On the off-chance you haven't heard, Bitshares has been rising because of the upcoming Peerplays sharedrop. This analysis compares Bitshares' action to Nxt's before the Ardor snapshots began, and concludes that Bitshares should enjoy a similar run-up. It is true that the cases are similar, but there's one important difference.

The main exchange for both is Poloniex. Its Nxt market is cash-only; you can't trade it on margin. With Bitshares, anyone can - and anyone can short-sell it. All you have to do is borrow some Bitshares that holders have offered up for loan, sell them, and hope that the price declines so you can buy back and repay the loan with cheaper Bitshares.

As I saw today, this option proved to be popular amongst some big creatures looking to profit from Bitshares tumbling down. Today, the Bitshares market was buffeted by the Attack of the Short Sellers.

Starting Off Firm

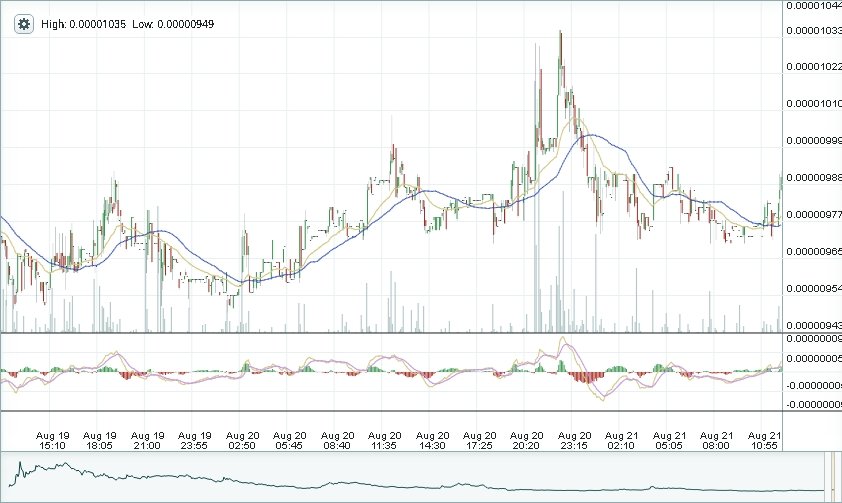

After surging and being whomped back yesterday, Bitshares firmed up overnight:

Its bottoming doesn't look that impressive in the two-day chart screenshot as of 8:15 AM (all times Eastern). But it does look better on the six-hour chart:

especially around 8 AM. Lots of buying pressure was pushing it up.

A Tempting Morning...

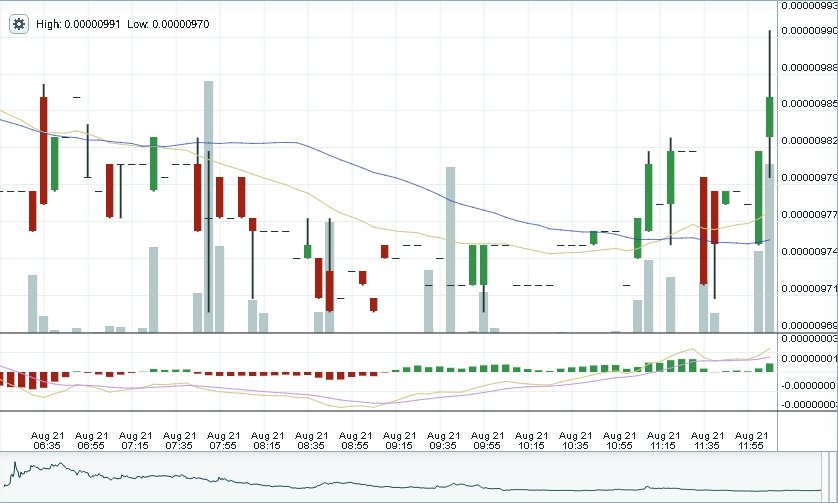

The morning did get off on the wrong foot, as hasty sellers pushed the price down (dumping) until the pile-on climaxed with Bitshares pounded down to 970. The market was quiet for a couple of minutes until a welcome whale arrived with a monster buy.

