2018 is shaping up to be a Perfect Storm for the Bitcoin industry. It will be the "best of times and the worst of times." The industry is going mainstream while the Powers That Be are plotting some kind of Global Reset to demolish the dollar and bring in a One World Currency to seize Absolute Power over humanity. The sheepdogs sense something is up and are pouring into digital currencies -- driven either by Fear of the Beast (FOTB) or Fear of Missing Out (FOMO). Their sheep? Well, not so much.

The resulting misallocation of wealth is staggering.

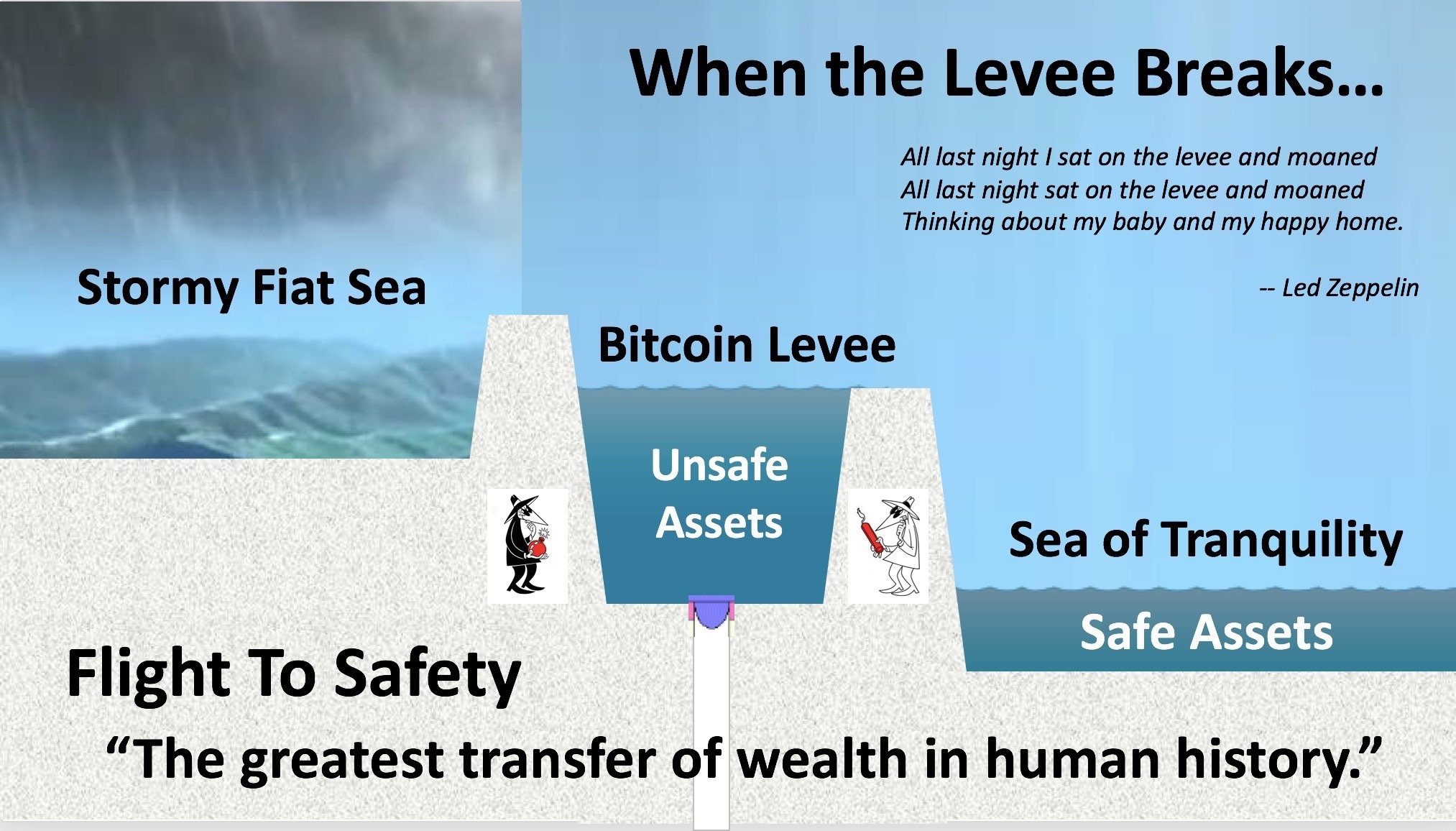

If it keeps on rainin' levee's goin' to break

If it keeps on rainin' levee's goin' to break

When the levee breaks I'll have no place to stay.

When the levee breaks, we will see "the greatest transfer of wealth in human history." I can't figure out who said that first. Just about every crypto/metals pundit has said it at least once since 2008. I think I first heard it from Chris Duane in his classic Silver Bullet and Silver Shield video.

Or was it Mike Maloney? Peter Schiff? Gerald Celente? Doug Casey? The Dollar Vigilante? ... the mind reels.

Whoever said it first was certainly talking about a movement of wealth from the fiat bankster system into precious metals. Lately, I've heard it used with equal enthusiasm about the Bitcoin Industry. Cryptocurrencies are hot and smart money is beginning to move into it. How smart is rather debatable.

Most of the "smart" money is moving because (a) they see the exponential run-up in prices, or (b) because they did their "due diligence" reading sponsored articles by people who interviewed one of their own media clients as a "subject matter expert" because they became rich and famous on Bitcoin or Ethereum and are now investing in projects based on Bitcoin or Ethereum. All unbiased critical thinkers with no agenda, of course.

They have no idea what will happen next.

Cryin' won't help you, prayin' won't do you no good,

Now, cryin' won't help you, prayin' won't do you no good,

When the levee breaks, mama, you got to move.

to the greatest misallocation of wealth

since the Great Tulip Mania of 1637."

