Content adapted from this Zerohedge.com article : Source

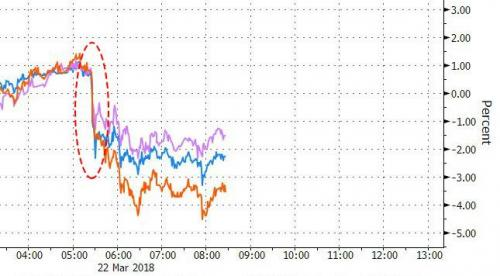

Every day it seems that some new negative development emerges for the cryptocurrency sector, and just days after digital currencies evaded the wrath of the G-20 (allegedly thanks to the BOJ's Kuroda), fears of which had slammed bitcoin and its peers to multi-week lows, overnight cryptos tumbled again this time dragged lower by fears of regulatory trouble in Japan where Binance - the world’s largest cryptocurrency exchange at the moment - was said to face a warning from the local regulators for operating without a license, according to Nikkei, unleashing a fresh round of concerns that increased regulatory scrutiny will curb demand for digital assets, even though this has now become a daily event.

Rumors are that the Japanese Financial Services Agency is going to tell Binance to stop operating in Japan without official approval. Bloomberg reported that Binance has employees in Japan and expanded without the proper permission.

Some are wondering if this was just another attempt to shake out weak Hodlers of bitcoin. Binance told the same Bloomberg that it was working on the license back in January.

Nikkei showed irresponsible journalism. We are in constructive dialogs with Japan FSA, and have not received any mandates. It does not make sense for JFSA to tell a newspaper before telling us, while we have an active dialog going on with them.

Singling out Binance does not make much sense for the Japan FSA since they issued 16 licenses to different exchanges. One with a license is Coincheck, Inc which suffered a $500M hack in January.

Binance has consistently ranked as the world’s largest cryptocurrency exchange by volume since late last year, according to Coinmarketcap.com. It held the top volume ranking for the past 24 hours, trading $1.8 billion, the website shows.

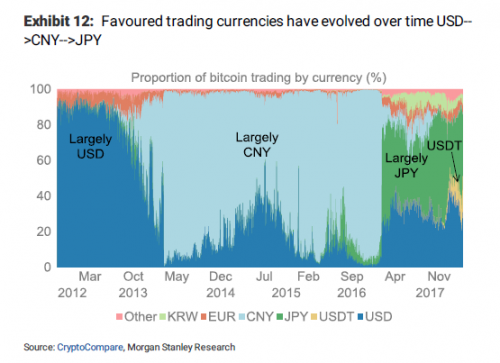

Over the past year, Japan has emerged as the top venue for cryptocurrency trading, and according to some analyses, the reason why the BOJ has been surprisingly supportive of cryptocurrencies - and may have warned against a harsher G-20 crackdown - is because cryptos now have a direct impact on Japanese wealth and GDP (see "Bitcoin "Wealth Effect" To Boost Japan's GDP Up To 0.3%.")

Non-adapted content found at zerohedge.com: Source