Hoovering up every sell order up to 1030, this whale - or group of eager buyers - threw in more than 23 Bitcoins to jack up BTS' price a full sixty satoshis. I had half-expected that this vault-up would be frustrated, but the market did its usual unpredictable thing. The price did fall back, but only to 1000 where it held firm. Then, in later morning, it reversed course and climbed! By noon, it had forged back up to1030:

But in so doing, it attracted the attention of short-sellers who had borrowed several million Bitshares and were looking to make a meal out of any bullish fish.

...For Short Seller Sharks.

It took me a while to realize it, but that nice uptrend in the late morning had attracted two hungry sharks who could each swing short-sell orders of well over one million Bitshares. As sharks often do, they started off circling cautiously. A little before noon, I noticed that the ask at 1031 had a huge volume of 1.5 million. At first I shrugged it off, figuring it was a school of spread-traders like me hoping to book some profits. It's wasn't until about 12:15 PM that I realized that it was a single order. As the market pulled back. I saw it move down to 1026. All at once.

It was a short seller, all right. At the same time, I checked the Lending market where short-sellers borrow and inferred that a lot of Bitshares had been borrowed by short-seller sharks. That single 1.5-million ask was not the largest one. At 1:17, I saw a second one for about 2.68 million. It was placed at 1027. Moving with the slumping market, the smaller one had been lowered to 1016.

Happily, that pair weren't the only big fishes in the waters. Buoyed by the upcoming sharedrop, big buyers came in and made it clear that the sharks weren't going to have an easy meal. At the same time, more than two million Bitshares was bid at 1000 and 1001.

The two sides eyed each other for a half an hour as trading diminished to almost nothing. Then, the bigger shark made his first move. At 1:41, the huger sell dropped to 1008. The big shark prompted a scramble of selling that exhausted itself at 1000 - but had whittled down that two million to less than 480,000. The shark smelled blood, and moved in for the meal.

He moved methodically, lowering what remained of his sell to 993 and even lower. The bull-fish scattered and Bitshares tumbled to 970. Unsurprisingly, the buybook regenerated slowly.

Until the day was saved by a welcome whale that - with one single buy order - obliterated all the sells up to 1015. The smaller shark chose patience; he raised his sell order to 1020. Then he waited. As of 2:30, calm returned as the smaller fishes like me also waited:

The second shark had seen that the bigger predator did not trigger a crash, so he kept waiting at 1019.

He was shrewd to do so. Taking heart, the bull-fish came back in and propelled the price up to his sell order - twice, in fact. Even though the buybook did not regenerate. The more cautious bulls were expecting another methodical gobble-up.

But it didn't happen; instead, Bitshares kept bobbing up and down. There was a slow descent over mid- and late-afternoon, but no tumble:

Just above is the six-hour chart as of 6 PM. Bitshares did sink, but not by that much. As I write, only about 200,000 of the shark's original order has been filled. The rest of the sell order is still there in the sellbook, immobile.

The real change happened higher up in the sellbook. The huge overhang of supply up to 1050 has shrunk. The largest sells above that 1019 has a volume of only 554,000; they're at 1035. If that shark vanishes, it would only take 27 Bitcoins' worth of buying pressure to take Bitshares up to 1060.

And on a longer-term basis, as the one-week-chart shows, BTS is slowly turning upwards.

That second shark is wise to be wary. The eager, bigger short-selling shark, unless he's scaled back his short, has more than 2.5 million Bitshares in his belly. If a rally obliges him to vomit them up, we'll see an all-out short squeeze.

But the shark could make his move - and he could be joined by others. I really don't know what will happen overnight. Accordingly, I reduced by long position to 500,000 shares. When the waters are choppy and big fish are swimming around, some of which have their hungry eyes on you, it makes sense to deleverage.

Lesson Of The Day

When the market gets choppy - or a little too calm - it's wise to pull back and hold some buying power in reserve. Especially if sharks show up!

Thanks (again) for reading, upvoting and commenting! We'll see tomorrow if the sharks prevail, another whale whomps them, or if the stare-down continues! Whatever transpires,