Stan Larimer

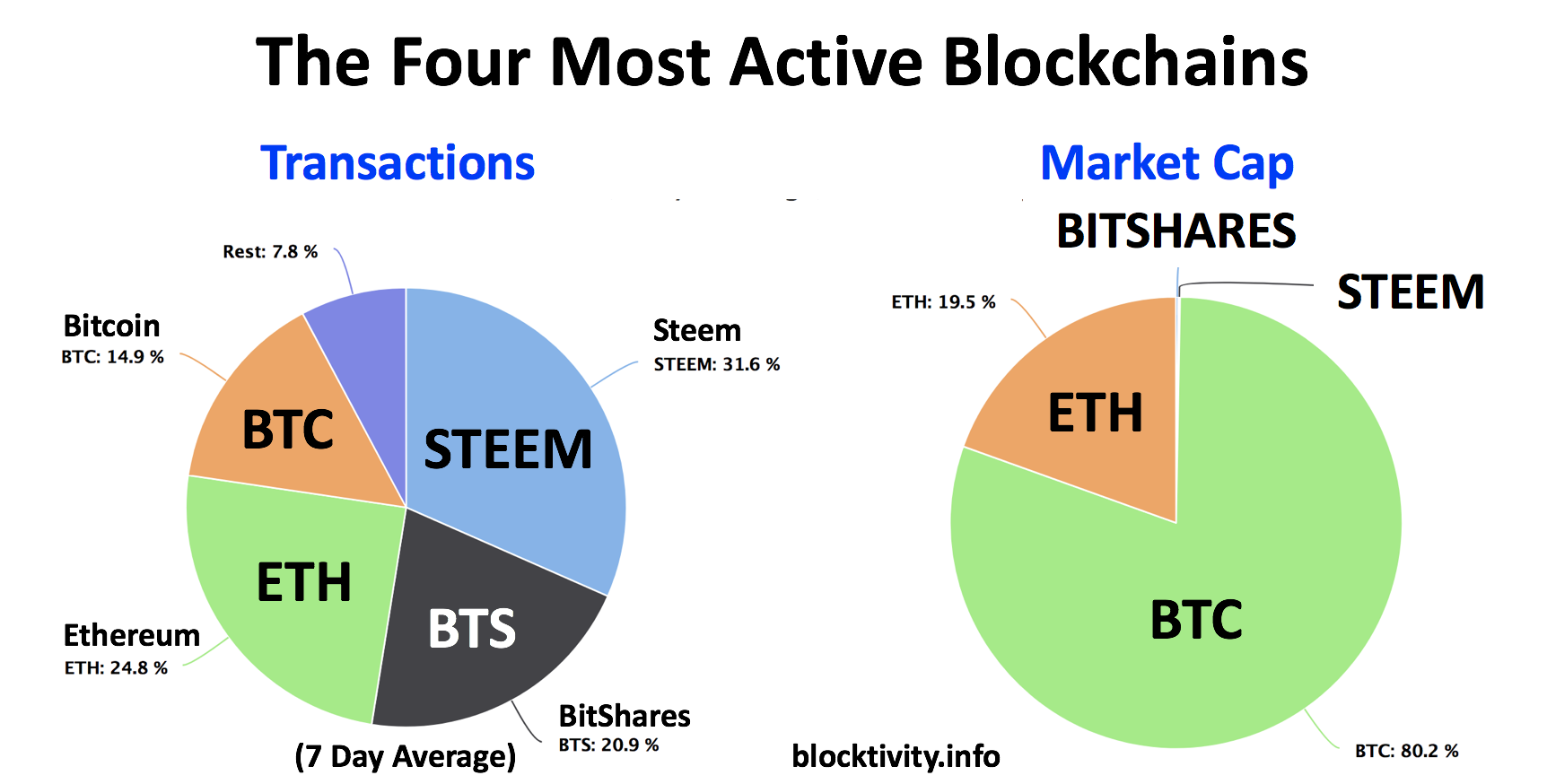

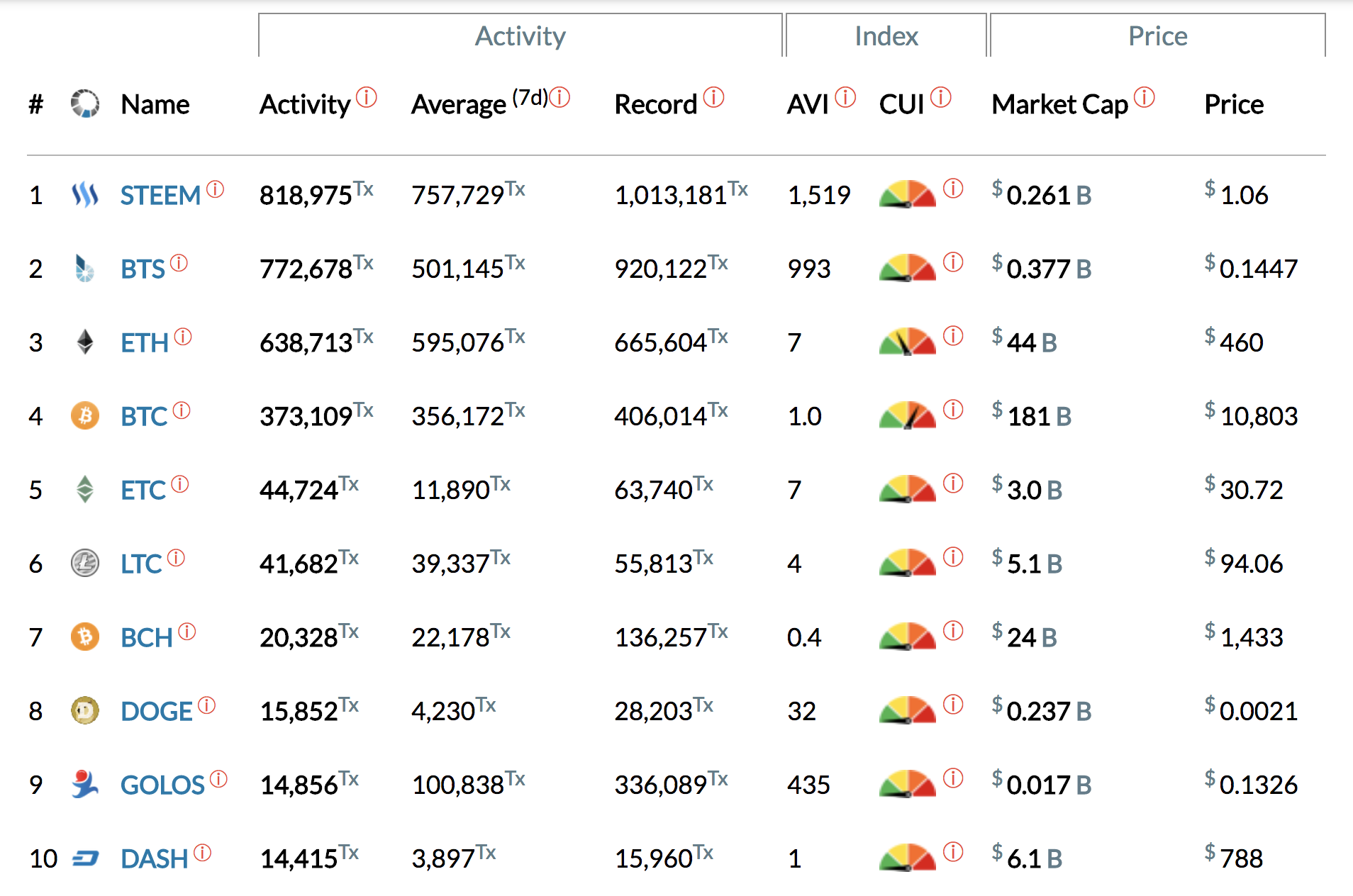

Take a look at what most of the "smart money" is buying. Notice any misallocation of wealth?

