Royal Scyths

DEX Market Maker Tutorial: bits & bots

BitShares Decentralized Exchange (DEX) BitShares 2.0 is an industrial-grade decentralized platform built for high-performance financial smart contracts. The decentralized exchange that allows for trading of arbitrary pairs without counterparty risk facilitates only one out of many available features. Market-pegged assets, such as the bitUSD, are crypto tokens that come with all the advantages of traditional cryptocurrencies like bitcoin but trade for at least the value of their underlying asset, e.g. $1. Furthermore, BitShares represents the world's first decentralized autonomous company/organization (DAC/DAO) that lets its shareholders decide on its future direction and products. Just as the tech and governance is decentralized so is the markets with English and Mandarin (Chinese) communities equally balanced with several other markets quickly gaining momentum in Turkish, Russian and French portals that all use the same DEX blockchain for every trading market. This tutorial assumes you’ve already created an account in the DEX.

bitUSD --Better than fiat, tether & other non-backed IOU’s

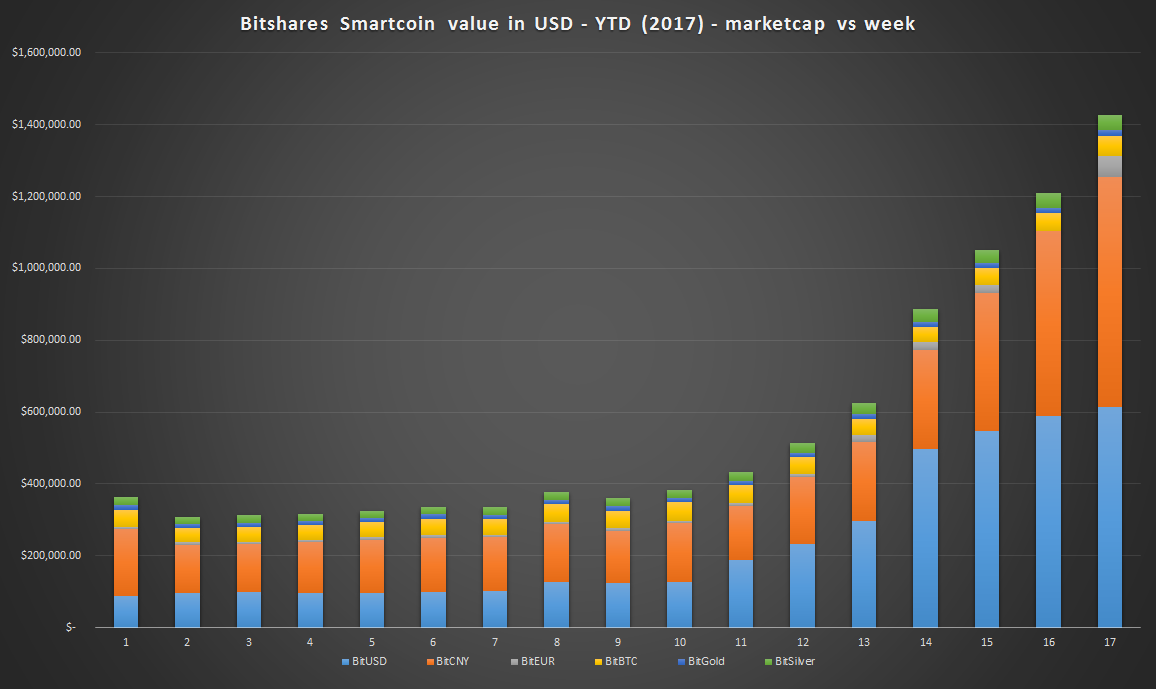

SmartCoin (bitAsset) issuance and market cap on the internal BitShares network continues to rise with the main SmartCoins (bitUSD, bitCNY, bitEUR, bitBTC, bitGold and bitSilver) reaching a market cap over 1.4 Million USD equivalent in April of 2017. This is a promising sign for the BitShares ecosystem strength and growth as the issuance of these assets are backed by a minimum of 175% in BitShares core token BTS. At the time of referenced analysis @steempower calculated the value backing these assets was greater than 5 Million USD worth of BTS. As this trend continues further stability will occur because the BTS is bonded [locked] to the network via a smart contract allowing these SmartCoins to maintain their face value without any counter party risk!

