Healthy skepticism

For many people "blockchain" still sounds like little more than a buzzword. They hear it's supposed to be "the next big thing" but a dose of skepticism is natural. After all, there's also the AI / ML / DL and the AR / VR crowds claiming the spot in software while in the "physical world" we have a lot of buzz about IoT, self-driving vehicles, drones, Crispr/Cas9 modified genes, robots and 3D-printing ...

We are indeed living in interesting times but our cognitive abilities haven't improved fast enough for any one person to keep up with all the miracles of technological progress. All these great things compete for our attention and focus.

One needs to prioritize and for that, a modicum of understanding of what each of these technological breakthrough brings to the table is needed. Something that doesn't occupy the attention for too long yet it manages to capture the essential aspects of a given topic.

This is how I was approached by one of our Directors to try and distill one topic in particular, "blockchain" and why is it hyped so much lately.

I thus prepared a short presentation as a simulated dialogue that served as a basis for our real discussion. I thought the value of such a "stripped down" explanation would decrease rapidly. Six weeks later I realize I was wrong - I keep crossing people who have little knowledge and understanding of those aspects of blockchain technology that make it a game changer in policy implementation.

The dialogue

| --What is this “blockchain” thing? | “Blockchain” is software. To be more precise, it’s a rather loosely-defined family of software designs. They facilitate co-ordination and help enforce commitments thus enabling business processes that were not economical before. |

| --Software? Just ... software? Why all the hype then? | Mainly because of the incredible success of Bitcoin. Bitcoin is an open-source implementation of a blockchain design which has attracted, as of 2018, more than 100 billion USD of value without a company behind to be held accountable. |

| --Ok. Tell me more about the "blockchain design" then | Be warned though: this is a quite complex topic. I'll try to make it simple but don't make the mistake to think that because you'll understand my simplified version you'd have understood the topic in full. The success of this design has its roots in ... |

Mathematics and human psychology

| --Software design based on mathematics and human psychology ... Intriguing ... | For the "mathematics" part: it's the advanced algebra that underpins cryptographic "hash" functions. These are functions that take an input of arbitrary length and give an output of fixed length with the following properties:

|

| --My head aches already ... Do I really need to know that? | Only if you want to understand blockchain |

| --Pfff ... Ok, go ahead ... | For the "human psychology" part, consider this: there is no cryptography that cannot be cracked, given enough time and effort. Cryptography alone cannot protect the integrity of the bitcoin network. There is a second crucial ingredient to the success of bitcoin. A simple, yet often forgotten truth: people respond to incentives |

| --What is your point? | 100 billion USD is a big sum of money. If the person who manages to crack bitcoin's cryptography were to make anything closer to that sum, it would be a serious, powerful incentive ... growing bigger whenever the value of bitcoin increases. Think of a it as a "bug bounty": there are more than 100 billions in the open internet for the first person who manages to crack bitcoin's encryption. A few billions can buy you the brightest minds and the most powerful computers ... will bitcoin's cryptography then withstand an attack potentially funded with billions? |

| --Will it? You tell me! | I tell you that ... it doesn't need to! Because of human psychology, because people respond to incentives, because of a field of economics and game theory called "mechanism design" which was awarded the Nobel prize in economics in 2007. Bitcoin's software design implements a clever mechanism whereby "attacking the network" does not make economic sense. |

| --So be it. That's bitcoin. Where does that leave us on "blockchain technology"? | In a nutshell, “blockchain” architectures enable the design of software systems that decrease the cost of “transactions” (in general, not only financial transactions) by increasing the level of trust between the transacting parties. In economic terms, they support “incentive compatible” interaction mechanisms. |

| --Pfff... here you go again ... What do you mean? | A “blockchain system” B has the following property: when interacting through B, it is in the interacting parties’ own best interest to act honestly and truthfully … rather than trying to cheat.