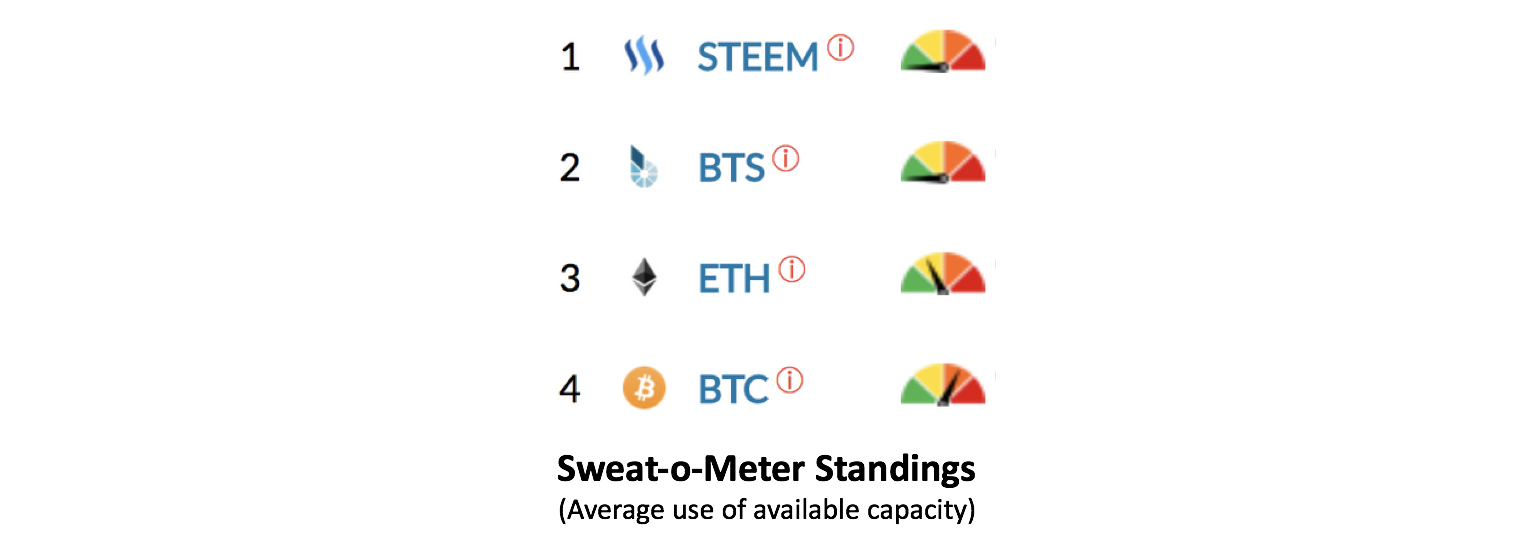

Yep. That's right. Bitcoin and Ethereum are the biggest simply because they are the biggest not because they are the most used. And it's only going to get worse because Bitcoin and Ethereum can't be more used. They are already saturated many times a day and forced to ration their use by raising their prices.

Mean old levee taught me to weep and moan

Lord mean old levee taught me to weep and moan

Got what it takes to make a mountain man leave his home

Meanwhile, the real-time blockchains using Dan Larimer's DPOS technology are quietly taking over - without even moving their own sweat-o-meters off zero.

Steemit and BitShares routinely top the charts at blocktivity.info. Both have huge excess capacity to grow, and companies with high bandwidth applications are beginning to notice. In the past few months the following companies have announced that they are moving to BitShares simply because it is the only platform that can handle their transaction volume.

- Bankcoin

- Eristica

- Micromoney

- Bitspark

- Augmate

- Stokens

- CVCoin

I know of a few more applications with huge existing user bases that are about to announce before Christmas as well. These are just the first fruits of a global awakening to the fact that performance, not good-old-boy networking, is what ultimately matters when you can no longer bluff your way forward with awesome contacts and great marketing. There are hundreds of new applications currently being built on the slow, overloaded mining-congested networks of yesteryear. Each is about to inconveniently discover that they can't service their customers after spending a year in development and promotion barking up the wrong tree. Then the above trickle of defectors will become a torrent as the Bitcoin Levee breaks, releasing all that misallocated wealth back into the system in pursuit of something safe to own.