You can follow markets on CoinMarketCap.com for bitUSD and bitCNY

Borrow USD, CNY, BTC with 0% Interest Charged

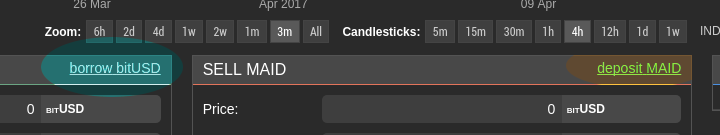

In order to increase your exposure to BTS and offer liquidity to SmartCoins (bitAsset), such as USD, CNY, GOLD, etc., you can borrow this bitAsset from the network and sell it short or pay for goods/services via BlockPay’s global merchant POS platform. We will briefly describe the process for creating bitUSD. This works especially well if you want to buy an asset that you think will gain value over the smartcoin you borrow.

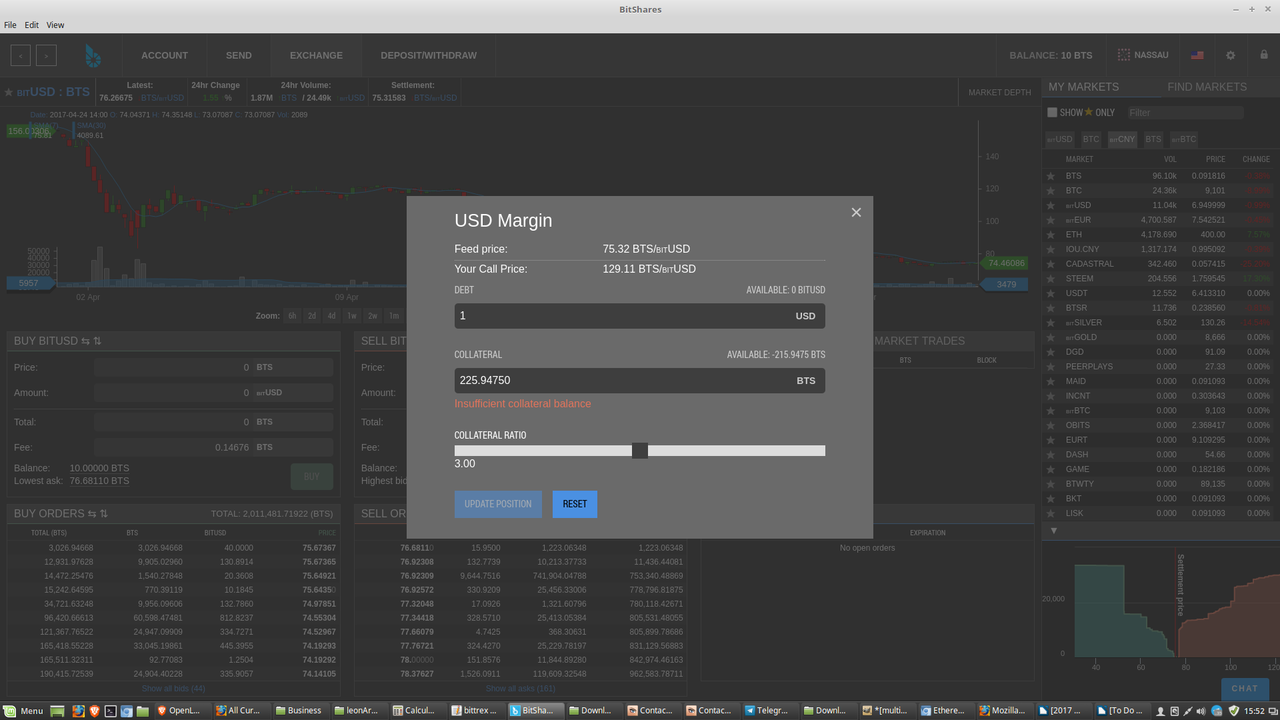

Borrowing from the DEX

The BitShares network is capable of issuing any amount of any BitAsset (SmartCoin) and lend it out to participants given enough collateral (Recommend at least 250-300% BTS collateral).

