- Bitcoin Kicks Off 2020 More Secure Than Ever as Hash Rate Hits Record ;

- Inside the Osaka Conference Where Crypto Got Serious About FATF’s ‘Travel Rule’ ;

- Katherine Wu on DeFi and the Inevitability of the Digital Yuan;

- What You Need To Know About Congress’s Two Proposed Crypto Laws ;

- Central Bank Digital Currencies: 4 Questions and Answers ;

- 🗞 Daily Crypto News, January, 2nd 💰

- STEEM Trading Update

Welcome to the Daily Crypto News: A complete Press Review, Coin Calendar and Trading Analysis. Enjoy!

🗞 Bitcoin Kicks Off 2020 More Secure Than Ever as Hash Rate Hits Record

Bitcoin (BTC) has already hit a new record in 2020 as the cryptocurrency’s network hash rate once again topped previous all-time highs.

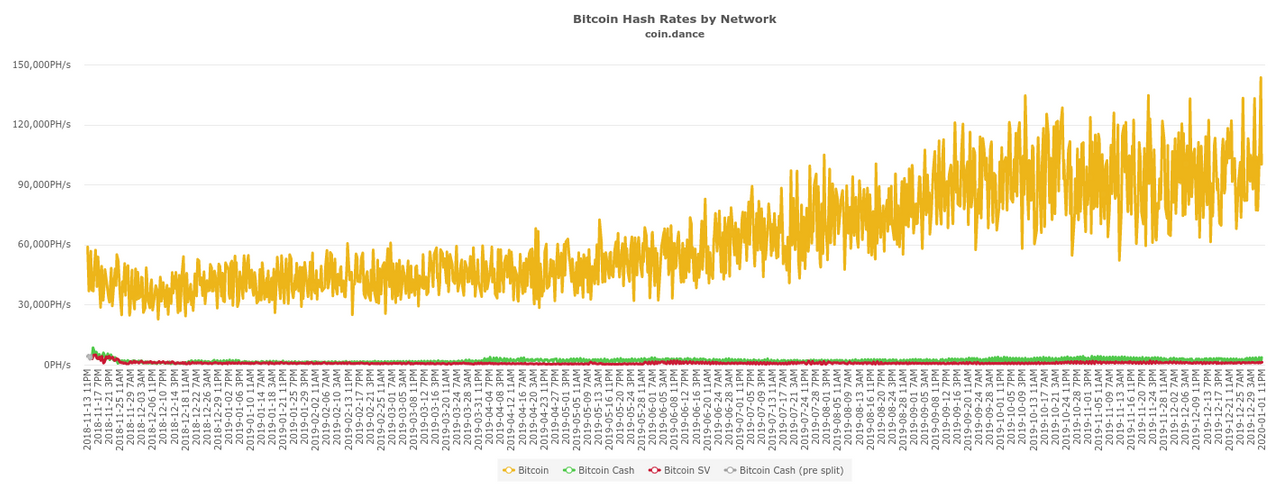

Data from multiple monitoring resources including Blockchain and Coin Dance confirmed hash rate was higher than ever on the first day of the new year.

Estimates point to an all-time high for BTC network

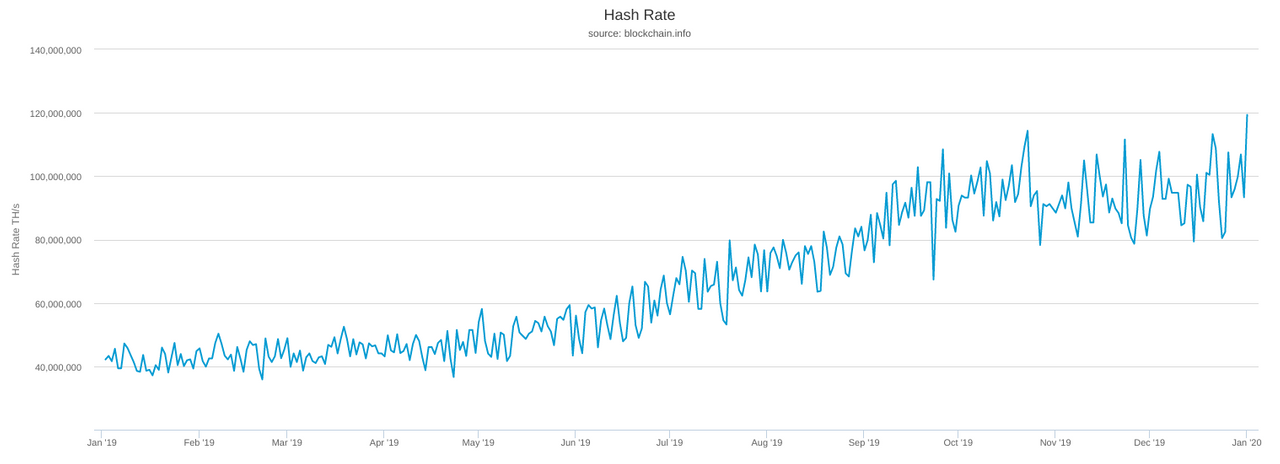

A measure of the computing power devoted to validating the Bitcoin blockchain, hash rate spent much of 2019 in a continuous growth cycle. Only for a brief period in Q3 did the upward trend level off.

Strong hash rate suggests Bitcoin is a more appealing proposition for miners — more mining power translates into better network security and robustness against potential attacks.

According to Blockchain, the metric hit 119 quintillion hashes per second (h/s) on Jan. 1.