All that business will be backed up and held hostage in a log jam behind the Bitcoin Levee. The reservoir where over $200 billion in digital currency wealth has been accumulating is about to discover that it is a stagnating dead pool with no place to grow.

"When the Levee breaks, got no place to go..."

But wait! There's more! At the same time enterprise level train wrecks are littering the landscape, the regulators of the world are going to be shutting down half of the big-money ICO's, locking up their purveyors and sending shockwaves through the market. The resulting stampede for the exits is not exactly going to calm the industry down.

All last night sat on the levee and moaned,

All last night sat on the levee and moaned,

Thinkin' 'bout my baby and my happy home.

So there will be a Flight to Safety all right. Businesses moving to proven real-time blockchains designed to handle their traffic and speculators seeking out high-quality tokens backed by licensed securities, trusted commodities, and utility tokens that offer real value.

Look on the bright side. It's very nice to have all those resources stored up for us behind the Bitcoin Levee. The opportunities for those who offer true quality and performance will be enormous!

What's in YOUR wallet?

Forget coinmarketcap.com! Visit blocktivity.info for live performance based Metrics that Matter.)

See Also

The Great Bitcoin Train Wreck of 2018

DISCLAIMER: Author is NOT a United States Securities Dealer or Broker or U.S. Investment Adviser. Sender is a consultant and makes no warranties or representations as to the buyer, seller or transaction. All due diligence is the responsibility of the reader. This post and the referenced related documents are never to be considered a solicitation for any purpose in any form or content. Upon viewing of this document, the Recipient hereby acknowledges this disclaimer. These documents are not from any banking or other Institution. We do not provide securities or securities-related advice. No information herein shall be construed as a solicitation of investment funds or a securities offering in any way.