Current bitUSD Settings

Current bitUSD Settings

- Maintenance collateral ratio: 1750 (175%) - Maximum short squeeze ratio: 1100 (110%) - Minimum feeds: 7 - Force settlement delay: 24 hours - Force settlement offset: 1% - Max force settle vol: 0.5% - Short backing asset: BTS

- Settlement price: The price for 1 BTS as it is traded on external exchanges.

- Maintenance collateral ratio (MCR): A ratio defined by the witnesses as minimum required collateral ratio.

- Maximum short squeeze ratio (MSQR): A ratio defined by the witnesses as to how far shorts are protected against short squeezes.

- Short squeeze protection (SQP): Defines the most a margin position will ever be forced to pay to cover settlement.

- Call price (CP): The price at which short/borrow positions are margin called.

Here is a video tutorial published by a BitShares community member How to create BitUSD

Market Making Bots on the DEX

leonArdo

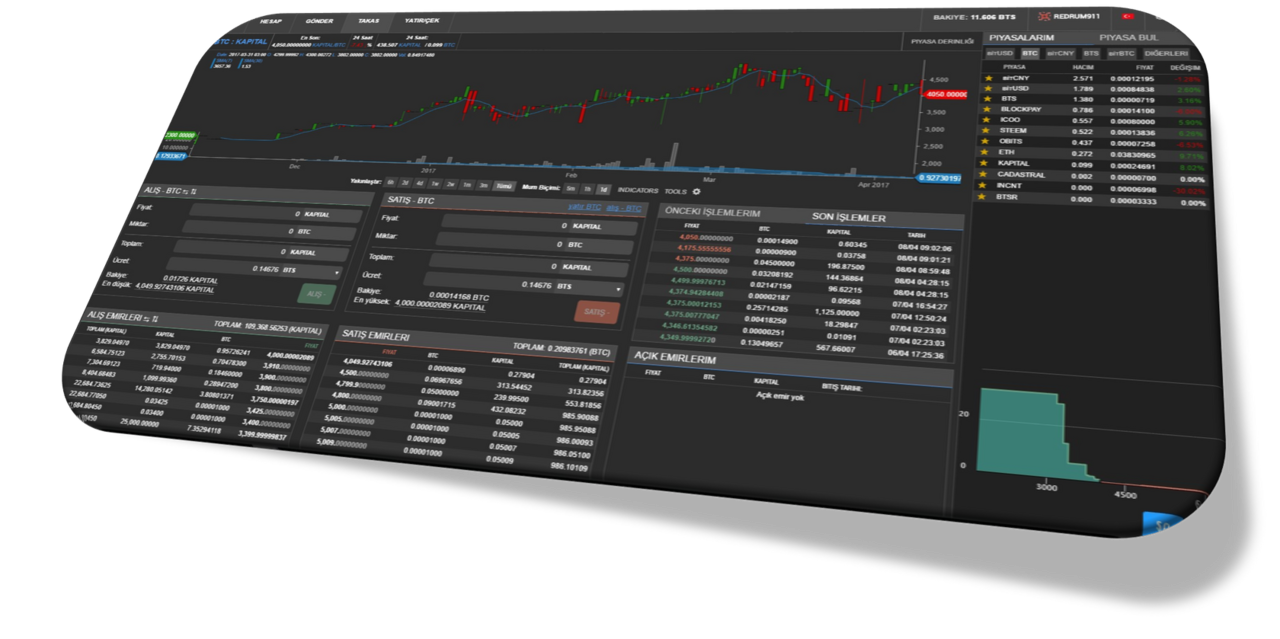

leonArdo has been designed as a visual trading front-end for different markets. However, rather than simply mimic market websites, leonArdo provides a host of additional features that; significantly improve your trading experience. leonArdo currently supports Poloniex, Bittrex, BTC-e, Bitstamp, Bitfinex, OKCoin and OKCoin CNY, but new market plugins are in the pipeline and if rumors are true then the addition of BitShares Decentralized Exchange is imminent.