Bitcoin 1-year network hash rate. Source: Blockchain

Coin Dance’s figures are different, with 143 quintillion h/s recorded for the same date.

🗞 Inside the Osaka Conference Where Crypto Got Serious About FATF’s ‘Travel Rule’

There he was, belting out Fats Waller jazz vibes like it was nobody’s business: Roger Wilkins, the former president of the Financial Action Task Force (FATF).

We’d just completed a practice run for the next day’s V20 Summit, and while the rest of us were exhausted and ravenous, sniffing out dinner options, Wilkins relished the opportunity to jump behind the keys of a lonely baby grand at the farthest end of the Grand Ballroom at the Hilton Osaka. Leaving my run-sheet behind, I sidled up to catch an impromptu performance from the man who once steered international standards in the fight against money laundering, terrorist financing and the proliferation of weapons of mass destruction.

“I usually play Bach or Chopin,” Wilkins said, wrapping up his medley.

The next morning, more than 100 of the world’s most formidable figures in crypto compliance assembled to unpack one of the most pivotal regulatory developments in the history of our fledgling industry. Held June 28-29, 2019 in parallel to the G20 Leaders’ Summit in Osaka, Japan, the V20 Summit was a chance for the industry to respond to a highly controversial new set of recommendations handed down by the FATF.

🗞 Katherine Wu on DeFi and the Inevitability of the Digital Yuan

Katherine Wu was a founding team member at Messari before moving into a VC role at Notation Capital, but is perhaps best known in crypto for her epic annotations of key regulatory enforcement actions.

In this end-of-year interview with The Breakdown, Katherine argues that decentralized finance is the narrative of 2019, but also that when it comes to 2020, the emergence of a Chinese digital yuan is likely to have a huge impact on the crypto space.

🗞 What You Need To Know About Congress’s Two Proposed Crypto Laws

As the cryptocurrency universe enters 2020, U.S. lawmakers are drafting bills to provide clarity around stablecoins and offer regulations for tech companies like Facebook that might want to create their own cryptocurrencies.

The draft legislation “Keep Big Tech Out Of Finance Act” was proposed on July 15, 2019 by the Democratic majority of the House Financial Services Committee. While this legislation specifically targets Libra, a new digital currency spearheaded by Facebook, the proposal aims to prevent big technology companies from operating like financial institutions.

According to a copy of the draft legislation, a large technology firm is described as a company offering an online platform service with at least $25 billion in annual revenue.

With that in mind, the bill specifically proposes that:

“A large platform utility may not establish, maintain, or operate a digital asset that is intended to be widely used as medium of exchange, unit of account, store of value, or any other similar function, as defined by the Board of Governors of the Federal Reserve System.”

🗞 Central Bank Digital Currencies: 4 Questions and Answers

Central Bank Digital Currencies (CBDC) is a complex and multidisciplinary topic requiring active analysis and debate. It raises questions related to monetary policy, central banking operations, and payment systems—as well as financial stability and legal foundations and regulation.

Below are some of the most pressing questions and answers on the topic.

What is the IMF’s role around CBDCs now and in the future?

The IMF can help in three ways: by informing the policy debate, by convening relevant parties to discuss policy options, and by helping countries develop policies. Because CBDC is a novel topic, the IMF has mostly been active in the first two areas, but it is gradually moving into the third area as member countries consider CBDC options and seek advice.

🗞 Daily Crypto News, January, 2nd💰

- Ignis (IGNIS)

"It’s official! Coalculus is launching MainNet on the 2nd of January 2020."

- Ethereum (ETH)

ETH Muir Glacier hardfork predicted to occur on Jan 2.

- NEM (XEM)

"Note: Our teams are off to celebrate holidays with their loved ones. We will resume giving updates on January 2, 2020:"

- Horizen (ZEN)

Team updates at 4:30 PM UTC/ 11:30 AM EDT: Engineering, Node network, Product/UX, Helpdesk, Legal, BD, Marketing, CEO Closing thoughts, AMA.

- Global Social Chain (GSC)

Download application, invite as many users as possible. Be the top 1 to win $50,000 and $100,000 for 200 top users.

STEEM Trading Update by my friend @cryptopassion

Here is the chart of my last analysis :

Here is the current chart :

So as expected, the support line at 0.124$ has been tested, broken during some minutes and a little bounce is starting from it. We are not yet saved... we must see if the market won't do a new attempt to break that line very soon. The ideal would be that we take some distances from that line with a nice bounce but let's see what will happen.

Last Updates

- 🗞 Daily Crypto News, January, 1st💰

- 🗞 Daily Crypto News, December, 31st💰

- 🗞 Daily Crypto News, December, 30th💰

- 🗞 Daily Crypto News, December, 29th💰

- 🗞 Daily Crypto News, December, 27th💰

- 🗞 Daily Crypto News, December, 26th💰

- 🗞 Daily Crypto News, December, 25th💰

- 🗞 Daily Crypto News, December, 24th💰

- 🗞 Daily Crypto News, December, 23rd💰

- 🗞 Daily Crypto News, December, 20th💰

- 🗞 Daily Crypto News, December, 19th💰

- 🗞 Daily Crypto News, December, 18th💰

- 🗞 Daily Crypto News, December, 17th💰

- 🗞 Daily Crypto News, December, 16th💰

- 🗞 Daily Crypto News, December, 14th💰

- 🗞 Daily Crypto News, December, 13th💰

- 🗞 Daily Crypto News, December, 12th💰

- 🗞 Daily Crypto News, December, 11th💰

- 🗞 Daily Crypto News, December, 10th💰