90 days have passed because the People's Bank or investment company of China (PBOC) released an official declaration explicitly defining primary gold coin offerings (ICOs) as against the law public funding activities. Because of this, all China-based ICO tasks were necessary to refund all first investments, whether or not or not project-based tokens were released; foreign-based assignments were necessary to refund investors so long as the tokens was not issued; and moreover, all China-based bitcoin exchanges, including Huobi, OKCoin and BTCC, turn off. The reason why given for shutting down: pressure from "related federal government departments."

Pessimists believed this might herald the finish of Bitcoin in China — and even round the world — a sentiment that is increased by the amazing plummet of bitcoin price on Chinese language exchanges from around $7,400 to only $2,400. And, as common, whenever gossips float out of China, market segments respond — whether those rumours are based totally, partially or never in truth.

As bitcoin exchanges in China turn off, public trading amounts of Chinese language Yuan became basically zero; therefore, any media from China related to Bitcoin should be unimportant to the purchase price. Bitcoin's ferocious bounce-back to practically $8,000 in mid-November 2017, an all-time high, verified the idea that whatever is certainly going on in China and no matter Chinese hurdles, the price tag on bitcoin will continue its ascent.

But there can be an exemption: mining.

Will Mining Be TURN OFF?

China continues to be the greatest coordinator country for mining facilities. Indeed, 70 percent of hash vitality globally originates from Chinese mining swimming pools. The miners made by Chinese language company Bitmain dominate the complete industry.

People be anxious about if the Chinese federal will ban mining, therefore reducing Bitcoin from China at its source and tossing the ecosystem into disarray. However, this is highly improbable.

