A few days ago, I wrote an article about the coming-soon BitShares product called HERO. This investment product is a smart contract token (or smartcoin, or if you like @stan's grandiosity, "mathemagical dreamcoin") that will be mathematically defined to appreciate by 5% annually. I have some serious doubts about its ability to do so, but I find the concept nonetheless intriguing. For more information about HERO itself, see @stan's original post and the official HERO documentation website.

Will HERO socialize risk? (TL;DR: no.)

The first question that BTS holders should ask about HERO is whether they will be on the hook for the "interest" that will be paid out on HERO tokens. (Note: HERO will not strictly pay interest; it is rather designed to appreciate at a predefined rate, thus effectively paying interest. I will use the two terms interchangeably in this article.) Fortunately, ordinary BTS holders will not be required to pay out interest. If not BTS holders, then who?

Note that if HERO were being built on Steem with the same mechanism that SBD uses, the answer to the question would be "yes." In Steem, SBD is backed by printing new STEEM tokens. BitShares uses a different mechanism to peg smartcoins. To really understand how HERO will work and where the interest will come from, we need a quick primer on smartcoins.

How do BitShares smartcoins work?

There are many explanations of this all over the place, but there are two basic operations that you need to understand to see how this works:

- Borrow

- Settle

(Note: the third, Margin Call, is also very important but not necessary for my explanation here.)

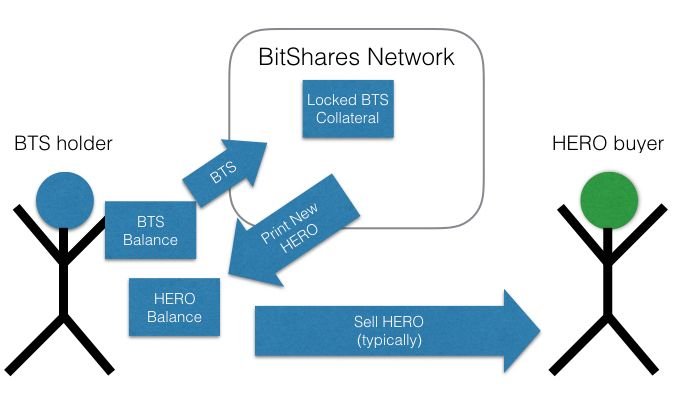

Borrow works like this, as depicted in the very cheesy diagram below. A BTS holder commits some of his BTS to be locked away in a collateral smart contract, and then receives some brand-spankin-new HERO in return. This person is the free to sell the HERO. Typically, you would borrow HERO when you think that HERO is overpriced in the market (or when you think BTS is underpriced), hoping that the price of HERO will drop (or BTS will rise) and you'll be able to buy back the HERO you previously sold (i.e., sell back the BTS you traded it for) and recoup your investment.

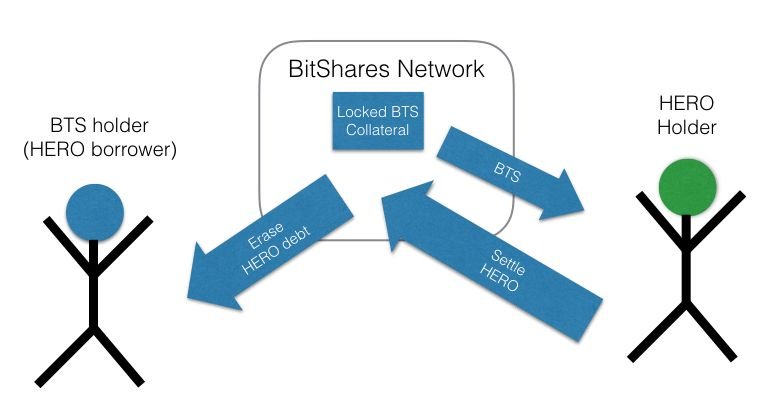

The second part of the mechanism, "Settlement," works like this (in a more complicated way, but you'll get the idea here). Again, I have a probably-unhelpful diagram to help out. Do note that the diagram is extremely oversimplified. Recall our original BTS holder who borrowed the HERO into existence; that person owes a "debt" of HERO to the network. Anyone who owns HERO can "call in that debt" whenever they like. This is called "Settling." If the HERO holder chooses to settle, this means they want to trade their HERO for an equivalent amount of BTS. Those BTS tokens are always available, since the people who created HERO in the first place locked them away as collateral. So when a HERO holder requests settlement, the network goes and finds the HERO borrower with the least collateral, erases part of their debt, and gives part of their BTS collateral to the person requesting settlement.

So who pays the interest, and can they get out of it?

The people who originally borrow the HERO into existence are the ones who are solely on the hook to pay the interest. But there is an important catch in here: Strictly speaking, they have no obligation to pay the interest itself; they merely have to support a minimum price for HERO tokens. There is no maximum price for HERO tokens! Consider this scenario: suppose that HERO trades consistently at double its feed price. That is, double its minimum price. Its minimum price corresponds to an annual appreciation of 5%; double its minimum price corresponds to annual appreciation of only 2.5%.

This presents a very interesting strategic problem. If a BTS holder sees a smartcoin trading at double its feed price, they will be sorely tempted to borrow some and sell it. They've been trained to believe that smartcoins are "supposed to" trade right at their feed price; if they see one double the feed, they'll think that it's likely to lose 50% of its value soon and will want to short sell it. On the other hand, if I see an asset that appreciates at a consistent 2.5% annually, I'll be sorely tempted to buy it. Good luck getting that from a bank account (except, of course, LMCU Max Checking)!

The other interesting complication is that settlement only happens at the feed price (margin calls happen at a higher price, but not typically 2x higher). This means that if I buy HERO expecting a 2.5% return because it's trading at double the feed, I'll only get this from appreciation; I can't actually get it through settlement. Will this reduce the buying pressure? Probably, but only time will tell.

Then what is a fair price for HERO?

So what should we expect a fair price to be? That's very uncertain! The only thing I can say that I believe for sure is that HERO will trade on average above its feed price, so that it pays less than 5% interest. It's going to be a fascinating experiment!

If you want to trade HERO when it launches, sign up with my referral link: https://bitshares.openledger.info?r=zebulon