![]()

Why are we writing this blog?

Imagine for a moment that you were transported back in time to the early 1990’s. Back then, the internet was still in its infancy and Average Joe and Jane had little to no understanding of how it worked.

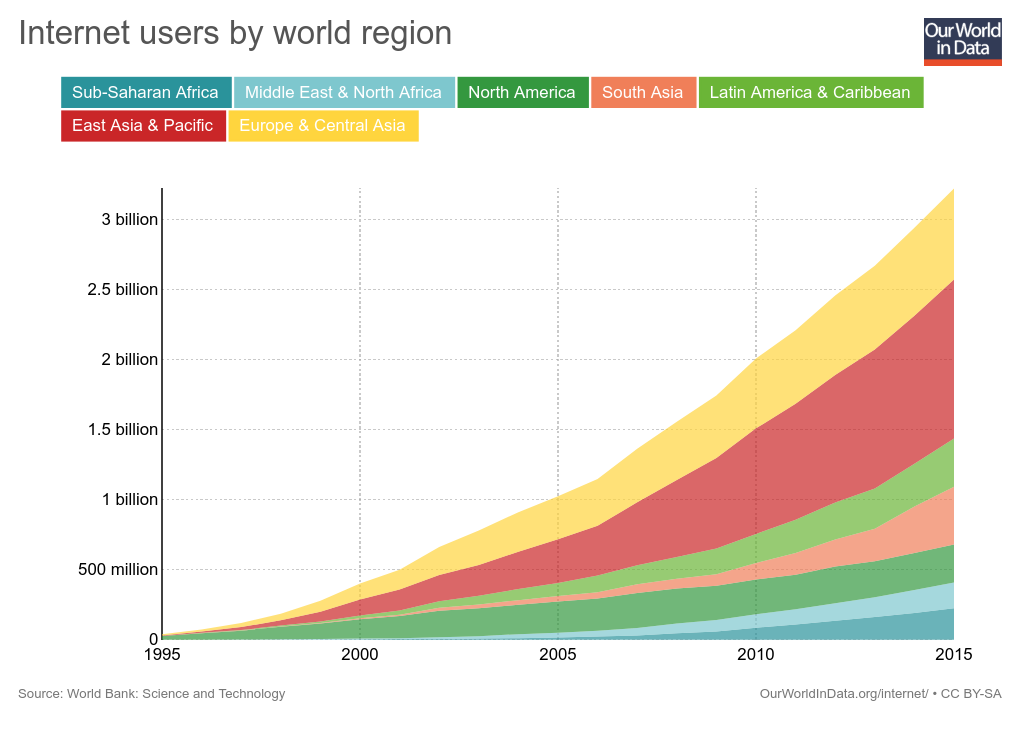

In 1993, the total number of worldwide internet users was around 14 million and the internet consisted of roughly 130 web pages (ourworldindata.org). Most people had heard of the internet, but it’s potential was still difficult to grasp for the vast majority of people. Imagine trying to explain the infinite possibilities and numerous use cases of the internet to 1993 Average Joe and Jane.

Around 1995, the internet moved from obscurity to mainstream as venture capitalists started to realize the enormous potential of the world wide web. Millions of dollars were poured into start-up companies, often consisting of little more than a small team of programmers and an idea involving the internet. Still, the internet had its skeptics, and mass adoption seemed far from certain.

I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse.

— Robert Metcalfe, the inventor of Ethernet, in InfoWorld, 1995

On 27 February 1995, Newsweek, an American magazine wrote:

The truth is no online database will replace your daily newspaper, no CD-ROM can take the place of a competent teacher and no computer network will change the way government works.”

— Newsweek, 1995

A year later the internet had 75 millions users. By 1999 it had grown to 280 million users worldwide.

Robert Metcalfe famously had to “eat his words” two years later at the World Wide Web Conference when he blended a copy of his column with some water and proceeded to consume the mixture in front of his audience (Wired). Newsweek ceased print publication to become exclusively available online in 2012…

So what did Robert Metcalfe and Newsweek get wrong about the internet? In our opinion, they grossly underestimated the internet’s capacity to reduce inefficiency, thereby increasing humanity’s ability to generate value. If the internet consisted of only cat videos and Reddit forums, There is no doubt it would still exist in some form, but the real reason why the internet now permeates every aspect of our lives is that it makes so many tasks infinitely more efficient for both private individuals and businesses.

Today, humanity is standing at the crossroads of another potential leap in efficiency due to a technological innovation called blockchain. It is difficult to know exactly how many blockchain users there are today but our best estimates are somewhere around the 10 million mark (Coin Journal). In the last six months, venture capitalists have started to realize the enormous potential of blockchain and are pouring millions of dollars into start-up companies often consisting of little more than a small team of programmers and an idea involving blockchain (weusecoins.com). Meanwhile, 2017 Average Joe and Jane has little to no understanding of how blockchain works.