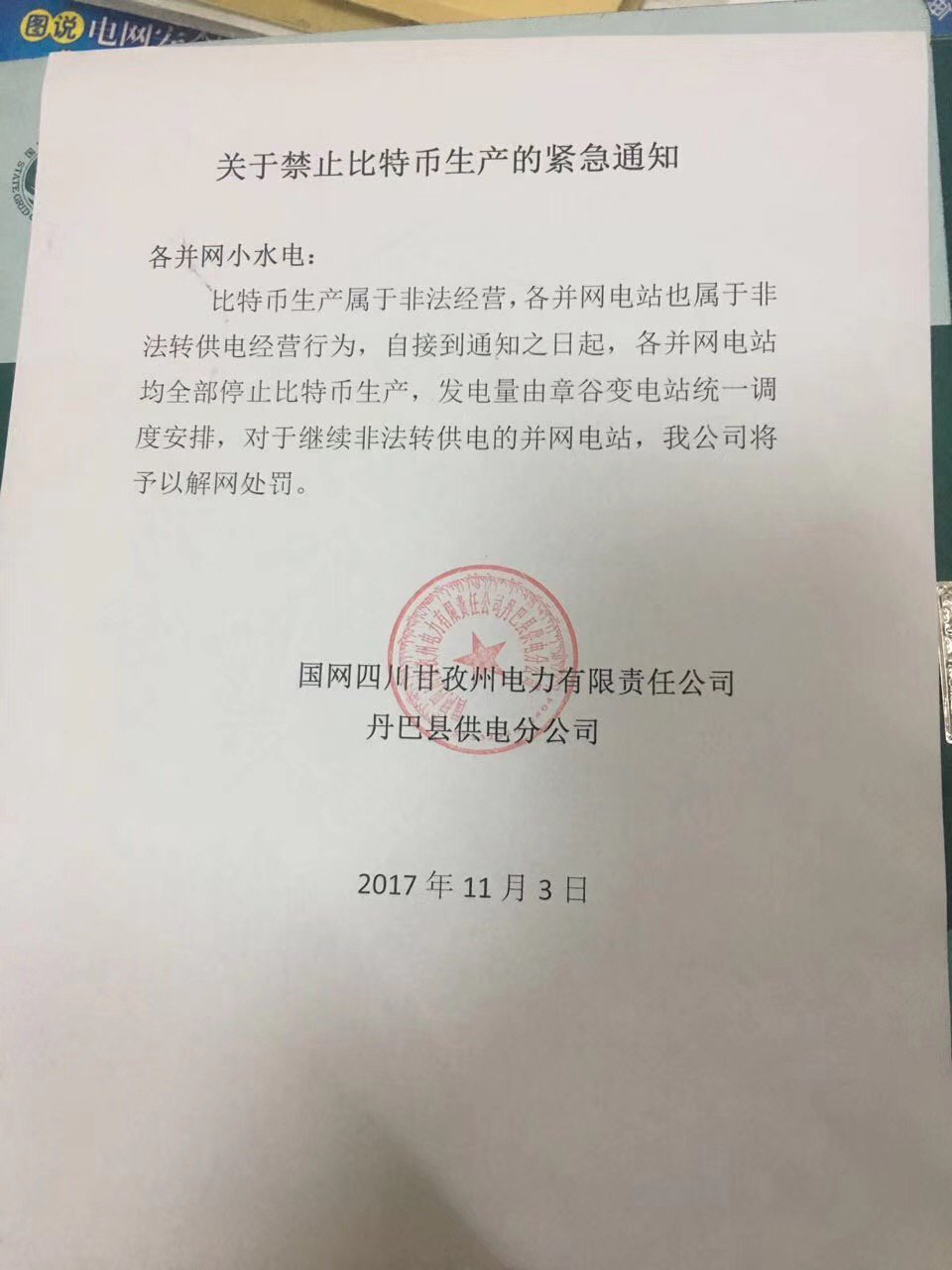

The recent rumor a mining ban is now possible was produced from a flyer, written by a power stop in the Chinese language province of Sichuan. The flyer explained, "Bitcoin is illegitimate thus the business shall not provide electricity to mining facilities."

Actually, this flyer is only a inadequately worded, company-level observe that mistakenly used the term "illegal." This content, however, has since been misconstrued as proof the official ban on Bitcoin mining.

An interior notice by an area power station proclaiming that "bitcoin creation is outlawed"

The financial office of Caixin — an established Chinese media source — and many citizen-based media sources have interviewed the energy company involved. These options have since proved that interpretation is only overhyped "fake media." The notice was designed for internal only use. Its chief purpose was to alert its affiliate marketers about the potential risks associated with providing illegitimate electricity. The energy station and its own affiliates can create electricity but have not anchored the requisite agreement from the federal government to market electricity to anyone — not merely miners.

It's important to reiterate that China hasn't denounced Bitcoin as unlawful. Bitcoin itself in China is undoubtedly a kind of good. "Folks have the flexibility to take part [in] bitcoin trading as kind of goods on the internet," a a PBOC notice stated in 2013. Therefore, the federal government does not have any reason to turn off the "factories" producing normal "goods." Although it is true that we now have accounts circulating that mining facilities are facing the pressure of possible suspension system, the reason behind this pressure relates to their illegitimate use of electricity, not mining activities.

More convincingly, Caixin reportedreported on Oct 13 that "a person near the regulator thought to Caixin that China does not have any intend to ban mining."

Lastly, there's a good chance that China could opt to create its controlled Bitcoin trading market. If these programs become a simple fact, China is even less inclined to ban mining.

You can find two explanations why this theory may be valid. First, China is highly encouraged to enter into the trading market. Japan has accredited several cryptocurrency exchanges, and CME is upgrading initiatives to list bitcoin futures to create a more controlled trading market.

China, as the second-largest current economic climate, has justification to want to develop its own controlled market, too. The reasoning is the fact that as bitcoin trading can't simply be forbidden by any one government because of its decentralized aspect, banning it'll only bring about uncontrollable OTC trading that may bring about more hidden-capital airline flight. This is actually the very last thing that the Chinese language government would want to see. Therefore, both exterior pressure and Bitcoin's inner features will drive China to take into account an improved mode of rules.

Second, Caixin also hinted a more controlled bitcoin market in China might be possible in its article entitled “Will Bitcoin Come Back to China After China Becomes Less Relevant to Bitcoin?” This article ends with: "Maybe someday when regulators find an improved way to modify Bitcoin, we can not preclude the likelihood that Bitcoin should come back again to China."

Caixin holds a particular position among all multimedia options for the Chinese language Bitcoin industry. It is definitely the principal source for legislation and policy signs from the PBOC: It includes literally end up being the mouthpiece for the PBOC in regards to regulating Bitcoin. The actual fact that sentiment was permitted to be posted under such tightly handled circumstances helps it be specifically interesting and relevant.

Blockchain Development Still Heading Strong

The trustworthiness of blockchain technology, which underlies Bitcoin itself, has been stained by the speculation area of bitcoin and alt cash somewhat. But luckily, the introduction of blockchain technology continues to be an important directive and goal for China.

Corresponding to China's Leading Li Keqiang this past year - in the government's 13th Five-Year Plan for Economic and Public Development - blockchain technology has been outlined as an important part of development for Chinese language endeavors. So long as this remains the situation in China, we can get to see overall beneficial conditions for accelerated expansion on the market.

Chinese language blockchain startups are starting to expand their neighborhoods overseas, and Chinese language exchanges have launched international sites. Shareholders, though significantly less than before and less openly, remain investing in blockchain-based corporations. Consortium blockchain alternatives are being welcomed by big companies. In a nutshell, there may be more rationality and less speculation.

Actually, the so-called ICO ban is really just an announcement, rather than specific law. There's a very simple balance between your industry and the regulators. The industry is tests governmental and regulatory restrictions as it gets to toward more autonomy. The federal government, because of its part, is watching if the industry really will surpass its revolutionary offers and is selecting the best way to encourage development while also staying away from speculation risks.

The blockchain industry must earn regulators' trust by actually dealing with commercial pain items to confirm that token-oriented models are possible. If no task can establish this and tokens still continue to be an instrument of real speculation, the industry simply can't expect looser regulations. It really is up to the crypto and blockchain community to surpass its promises and deliver the technology that today's world needs and needs.