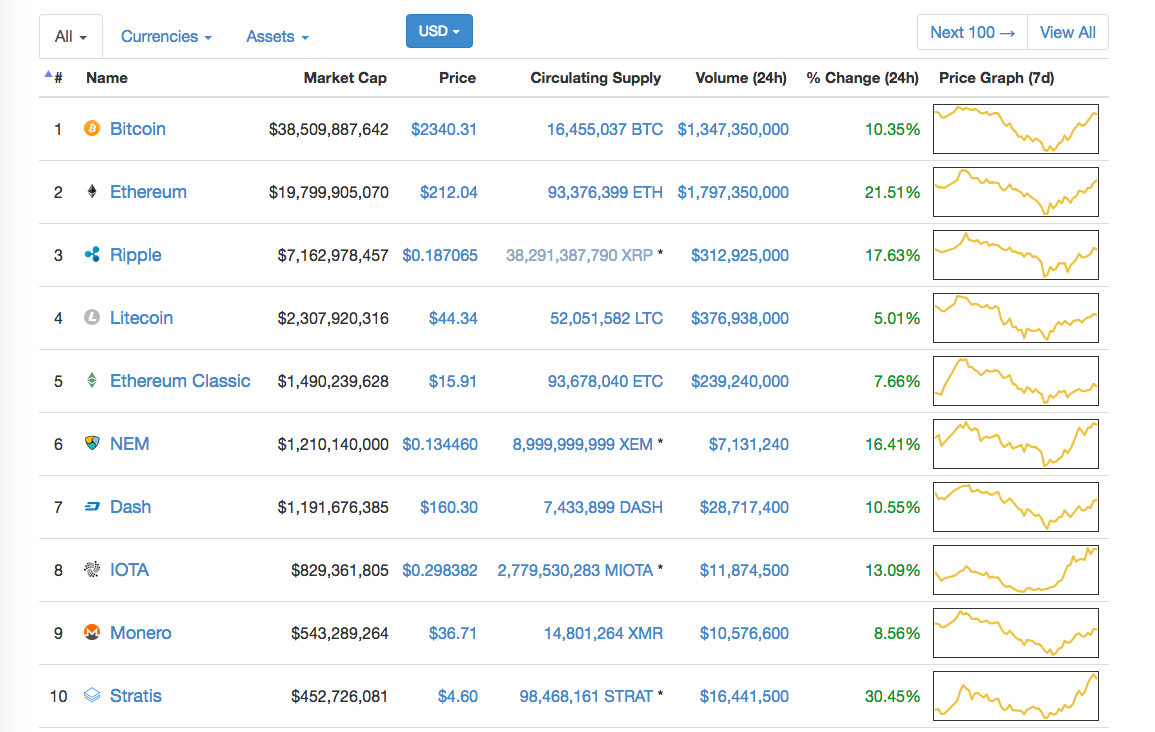

BIP 91 already has 63% support (in the last 144 blocks) out of the 80% needed according to Coindance.

(NB to activate it needs 80% miner support over 336 blocks).

If it continues to gain support over the next few days we could actually see a swifter resolution to the current crisis and a faster return to the more positive and bullish sentiment we had prior to the recent price falls.

What do you think about BIP 91? Is it responsible for the recent market recovery? Will it pass?

Let me know in the comments.

Thank you for reading