This blog attempts to introduce 2017 Average Joe and Jane to blockchain, give them an understanding of the technology and teach them how to become early adopters. Over the course of this blog, we will take a deep dive into some of the technological aspects of blockchain, explore its use cases, analyze different blockchains, provide a step by step guide for beginners, discuss investment strategies and talk about long term predictions for blockchain technology.

Blockchain as an accounting revolution

While blockchain is often thought of as an advancement in computer technology, it can more easily be understood as an advancement in accounting. In its essence, accounting is the task of keeping track of transactions and ownership of value. Ownership, is kind of a vague concept if you think about it. Ownership is not an intrinsic attribute of an object. Rather, ownership is determined purely by consensus. You can write your name on an object or plant your flag on a property but unless you can convince other people in your society that an asset truly belongs to you, it can be taken away from you just as easily. So, if ownership is not an intrinsic attribute, how do we determine ownership at any given time? How can we set up a system to ensure that ownership information is safe and can’t be altered by people with malicious intentions?

This is not a simple question and it is one that humanity has invented increasingly clever ways of answering as our societies have grown more complex. The exact ways in which we determine and record ownership in the modern world vary between asset types but can commonly be boiled down to something like the following.

Our current system of tracking ownership is complex, inefficient, not particularly reliable and often not very transparent. This includes involving intermediaries and making documentation safe from outside interference (hacking-proof) and difficult to forge/reproduce. This is why many countries require you to pay stamp duty or other taxes to make documents such as marriage certificates and land titles legally binding and enforceable. This is also the reason why it takes 3 days to send money to relatives abroad. Intermediaries are required to ensure that the money enters and leaves the correct accounts and that the appropriate records are intact and correct. The same is true for all information ledgers where accuracy is critical; payment and currency systems, asset management, regulatory compliance and auditing, real estate, record management, identity management, voting, taxation and more.

This is where blockchain technology comes in. A blockchain is essentially an accounting tool that greatly simplifies this process and provides a system of record keeping that does not rely on intermediaries, yet is:

- Fast and efficient

- Safe from forging/hacking

- Reliable

- Immutable (once information is locked in, it cannot be changed)

- Transparent

- Does not require trust between parties

The inner workings of a blockchain

Simply put, a blockchain is a database containing an ever growing number of chained blocks of cryptographically secured information that is replicated and distributed across a network of independent, decentralized nodes.

Don’t worry, we were pretty confused at this stage too. Let's start somewhere a little bit simpler.