This means that as we transition toward blockchain systems (as mediators of our interactions), the cost of protecting against potential fraud will plummet. |

| --So ... "blockchain systems" reduce the cost of protecting against fraud? | By orders of magnitude and in all kinds of "transactions" (not only purely monetary) |

| --How is that possible? | We need to go into technology. You sure want to go there? ... I'll take you back to Bitcoin then. |

Technology features

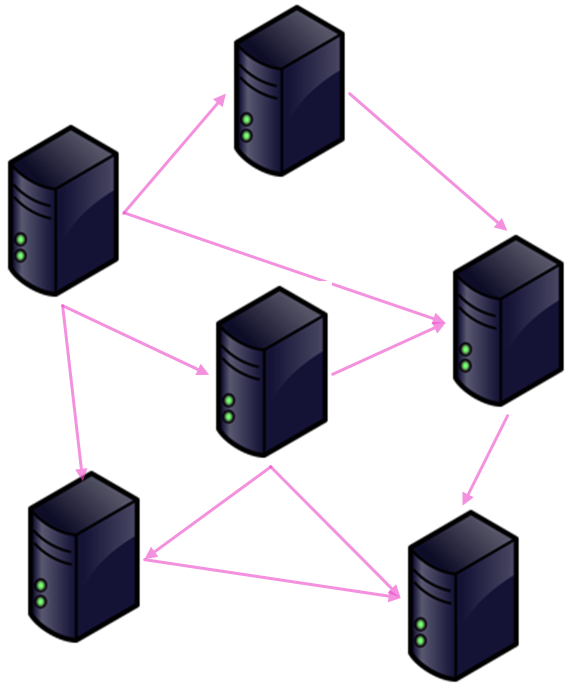

A “blockchain system” is distributed. This increases resilience. The data (sometimes including code) is copied to more than one computer (called “node”). To take it down, you need to take down more than one node.

These nodes continuously communicate with each other to make sure they all hold copies of the data, in a consistent state, like in a distributed database architecture.

Users interacting with a blockchain system (starting at any node) generate “transactions”. A transaction changes the value of some attribute of the software objects in the system.

Distributed ledger - multiple-entry accounting

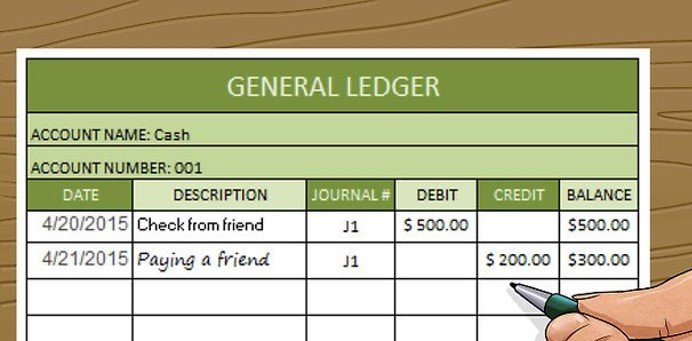

“Blockchain architecture” means that attribute values are balanced according to a set of rules, like in a ledger: if one value increases, another one has to decrease by a corresponding amount. Hence the other name of blockchain systems, “distributed ledgers”.

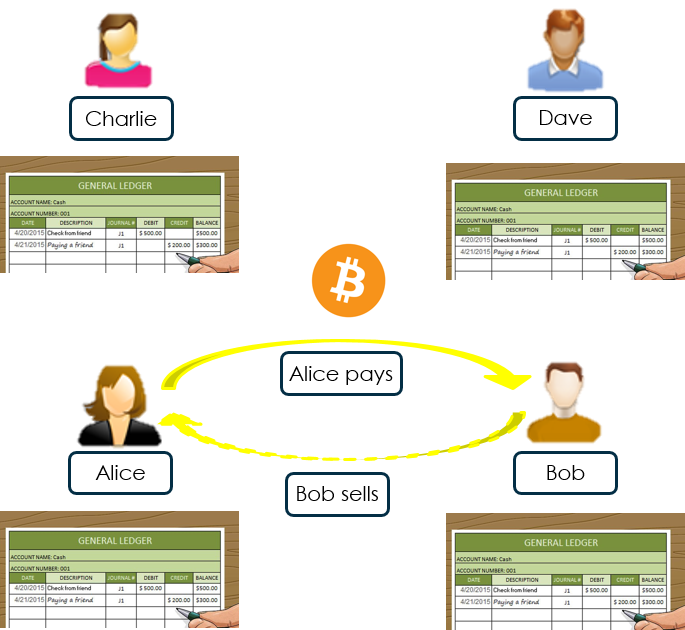

Shared, distributed ledgers discourage fraud by introducing one or more “referees” holding copies to which transacting parties can refer to in case of dispute. If Bob or Alice want to cheat, they’ll need to alter not only their copy of the ledger, but also Charlie’s and Dave’s.

