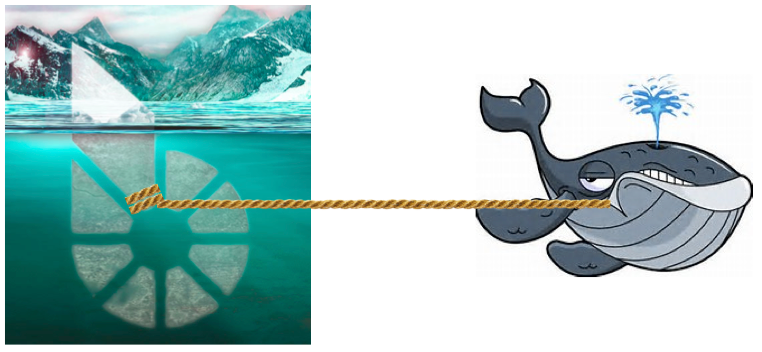

Whale Powered Assets

Governments and wealthy institutions (sovereign whales) traditionally supply our currencies because they can decree them by fiat. We all know why we don’t like that, but such coins generally work well enough for economies to function – until they don’t.

Crypto currencies are intended to fix what we don’t like about whale issued coins, but they have their own problems, such as instability and reluctant mass adoption.

So most of us settle for a mix of the two to meet our needs for a Store of Value (SoV), a Unit of Account (UoA) and Medium of Exchange (MoE). BitShares is a versatile, low-friction economic platform where such mixing can take place efficiently.

But it can also be thought of as a “currency factory” that offers a way to create a variety of useful hybrid coins that breed desirable features from multiple currency strains. Some are trustless. Some engineer blockchain-assisted trust. Some represent real assets mapped onto the blockchain by trust alone. Others are stable with respect to external assets that may or may not be stable themselves. Some are deterministically self-contained mathematical constructs. Others extract order from the unpredictable external consensus of generally clueless people. Our industry is generating a Cambrian Explosion of new coin species. Some will emerge as the fittest.

So what are we missing? Are there other strains of monetary DNA that could be added to the mix that would serve as versatile building blocks for the perfect hybrid currency?

Well, what about sovereign whale power? There are plenty of whales out there itching to use their power (benevolently, of course) to create better currencies. I’ve talked with some of them. Is it possible to use crypto-integrity to harness and safely direct sovereign whale power? If I were a friendly sovereign whale with relatively unlimited resources, could I find a way to infuse that power safely into the BitShares factory to produce the ideal cryptocurrency – without destroying its essential self-governing robotic integrity?

Strange bedfellows spawn the “perfect” currency?

In December 2014, Dan “Bytemaster” Larimer posted a two-part article (with cameo appearances by Vitalik Buterin) explaining how to do the “impossible” task of creating a stable decentralized crypto-currency.

Stable Crypto Currencies are Impossible.

There, he opined “The real goal is the global acceptance of a fixed supply, predictably appreciating currency. The challenge is how do we get from where we are today to global acceptance when the value of our crypto-currency is highly volatile.”

That’s where I think whale power might come in.

In Bytemaster’s opinion, if BitShares were to somehow become big enough and accepted enough it would be both (a) the ideal predictably appreciating asset to use as a currency itself and (b) the ideal reliably appreciating base asset needed for generating currencies pegged to everything else.

Whales specialize in making things big, accepted and appreciating.

“Unlike the other pegging systems,” says Bytemaster, “BitAssets have a positive return proportional to the expected growth in the value of BTS relative to the value of the pegged asset. In time BTS will become the reserve currency and will ultimately become the fixed supply, counter-party-free, highly predictable, constantly growing ideal money.”

So, all we need to do is to harness up a whale to provide these three missing ingredients:

- Acceptance. A whale can provide marketing power and branded clout to generate consumer awareness, trust and demand.

- Liquidity. A whale can provide market-making functions that drive liquidity of the base asset and the BitAssets built on it.