LeonArdo was included because of Bittrex's integration of bitCNY. After the DEX is added users will be able to leverage the bitCNY:BTC trading pair to take advantage of any arbitrage between markets like MAID, BTS, bitCNY, LTC, ETH, DASH. Users of Tether know the inconsistencies associated with running on the Bitcoin blockchain, which BitShares SmartCoins are the solution. Plus adding in the counterparty risks proven recently with Tether markets further diminishes the value of non-collateralized fiat pegged IOU's. bitCNY (bitUSD) and its BitShares Graphene Blockchain has a transaction confirmation time of 3 seconds or less and has been proven to handle a minimum of 3,300 Tx/second. After this most recent USD pegged asset [Tether] falter; hopefully exchanges such as Poloniex who used to list bitUSD will return to it for the security and safety of their customers.

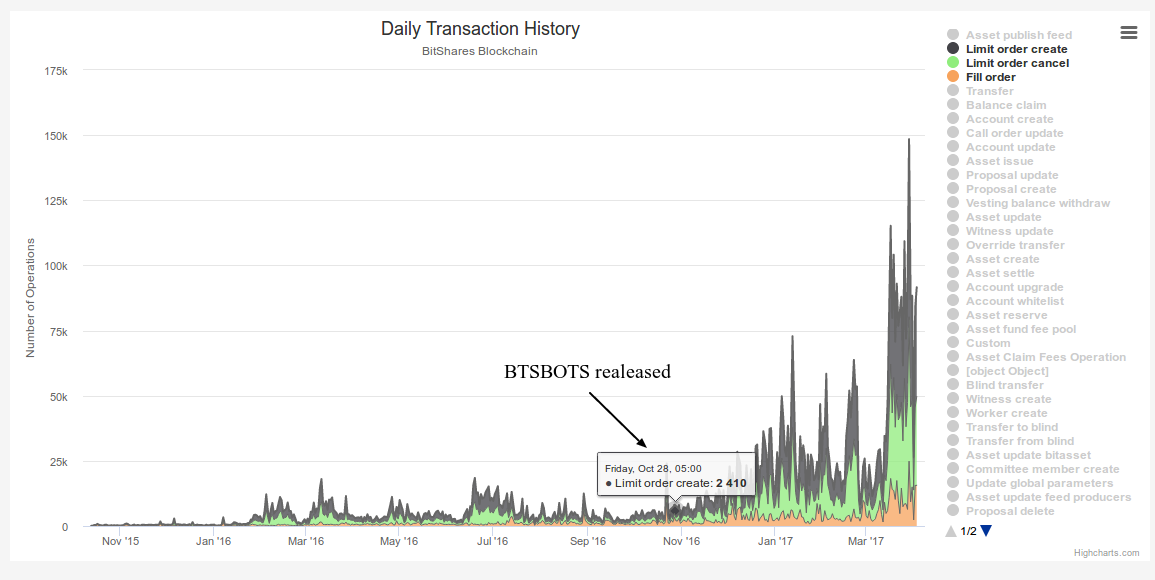

BTSBots

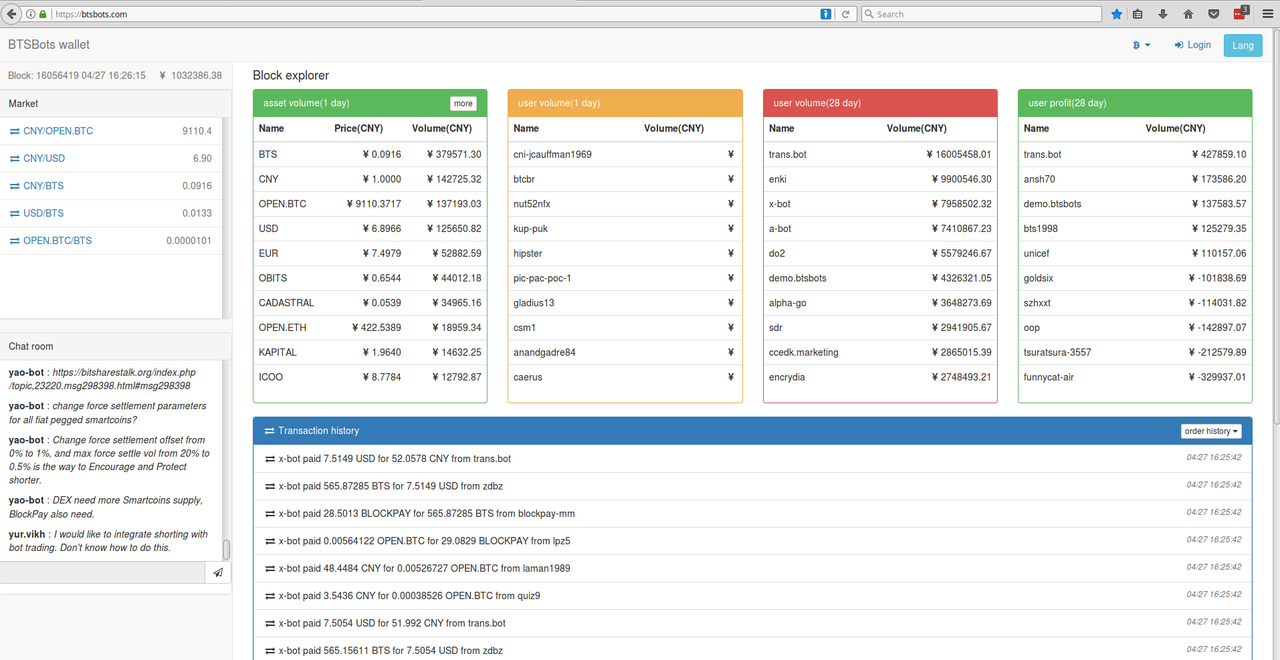

btsbots.com is third party market making bot software from a trusted BitShares community member Alt. This software is available at btsbots.com or from the android play store. The APP allows no page to be left open feature.

The fees for trading on the DEX are already low for crypto trading, but to further reduce fees by 80% (plus other benefits) that these little bots can create you should consider upgrading your BitShares account to a Lifetime Member (LTM). Using BTSBots requires users to share their active permission private key so we recommend creating a second account, for a nominal fee of ~7 BTS, specifically for bot trading (still gets the discounted fees if created with your LTM

Using BTSBots

Here is a video tutorial published by a BitShares community member: btsbots app demo

