Bitshares cash flow and some upcoming important milestones that will change the dynamics forever..

In a recent post a steemian had an interesting question and in my response to him i realized the answer was so long it deserved a full post; so here we are. Thank you to @fintekneeks for a brilliant question and i hope i do the explanation justice as it is a hard topic to wrap your head around; I also think it is very valuable information that is not widely known.

To Answer @fintekneeks question(bottom of this post); i need to start back a little bit and let you know the history of the distribution of Bitshares. I will start with what does Bitshares do, How does it manage to pay it's workers and witnesses/miners without dilution and then the historic distribution and why in my opinion the game is about to change

Bitshares - General overview and Flagship products

Bitshares is the first Graphene based blockchain platform running with 3 seconds block times which provides it's customers with a means of trading on it's Decentralized Exchange (DEX) and very comparable speeds to a centralized alternative. The core benefit of this Decentralized exchange is the ability to trade while retaining ownership of your funds!! In comparison when trading on a centralized exchange you deposit real 'assets' and are issued with promissory note by the exchange; These notes are redeemable for the asset that you deposited or the asset which you traded the deposited currency for.

This is fine unless the exchange gets hacked, shutdown, frozen or violated by fraudulent staff or owners; anyone in the space will be aware this is a common occurrence and if it was to happen to your favorite exchange the promissory note that you exchanged your real 'asset' for may just become worthless overnight.

One of the Bitshares platforms flagship products is the DEX itself and Smart-coins (pegged to real world assets) allowing the DEX's users to hedge into fiat currencies of commodities. The DEX also allows its customers to margin trade by putting BTS as collateral and borrowing smart-coin from the blockchain allowing smart-coins to be used as a vehicle to margin short or long (profit from rising or falling) markets. Smart-coins are powerful assets that can also be used like any other cryptocurrencies; they are transferable, divisible, fungible and backed by the blockchain.

Bitshares also offers a host of other interesting use cases such are encrypted messaging, dynamic account permission, ability to issue you own asset(UIA's), prediction markets and many more.

Bitshares Stats:

| Metric | Value |

|---|---|

| Maximum coin Supply | 3.7 Billion |

| Reserve Pool Balance | 1.029 Billion |

| Bitshares in public circulation | 2.671 Billion |

| Current Market Price | 0.0000995 BTC |

| Current Market Cap | 26576.45 BTC |

| Current Market Cap USD | $15,414,341 USD |

Bitshares Cash flow

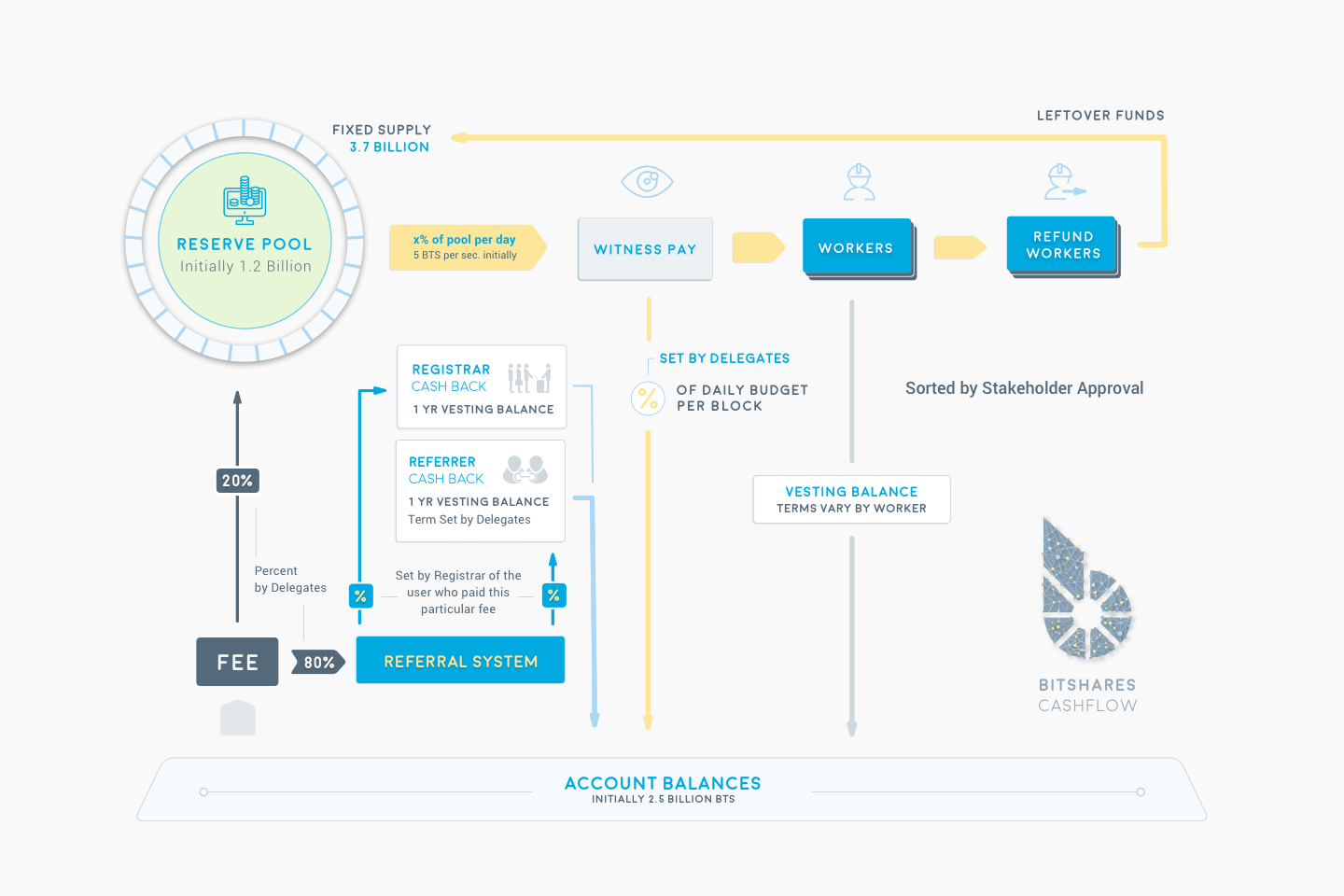

Bitshares has a fixed market cap of 3.7 Billion shares; initially distributed between normal account balances: 2.5 Billion and a Reserve Pool: 1.2 Billion

No new shares are ever printed; only the movement of shares between either being in circulation or being in the Reserve Pool.

Balance Types

Account balances:

These include all account balance held by users; this category also contains vested funds; vested funds are BTS that cannot be spent until a particular point in time, these funds maybe vested because they are the reward from a worker proposal or because they are the result of a share-drop (i will explain more details on this later).

The Reserve Pool:

The Reserve pool belongs to the Bitshares Blockchain and collects money in fees from operations such as transfers, trades, UIA registrations etc. This pool is also responsible for paying witness (Block validaters / similar to miners) and for funding development or other works via a worker proposal.

Bitshares Expenses

Worker Proposal:

Worker Proposals are submitted by developers or user looking to work for the blockchain; it could be for anything such as development, marketing, education etc.. Proposals contain summary of the task to be completed, milestones, the amount desired by the worker, a start and end date and a vesting period. proposals are submitted to the Bitshares blockchain and shareholders vote to approve or decline the proposal; If approved the blockchain itself will pay the amount requested by the approved worker proposal starting and ending on the dates specified.

Witnesses:

Witnesses are voted into their position by stakeholders and it is their primary job to secure the ledger and facilitate adding and verifying blocks to the blockchain. These witnesses are paid for their constant vigilance and can be voted out if they are seen to not be preforming their duties

Bitshares Income

Bitshares collects income in the form of fees paid to the network from operations such as transfers, trades, UIA registrations, account registration ect..

Bitshares Initial Distribution; History and 'The Merger'

Anyone that has been around the bitsharetalk forums for some time may have seen references to 'the merger'; this was an important time in Bitshares history and the point that all previous chains where merged into what we know as Bitshares today.

History:

Before Bitshares their was Protoshares (PTS) Launched on November 5th 2013 (Guy Fawkes Day); Protoshares was a clone of Bitcoin with a vision to allow its holders to be a share-drop target for all future projects of invictus innovations. PTS was a means to help fund development of the Bitshares decentralized exchange, the funding did not go as well as could have hoped due to large mining pools sucking up the mining rewards and dumping them on the market. Sometime later Angel shares(AGS) was announced as a direct method to help fund development by donating money in return for AGS in a virtual mining competition un-corruptible by big physical miners; AGS holders as with PTS holders would receive a 10% sharedrop of any invictus innovations project going forward.

Time moved on and BitsharesX, DNS, PLAY, Music and Vote projects where released to the public and the social contract was upheld and allocations to PTS and AGS holders were honored. BitsharesX was actually allocated completely to AGS and PTS holders as far as i am aware.

