In times like these with a huge bull market forming, I like to take the time to look at specific values of cryptocurrencies and try to evaluate them depending on use. Now before I get started I want to make sure the readers know that this is just personal opinion and should not be taken as investment advice. I am someone who has lost interest in Bitcoin years ago for the sole reasons that it doesn't do things it promised to be able to in the beginning. Since then I moved on to other project such as Ethereum and I have huge respect for the creator of it. I believe that the token economy around it got spammed too fast and too much in a short amount of time. With the general thought process of investors "holding" this may have caused huge over-estimates of the value of tokens compared to their usage and effectiveness in the real world.

To start off, here are some of the biggest ERC20 tokens.

I'm not going to lie and tell you I know what all of these do, it's come to a point where there are just way too many for a normal human to be able to follow them all. I'm sure they all have their specific usage for certain purposes and deserve a certain value, but at this point it's mainly being pushed by speculation alone.

Speculation can be a good thing, but after some time if certain projects barely do anything real or are being used by real people for their designed usage, it's just another blockchain on top of Ethereum doing nothing but being a placeholder for its name while being speculatively traded on exchanges.

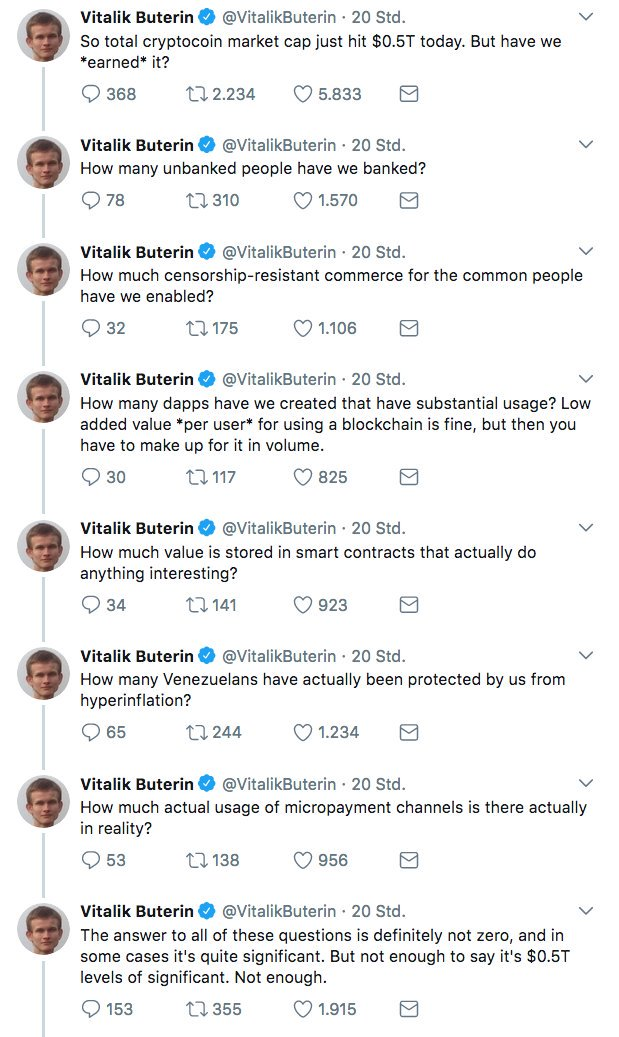

I stumbled upon these tweets by the creator of Ethereum Vitalik Buterin after the total market cap of all cryptos passed $500 billion recently.

As I said earlier I have huge respect for Vitalik, I've followed his tweets and Reddit comments for as long as Ethereum has been alive and I do believe he has a point in these. The recent mainstream adoption surely is not to be underestimated, everyone and their parents has heard of Bitcoin or blockchain up at this point. Many seem to forget though how inaccessible many of these currencies and tokens still are to the rest of the world. The big exchanges we know and use today are only a fraction of exchanges that exist for stocks, and the % of them that accept cash to trade in for crypto is even smaller.

Is he hinting that the blockchain market might be in a slight bubble right now and is awaiting a correction? Could be, or he could be pointing out how little usecases most of these tokens still have to this day other than being traded and speculated upon.