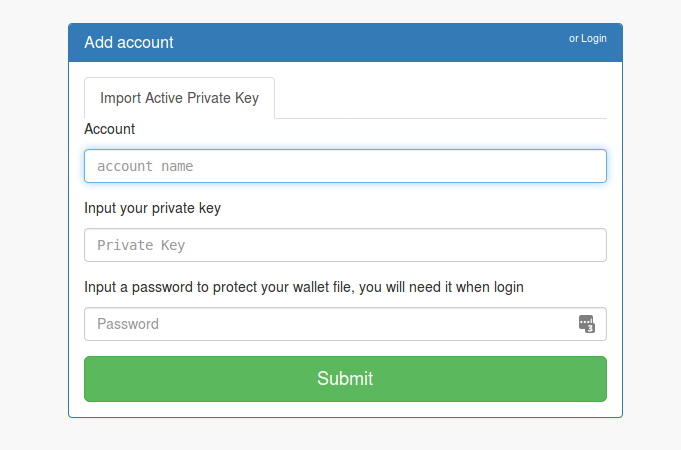

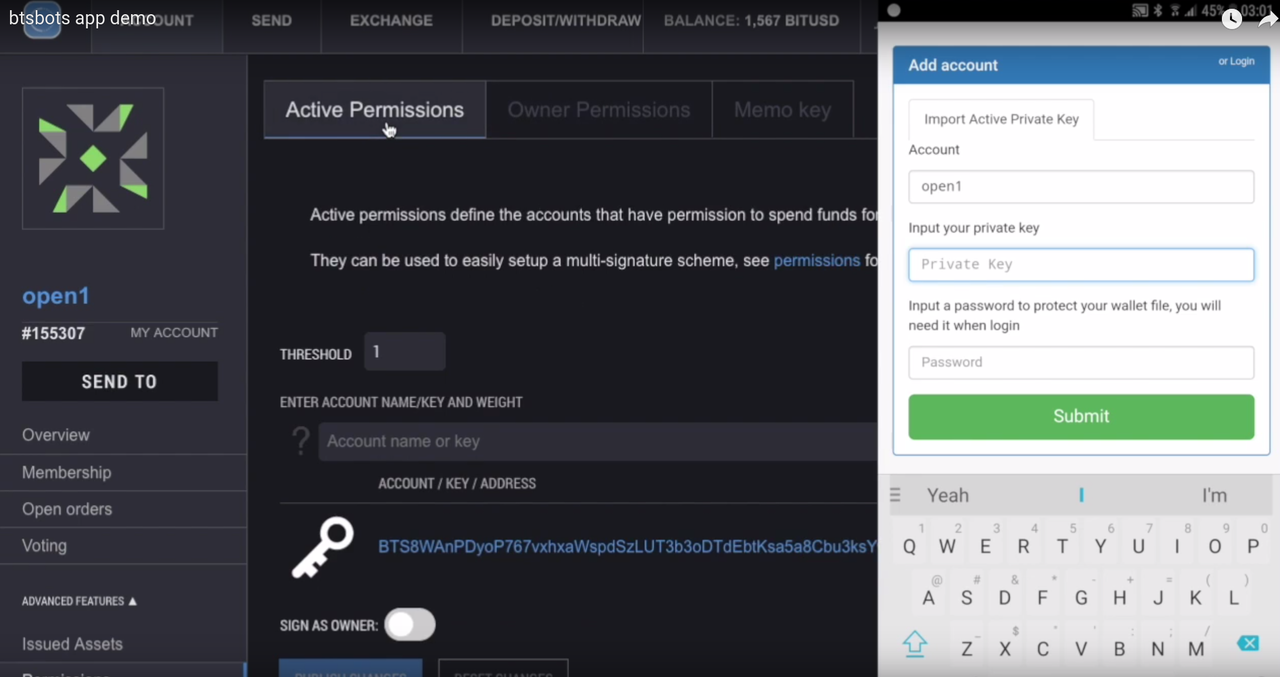

1. Create an BTSBots account. Go to btsbots.com and follow the instructions. To use your existing bitshares account, you need to import its active private key from DEX account. Use a different unique password than DEX account.

Remember it is the "Active Permissions" key in an account you have created specifically for bot trading since the private key will be shared with btsbots (encrypted with a unique password in registration process). Click on the Blue Hyperlink next to the key icon. Then you will get this screen

