OKCoin Futures Liquidation

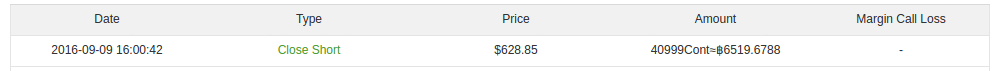

The screenshot immediately above is of an OKCoin forced liquidation that happened shortly after the last push higher on 9 Sept. Right-click on the image, open it in a new tab, and prepare to be shocked.I’m not posting this to mock the trader or to celebrate that loss. My reasons for posting this are four-fold and serve as a reality check and by way of learning from others’ mistakes (rather than our own!):1) to show that these things happen. It is an astonishing amount of money that was lost by the trader and went into direct ownership of the OKCoin company. 6519 BTC is the equivalent of $4mil (USD) at the liquidation price of ~$628.85.2) just because you’re a tuna, dolphin or large wallet in the market does not mean you have a good idea of where price is going3) there are multiple reasons why that trade was poor: its direction was wrong and the loss should never have been allowed to run to forced liquidation. In other words the trader lacked method, money management and risk control measures4) there is no rational justification for ever placing an order of that size and value in the market. 6500 BTC (or ~40,000 contracts) does not match the liquidity in the market. OKCoin futures has fairly high liquidity, but to comfortably get in and out of position traders should not exceed max position sizes of 1000 contracts (8 BTC at 20x leverage and 16 BTC at 10x leverage at current price of $620).A trade of this kind of position size (8 BTC margin at 20x leverage, i.e. 1000 contracts) will yield 4 BTC over a $20 long price movement – and even more to the short side. That is ample profit for a trade and as much as we should reasonably expect in this market.Presumably the trader is worth more than $4mil. I invite this trader to xbt.social for a simple introduction to rational market participation and to never misunderstand market direction ever again.

Summary

Bitcoin price continues advancing even while most of the market is trapped short. At $680 most will go long, but not the readers of this analysis post. Precluding a surge to $900, from $680 we’d expect to see price revisit $600 brfore The Big One.