The Merger and the initial distribution of Bitshares

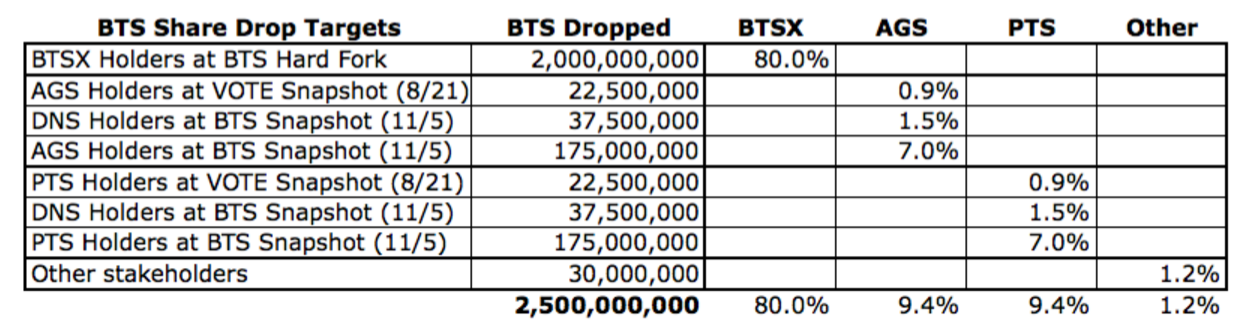

With a number of projects in flight the decision was made to 'Merge' all projects into a super DAC known as Bitshares; This Merger would occur by means of distributing 100% of the Bitshares tokens to holders of the projects. 9.4% to AGS, 9.4% to PTS, 1.2% to DNS and VOTE and 80% to BTSX holders (of which PTS and AGS where the sole benefactors initially).

BTSX holders would received 80% of the BTS tokens which would be available immediately.

PTS and AGS, VOTE and DNS holders would receive 20% of the BTS tokens and they would be vested over 2 years allowing a slow release of fund to these holders; similar to Steempower.

This Merger occurred on the 5th of November 2014 (Guy Fawkes Days) and the Vested balances would be unlocked slowly until the 5th of November 2016.

Bitshares was born.

There is more history that is not told here and the account is only brief and only to serve the question asked by @fintekneeks. If you would like to read more about the history of Bitshares i suggest checking out @stan as he has a nice account of the events of the past.. if you are not a keen reader or decide the history is too vast; stay tuned to my blog as i have a nice surprise for you shortly :)

The end of an era - Bitshares paid it dues

1W candles - chart looking back to the merger on the 5-Nov-2014

The time is almost upon us where Bitshares has completely paid off its social contract to PTS and AGS holders and the selling pressure they have added to the market so far. Given the mining in the early PTS days was dominated by big miners there are a lot of early PTS holders that did not share the grand vision the was Bitshares and were purely motivated by monetary gains. These miner have had a free ride on BTS for the last 2 years and have been selling their vested BTS as soon as it has become available. After the 5th of November the only people holding BTS will be the people who have bought it at market and are aligned with the vision.

The Free ride for miners will be over :)

@fintekneeks Question

fintekneeks40 Comment as found HERE:

Am I missing something with BTS? I own some, but it's supply is constantly being diluted and I'm curious where some members are getting the notion that it's going to skyrocket in price. I know how it underlies a lot of different ideas, but if you constantly dilute shares, it doesn't matter how many good ideas you come up with - the value will fall.

So can anyone address this because I don't get the feeling people are looking at the supply constantly increasing and realizing how that's going to affect the price long term. Stated in another way, a smart investor wouldn't buy stock in a company that constantly dilutes their shares because it negatively impacts him.

The supply of Bitshares is Fixed at 3.7 Billion shares; which are allocated between the Reserve Pool and User balances. This means there is no dilution at all in Bitshares; only the change in the ratio between funds in the User Balances and the Reserve Pool. I like to think of the Users Balances and any Vesting shares as shares in circulation.

The only way the circulating supply of Bitshares can increase is via witness and worker proposal pay which is capped at a Maximum 4.26% per year and paid out of the Reserve Pool.

Bitshares is currently paying these roles at a rate of 1.35% per year. This included pay for Witnesses and a Blockchain and GUI developer

As for the other increase in circulation it is not in fact an increase as the vested balances of PTS holders are already included in the calculation. The only difference is that the shares are becoming available to them which is increasing downwards pressure on the market. The current rate that this vested balance from the merger is being released is: 6.89% p/year in a few short month this figure will drop to 0 and the only increase in circulating coins will go to people working on the platform itself.

| Increase in circulating Bitshares(Vesting/Expenses) | Percentage of Total Supply |

|---|---|

| Current | 8.24% |

| Proposed (after November 5th - assuming worker pay stays the same) | 1.35% |

As you can see in the details above the supply of Bitshares is not being diluted at all; its a fixed at 3.7B shares.. but the circulating shares are being increased by means of vesting balances maturing; in saying this it is important to note the total coin's does not increase at all as all vesting balances are included in available share count.

Soon this social contract will be completely paid off and Bitshares will be free and in the hands of people who choose to own them. This is why the community is excited. we know we have great tech and the only reason the price does not reflect that fact is the selling pressure caused by greedy PTS miners that were share-dropped into a very valuable position.