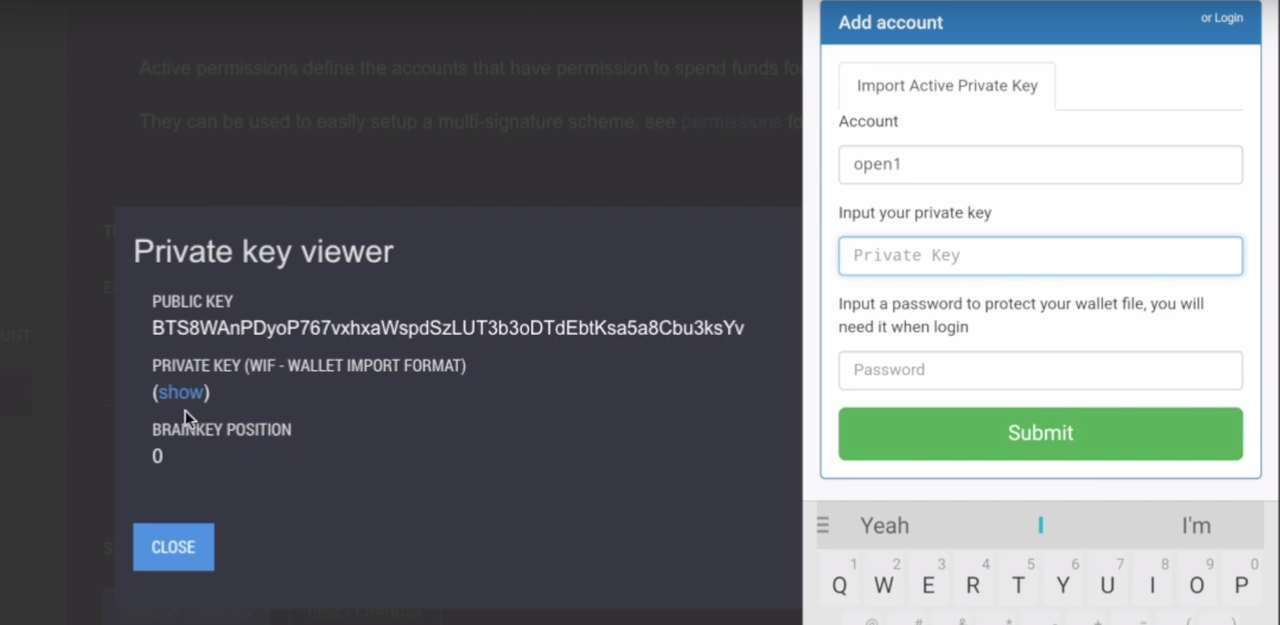

2. To view your account, select it from a drop down list with user icon at top-right. The account overview page shows account balance, 1 day trade volume, 28 days trade volume and 28 days balance change for each asset, their equivalent values in CNY and total value for all assets in CNY. A number at the top of the right column (trade balance(28 day)) shows you how your trading is performing. If it is positive, you are doing good. To add a new account to favorite list, type its url, e.g.

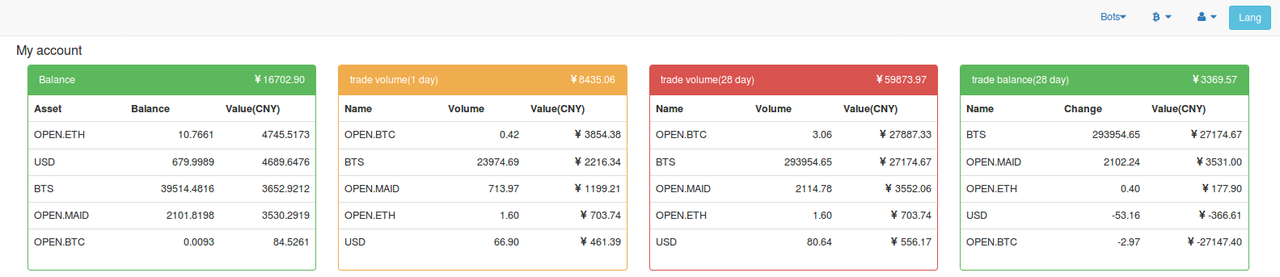

3. Left column shows you a list of favorite pairs. To add a pair, type its url (see below) and click a little heart icon at top-right. You can invert base vs counter asset by typing url or clicking the price hyperlink. You can trade all asset if you can get the reference price. For some asset lack of trade history, no reference price from btsbots.com. You can set a custom price in the bots's config page

All current reference price sources from script btsprice which used by delegate.baozi

- All MPA's issued by committee

"KRW", "BTC", "SILVER", "GOLD", "TRY",

"SGD", "HKD", "RUB", "SEK", "NZD", "CNY",

"MXN", "CAD", "CHF", "AUD", "GBP", "JPY",

"EUR", "USD", "TCNY", "TUSD", "ARS"

