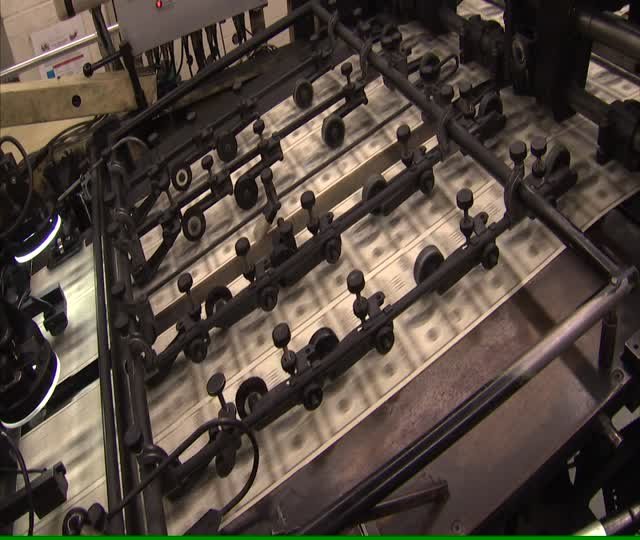

The subject of inflation has been very topical of late. Steem has a flat supply, in any given amount of time, the amount new is the same. Bitcoin has a flat supply curve but every two years it halves. Given about 6 years, Steem will drop below the usual 2% target that Central Banks aim at. Gold and Silver inflate about 1.5% per year.

But the new thing that is happening is new currencies at a very rapid rate. The initial supply rates are always high, and usually linear against time. There must therefore be an initial period of high inflation in most new cryptos

But is this ideal, and what could be done instead?

Back in 2013 I came up with an alternative scheme for controlling Iisuance. As should be clear, as new currencies, the initial supply question is far more visible than ongoing. Pretty much, the way I see it, this makes it such that new cryptos will have crazy valuations for the first 6 years, maybe you could say Bitcoin drops this to about 4 years, but in the beginning, supply is not appropriate to demand.

So, let's just examine the existing issuance regulation systems.

Many people do not understand what "Proof of Work" actually means. It is a mathematical puzzle that by its nature generates randomly at a known rate over time, a certain number of solutions. The rate is affected by the number of mining nodes and their aggregate hash power.

To bring this to a flat rate, the network as a whole by consensus adjusts the difficulty, which decreases the issuance by requiring more rare numbers to be discovered.

But this does not address the early adoption phase.

In fact, the success of Steem has been its own worst enemy. It took up a lot of new users very quickly, which then rapidly slowed down. Then the supply rate continued on its flat rate, and rapidly diluted that which people were holding, and the rate of new signups slowed dramatically.

So the problem is basically that adoption rates also have a big effect on a currency value. But meanwhile, the dumb difficulty regulation just targets some fixed preconception of what is good issuance, which is based on mostly data from relatively long living financial instruments.

In monetary theories, the central focus is on issuance rates.

All monetary items have a rate of production. The Neo Keynesians of the mainstream believe that inflation is better than deflation. Inflation diminishes the yield of lenders, as the currency slowly devalues by continued supply expansion. Inflation benefits borrowers.

If a currency supply increases slower than people adopt it, then the currency is deflationary. This advantages savers.

But adoption rates and supply have never been bound to each other ever before. My idea is that the two should be in lockstep. This means the rate limiting properties of cryptographic proof of work has a serious weakness: it is independent of adoption.

It is a little known fact that in fact the PoW system devised for Bitcoin was directly derived from an anti-spam system for email called "Hashcash". This simply works as a distributable rate limiter - no Central governer is required, but nobody can issue tokens faster than some amount which is defined by network consensus.

But what if instead, we could tie another, external factor to the rate of issuance, while retaining the advantage of decentralisation?

Like the rate of traffic within the blockchain itself...

My solution addresses numerous issues at the same time. The amount of new currency directly related to the amount of traffic on the network. To achieve this, there must be an anonymous system of issuing vouchers (redeemable by only one provider) whose fulfilment then forms a certified token on a blockchain and owned by the relay service provider.

There is two direct use cases, one is payment directly for providing network access, such as hotspots, and secondary, a means to charge for relaying traffic, to enable location obfuscation.

Next point to be aware of is it a intended that the network I propose is intended to be a protocol layer, level 6 in the OSI model, presentation, and within this network is servers and peers who can exchange data for various purposes.

Credit, Insurance and Issuance Regulation in One

The idea is that the volume of traffic within the network always relates to usage rates, and that many peer to peer services can be chargeable and tokens issued and certified from these services also form a type of promissory note, a built in credit system, the service offers in a voucher for some service, which can also be issued to use as an anonymous payment method, but regulated by the performance of service.

So for this there has to be an insurance system. This effectively calculates the value of these promises based on past performance, forming an actuary table. A user can, in the event of inability to perform services, pay the voucher holder seeking redemption, or alternatively their vouchers become worth less on the market, by becoming more expensive to insure.

This system would end the problem of inflation in periods of attrition of users, it would enable in-band payment for network traffic, it enables universal location obfuscation, and forms the basis for simple insurance blockchain which can eventually build into more complex systems.

The use case of location obfuscation is under-recognised as having value. But if I know the IP of a node, which I know has an association with an account, and a knowable balance of tokens, I have all the intel required to select a high yield target for hacking. Indeed, I can correlate it to a physical location, opening the option of physical attacks also, like theft, robbery, or extortion.

It should be obvious but it is not. It is an emerging problem and the solution exists but until the cost become visible, people will ignore it. But as I have described, it is a means to solve supply regulation problems.

Steem shows that a simple, permanent record of human generated content can be stored on a blockchain. But this also hints at a way to do his with transient data as well, which enables messaging both long and short block. Long messages can form the basis of advertising, and a linked inventory system. Service availability insurance can extend from simple network services to assurance for delivery of goods and services from providers on the network in addition to escrow multisig systems and even potentially investments that are regulated in-band as well.

But the immediate benefit would be a naturally stable currency price. Network traffic is nearly perfectly correlated with the amount of users, and so currency is issued by need for it alone, and not some objective measure outside of the activity of network users.