Steem is one that doesn't seem to have been gathering all that much attention lately, it might be due to it being quite new compared to the other giants. When new money is coming in it doesn't mean it's smart money, especially during mainstream times like these. How many new investors that create a Bittrex or Bitfinex account do you think look past beyond the top 5 currencies? I doubt there are too many and probably even less that do actual research on the the projects before going in. The FOMO effect is not to be underestimated these days, combined with a "holder" mindset Bitcoiners and others tend to brainwash them, which might not be so healthy especially for new investors facing a correction which they won't be able to react to even if they wanted. Yes, I'm looking at you Bitcoin's bloated blockchain. In one way you want to hold your coins off exchanges for safety, in another way you know it might take ages for them to be transferred to exchanges if the time comes when you will want to due to insane large confirmation times and a transaction backlog.

To get back into his tweets, as an active Steemian of course I couldn't help but compare most of them to Steem. Ethereum is after all not completely guilt-free from transaction costs and a blockchain being backlogged by kitties. Of course there are no direct answers to many of his questions, I'm just adding my opinions on them compared to our blockchain.

How many unbanked people have we banked?

There are so many people in the world that don't have access to a bank in this day and age. The pace of technology evolving and simple smartphones becoming cheaper each day allows for many to get access to digital banks through cryptocurrencies. This is very important for people in developing countries as many have to rely on cash which is losing value daily sitting in their pockets. For them owning and being able to use crypto's such as Steem will be of the utmost importance. Do you think someone wanting to buy food for 0.0015 BTC will want to pay a 0.001 BTC fee? Or using Ethereum to pay 0.05 ETH and pay 0.01 ETH in fees. No, they will want to use a method that doesn't use any fees but at the same time secures their transfers and holdings with cryptography. Once more people start using it and accepting Steem as payments people will start to notice what being able to transfer value with no fees attached actually means for its usage.

How much censorship-resistant commerce for the common people have we enabled?

How many dapps have we created that have substantial usage?

Although Steem doesn't rely on ads and adrevenue the same way older platforms do, we sure have a strong censorship-resistant platform which makes it possible for anyone to earn off their content no matter what the content is about. Since the blockchain only stores text files we already have projects enabling other kind of content to be uploaded while being censorship-resistant and using the Steem blockchain as a payment gateway. There is @dtube for decentralized video hosting, @dsound for decentralized audio hosting and recently announced @dlive for decentralized streaming. With so much more to come.

Augur which is a prediction market project has recently launched it's beta and you're telling me it is worth the same market cap as Steem? I think that's what he is pointing out with the usage of the ERC20 tokens, many of them lack it a lot and are just speculative predictions for now following the footsteps of Ethereum's own success.

How many Venezuelans have actually been protected by us from hyperinflation?

This one hit me the most as I've been reading and seeing a lot of posts from Venezuelan users on the platform lately. Many who have also contacted me on steemit.chat and discord, etc. Post reward for them are worth hundred times more than for some of us, they are people of many countries who are facing the same hyperinflation lately and blockchain is doing wonders for them. Can we say the same thing about many of the other blockchains? Bitcoin recently hit $120 average fee costs, with that amount in Venezuela you could probably afford food for a whole year for yourself.

How much actual usage of mircopayment channels is there actually in reality?

This one is a bit relevant to the other. Steem changes the whole meaning of micropayments because it has 0 fees. This will be really gamebreaking once the mass of users realize how this can work on the Steem platform.

Steem does all that very well already and so much more, yet it has the market cap of one of the least used ERC20 tokens probably. I do believe that the market right now might be overvalued and there could be massive corrections coming up soon, but in the long run there is nothing but upwards trend for blockchain technology. Where and when the money will be moving to from currency to currency is the billion dollar question, but I personally am happy to have found one of the most technological advanced blockchains out there and I consider myself very lucky to be here.

Then again I thought Bitcoin was overvalued when it was closing in on $1,000 compared to Ethereum which barely had a $50 million market cap. Now I believe they are both way too overvalued and I'm looking forward to see how things change from here on out.

Thanks for reading.

Thumbnail Source