- Growth. A whale can generate the buying pressure, shrinking supply, and momentum necessary to cause “predictable appreciation” of the base asset.

What is especially intriguing is that it might be possible to get a whale to do this without giving it any power at all to corrupt the resulting suite of currencies. A robotically honest, whale-powered cryptocoin factory? Surely you jest!

No. And don’t call me Shirley.

First, let’s assume that our friendly whale is big enough to generate a revenue stream sufficient to power our factory. Suppose it comes from the earnings of a whale-owned asset that the whale is willing to provide because of the economic or social benefits she expects to derive from the mere existence of such a currency. Nothing outrageous, mind you, just a billion dollars per year – the amount McDonald’s pays for its hamburger input stream. If you are Apple or Exxon, or can buy Apple and Exxon, you could siphon off just a few percent of your profits to power BitShares. That’s all you would need to create the ideal world reserve currency(!). That’s a tiny fraction of what it would cost you to back a currency directly with gold, oil or cannabis. Perhaps we could simply reallocate 1% of the improper payments made in subsidizing the US healthcare system.

I’ll leave the details of how to harness whale power as an exercise for the student. Like plutonium, let’s focus on all the cool things we could do with it if we had some.

The Brute Force Counterparty Method.

If I lacked all imagination, I would simply tell our whale to issue a User Issued Asset called the, um, “McBuck”, and use her whale power to pay interest. That would immediately set it apart from all other currencies in an era of negative interest rates.

A billion dollar stream would back a 20 billion dollar currency at 5%. That’s an interest-paying digital currency three times bigger than Bitcoin and 100% liquid. Sure there’s counterparty risk, but that mythical whale is spending a billion dollars a year promoting a public chain she doesn’t control just to earn the world’s trust – and she owns Apple and Exxon! How risky can that seem to the consumers we are courting? How does that even compare, in the public’s mind, to the risk associated with the three self-appointed mining companies that control Bitcoin?

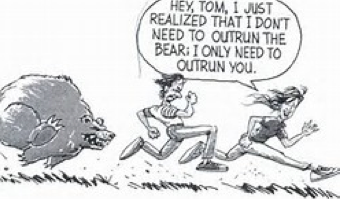

If you are worried about referencing the McBuck to a decaying fiat currency, why not use a whole basket of currencies and reference the McBuck to the best of the bunch on any given day – plus 5% APR scheduled appreciation. Since the best fiat in the basket is just losing ground at the slowest rate, it will actually cost less than 5% to redeem a McBuck in constant terms. To be successful we don’t have to outrun the coming fiat collapse. We just have to outrun the competition.

The Elegant Counterparty-Free Method.

But can we use whale power with no counterparty risk at all? Sure. Here, we simply use whale power to accelerate how quickly BitShares itself gains the remaining things it needs to become the ideal currency – acceptance, liquidity, and growth. The question becomes how best to use an annual power stream of $1B to make this happen. Here are some things that a whale could do with her power stream, although it is not clear what the optimal mix might be:

- Pay for marketing and education about BitShares and its Smart Coins.

- Fund BTS workers allowing dilution to remain zero while improving ecosystem.

- Offer free samples to get new members to sign up.

- Buy up to $1B worth of BitShares per year and lock or burn them.

- Pay lifetime membership fees for every user (moving 20% out of circulation).

- Fund an interest-paying asset like the above McBuck to attract more users.

- Fund market-making activities to give BitShares the best depth and liquidity.

Note that the only involvement of the whale is in boosting acceptance, liquidity, and growth. The whale has zero control over the currency or the platform that operates it. All it does is build kinetic and potential energy. If the whale power stream ever ends, BitShares continues to safely glide forward until we can hook up another whale. At scale, BitShares should be stable enough to ignore any such transients and will no longer need whale power. We are only relying on the whale to tow our glider to a self-sustaining altitude.

A big enough whale might choose to do all of the above and give consumers and businesses a rich choice of options. So, assuming, hypothetically, for the sake of motivated discussion, that our business development team could find such a whale, what should they be telling her right now?