- UIA issued by trusty gateway:

"BTC": ["OPEN.BTC", "TRADE.BTC"], "USD": ["OPEN.USD", "OPEN.USDT"],

"EUR": ["OPEN.EUR"], "CNY": ["OPEN.CNY"], "RUB": ["RUBLE"], "GRC": ["OPEN.GRC"]

- exchange poloniex.com price feeds

UIA asset "OPEN.ETH", "OPEN.DASH", "OPEN.STEEM", "OPEN.MAID", "OPEN.LTC", "OPEN.OMNI", "OPEN.LISK", "OPEN.GRC"

- special SYMBOL can used in bots config page

"POLONIEX:USDT_BTC"

All other asset prices are from DEX's trade history with simple algorithm, you'd be better to set a custom price for these assets. Also, no price feeds from some assets, because they lack enough trade history.

Here are several markets with excellent liquidity:

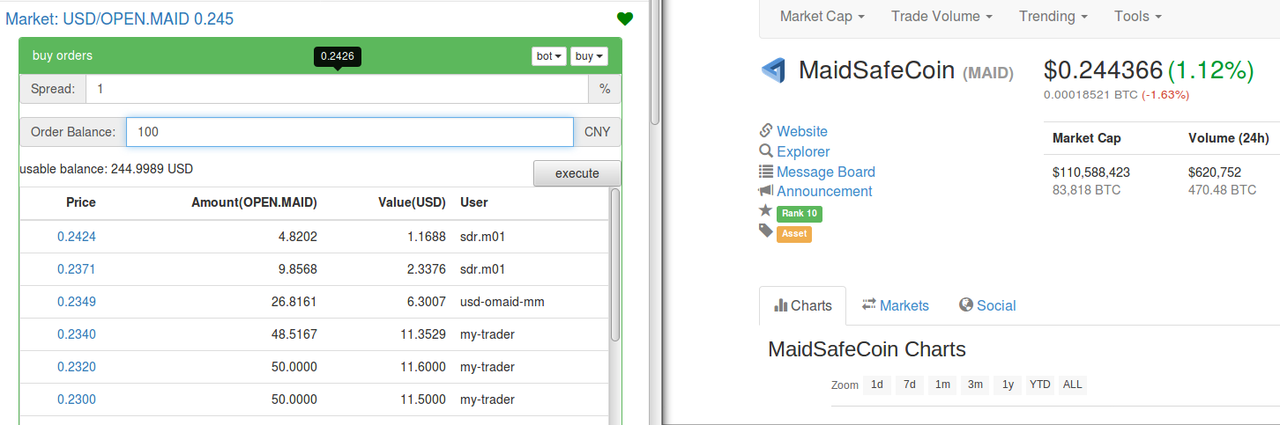

- https://www.btsbots.com/m/USD_OPEN.BTC

- https://www.btsbots.com/m/USD_BTS

- https://www.btsbots.com/m/USD_OPEN.MAID

- https://www.btsbots.com/m/USD_OPEN.ETH

- https://www.btsbots.com/m/USD_OPEN.DASH

- https://www.btsbots.com/m/USD_OPEN.STEEM

- https://www.btsbots.com/m/USD_OPEN.GRC

- https://www.btsbots.com/m/CNY_USD

- https://www.btsbots.com/m/OPEN.BTC_BTS

- https://www.btsbots.com/m/OPEN.BTC_OPEN.MAID

- https://www.btsbots.com/m/OPEN.BTC_OPEN.ETH

- https://www.btsbots.com/m/OPEN.BTC_OPEN.DASH

Click a little heart icon at top-right. Now you can select exchange. btsbots from the favorite list. To remove account from favorites, select it and unclick the heart icon.

4. Once you selected a market, you can start trading.

a. You can place an order manually by pressing "buy" or "sell" buttons

b. You can set up a bot to make trading for you by pressing "bot" button.

Please be aware of your local laws. A lot of the software discussed is experimental. Use at your own risk. This is not investment advice.