Yesterday I posted an altcoin story about getting into PIVX and BitShares. Today I've been learning more about BitShares and its decentralized exchange or "DEX" called Open Ledger.

You can create your own Open Ledger account here: https://bitshares.openledger.info. It's a full wallet and exchange built for the browser. If you do set it up, be sure to back up your wallet regularly and secure it with a strong password created by a password manager like 1Password. And by "back up" I mean store the file somewhere other than your hard drive. One trick I use with 1Password is to store secrets there which can include backup files and encryption keys. The encrypted 1Password file is then saved to the cloud via Dropbox.

The first thing I did last night to learn more about BitShares was to watch these five BitShares 101 videos by Max Wright for BitShares TV (thank you @kenny-crane for the recommendation):

I also read a bit from Dan Larimer's blog talking about how Pegged Assets work along with Price-Stable Cryptocurrencies and User Issued Assets (UIAs) from bitshares.org. I also really enjoyed this video from Jonathan Harrison on how to create bitUSD:

The BitShares 101 videos goes into greater detail about what distributed autonomous companies are and how the pegged assets work. Now that I was all "learned up", I wanted to actually try things out.

Doing the Thing

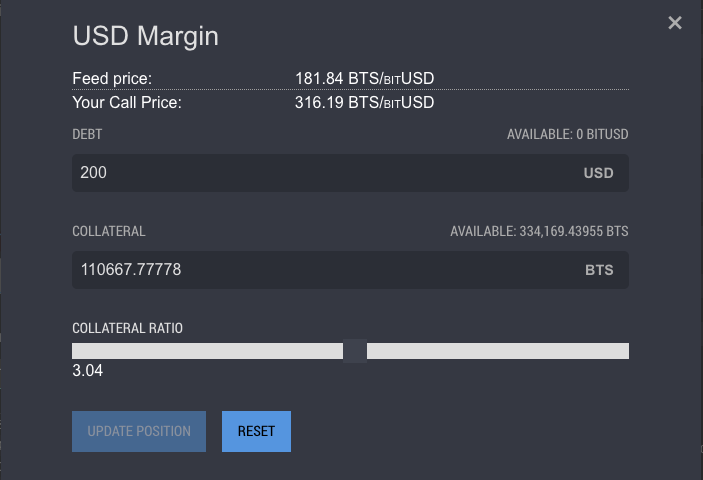

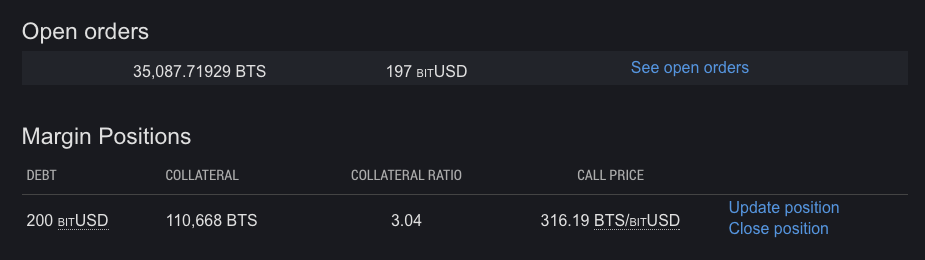

Today I created a $200 loan in bitUSD using 110,668 BTS as collateral (at a 3 to 1 collateral ratio). This created $200 in value, essentially out of nothing and with no central party's approval. I then bought 37,119.58 BTS with that bitUSD and if the price of BitShares continues to rise, at some point my sell order will hit to obtain $200 worth of bitUSD at a lower price in terms of BitShares to repay the loan and release my collateral. Best case scenario, it will only make me about $10 worth of BitShares (though, of course, the price could go the other way as well and I'd lose money), but the point was to learn something.

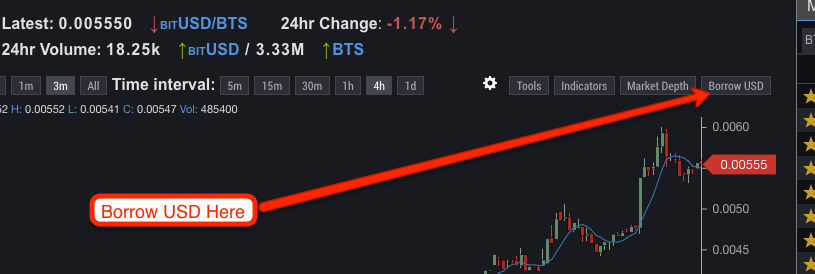

I highly recommend the video above which walks through how to do it, but the basic idea is to hit this "Burrow USD" button in the exchange for the bitUSD market:

You can then use your BTS as collateral to borrow bitUSD into existence.

You can see my open order here along with my margin call:

So why care about any of this? Why does it matter?

For far too long central bankers, "auditors," and corrupt multinational hedge funds have been manipulating centralized financial systems for their own gain. Today we have the technology to provide things like derivatives (which are actually really important for global trade) without having to trust any third party or auditor. The market failures of the past were driven in many ways by greed, corruption, and human error.

Time and time again, if we have to trust people, we see a breakdown in expectations.

Governments get around these failures by using the threat of force and stealing from tax payers to keep the whole faulty system going. In the future, "too big to fail" banks will put their depositors on the line with bail-ins and negative interest rates.

We now have the power to stop this and chart a new path. The multi-trillian dollar derivatives market could be run openly, honestly, and securely on a platform like the BitShares Open Ledger DEX. We don't have to trust systems built on fiat currency made out of nothing or fractional reserve systems with almost no collateral.

Here's how you can start helping:

Don't just trade currencies on the big exchanges. Use Use Open Ledger and enjoy the tiny fees (only small amounts of BTS worth less than a penny) while having all the results already directly in your secure wallet with no need to pay withdrawal or deposit fees.

The biggest challenge is just getting the liquidity there. With enough people using it and talking about it, Open Ledger could get some serious attention from companies who are sick of playing by corrupt rules for corrupt people.

The future is open.

The future is decentralized.

Even though I've been involved in crypto for a while, I still feel like I know nothing because there's so much more to learn.

I get excited about this stuff because I think it represents some of the best practical answers to how we can actually make the world a better place without the need for government violence.

I hope you'll join me.

Luke Stokes is a father, husband, business owner, programmer, voluntaryist, and blockchain enthusiast. He wants to help create a world we all want to live in.