Ensuring that the overall state of the system is consistent over many nodes and only balanced transactions are added to the database and replicated is a tough technical problem called the “consensus protocol”.

In Bitcoin this is the famous “Proof of Work” which burns electricity to calculate cryptographic hashes. This plays a central role in Bitcoin’s “mechanism design”.

Like in a ledger, “blockchain systems” maintain historical consistency: the changes in all attribute values can be traced back in time to the origin of the system. All the changes are consistent with the rules of the system.

Bitcoin’s implementation of blockchain uses only one asset (bitcoin itself) and a shared ledger of all bitcoin transactions ever. If you want to “steal bitcoin” (credit your bitcoin account), you need to:

- Debit another account

- Re-create a complete spending history since the beginning of the “ledger”

- Convince the other nodes that your (fake) ledger is the correct one.

Because you can’t erase every participant’s memories and all offline copies, you can only do step "3." above once before ruining the credibility of the whole system.

But … those cryptographic hashes require so much computing power to rewrite that you are better-off using it to defend and perpetuate the system than to attack and destroy it.

This is the beauty of the Bitcoin’s "mechanism design"!

-- You said something above about a 'set of rules' ...

Indeed. When the rules themselves change, this produces a “fork”. This is why we have “Bitcoin” and “Bitcoin Cash”, “Ethereum” and “Ethereum Classic”, etc.

-- What is "Ethereum"?

A major “blockchain design”, different from bitcoin. It includes the ability to bundle code (“contracts”) alongside accounts and have those pre-recorded routines execute when a set of conditions is met. A bit like stored procedures and triggers in an Oracle database.

Blockchain and public policy implementation

-- This becomes really complicated. So why is public administration concerned?

Let’s compare European policy implementation as it is now and as it could be if we ran it on blockchain architectures.

The European Commission (EC) fixes “policy objectives” and earmarks money for their realization. Private or public organizations respond, alone or as consortia, to calls for expression of interest. They tender for the money. The EC then calls in independent experts to assess and rank the tenders in decreasing order of impact and likelihood. Tenders that rank highest receive funds. The EC then monitors that the awarded money is spent how the winning consortium said it would be spent.

Whether that also achieves the initial policy objective is moot, because by running the selection process, the EC assumes responsibility.

-- How does blockchain change that?

It makes economic a different policy implementation process. The beginning is similar: the European Commission (EC) fixes “policy objectives” and earmarks money for their realization. But now the EC elaborates further into more concrete, S.M.A.R.T. objectives, with associated K.P.I-s.

Private or public organizations respond, alone or as consortia, to calls for expression of interest. But now in their tenders, they are required to explain how their proposals will meet the K.P.I-s. They tender for the money like in classical project finance.

At this point, the process diverges. Instead of the EC overseeing the tender evaluation, the assessment of the quality of the proposed projects is done by private sector banks, used to project financing. Pledges and commitments are recorded in the shared, distributed ledger of the blockchain.

The EC then monitors the K.P.I-s and awards “digital currency” to the consortia. These use it to pay the banks, which redeem it against euro from the EC.

The shared, distributed ledger and the mechanism whereby:

- The entities assessing the proposals (the banks) are incentivized (lest they lose money)

- The tenderers finance spending with debt and only recoup their costs after delivery, based on comparing actual results to pledges made upfront.

Both constitute a novel economic mechanism for grants that discourages fraud and better aligns the interests of the participants.

Conclusion

-- Couldn't this be done without blockchain?

It could, in theory. If it hasn’t been done before, it’s likely because it had been deemed unfeasible or uneconomical. As I said, blockchain is a family of software designs which facilitate co-ordination and help enforce commitments thus enabling business processes that were previously not (thought) economical.