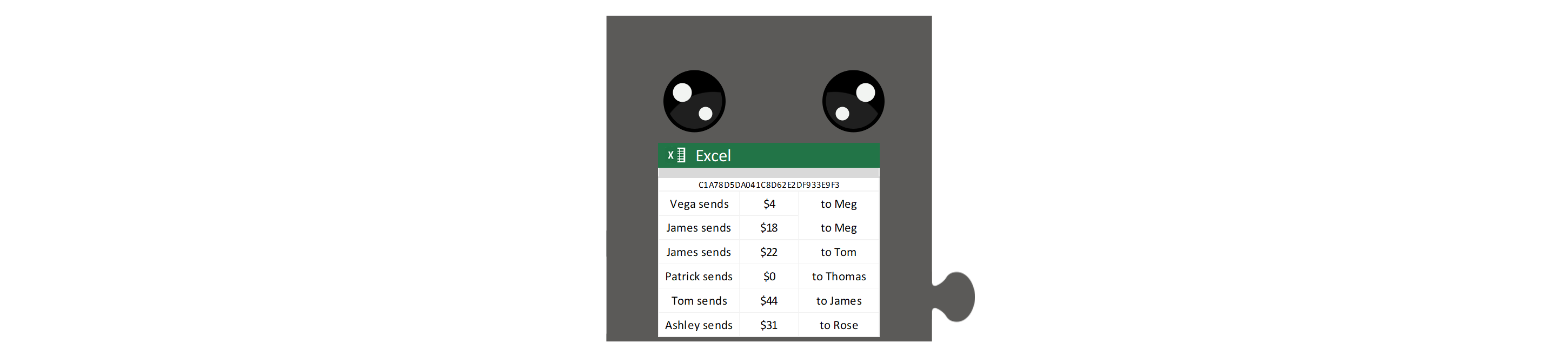

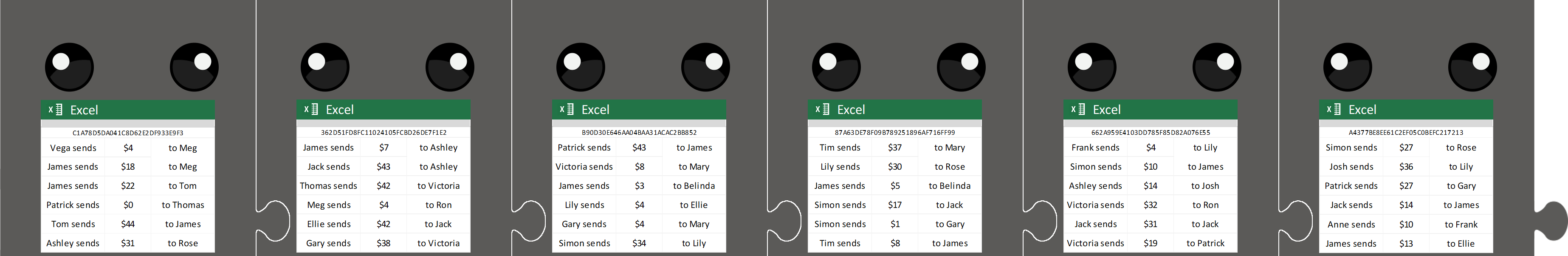

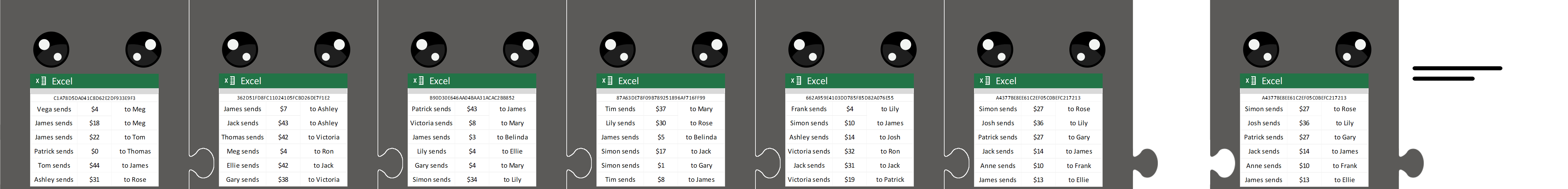

In blockchain terminology, a block is simply a collection of information that is considered to happen at the same time. The easiest way to think about it, is to imagine a single block as a spreadsheet

Each row in the spreadsheet contains a single line of information such as a transaction, e.g. “Vega sends $4 to Meg”. Eventually, the spreadsheet block is “complete” and gets linked to the previous block in the chain.

The newly added block then gets broadcast to every node in the network. A node is simply a computer that someone has dedicated to the blockchain.

The result is a long chain of spreadsheets containing millions of rows of information, replicated and stored on thousands of different nodes. Since anyone can set up their computer to act as a node, you end up with a huge network of publicly owned computers around the globe, all contributing to the health and safety of the blockchain as a whole.

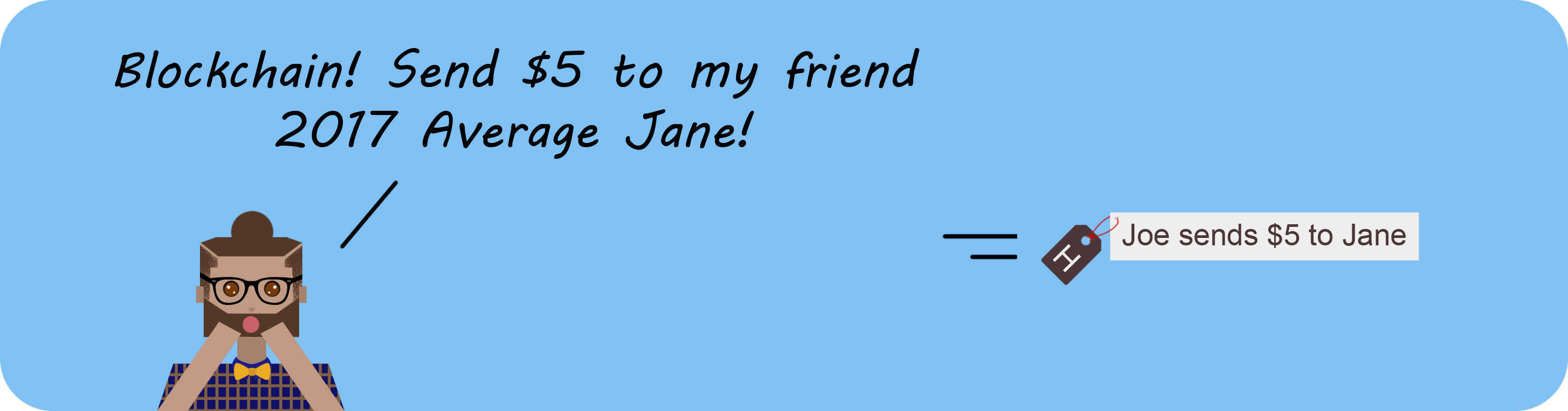

Let’s look at a specific example to understand exactly how information is transmitted through the blockchain. Say 2017 Average Joe wants to send $5 to 2017 Average Jane using the world’s most commonly known blockchain, the Bitcoin blockchain. To do this, all 2017 Average Joe has to do is write out the code for this transaction on his computer and broadcast it out to the Bitcoin blockchain network.

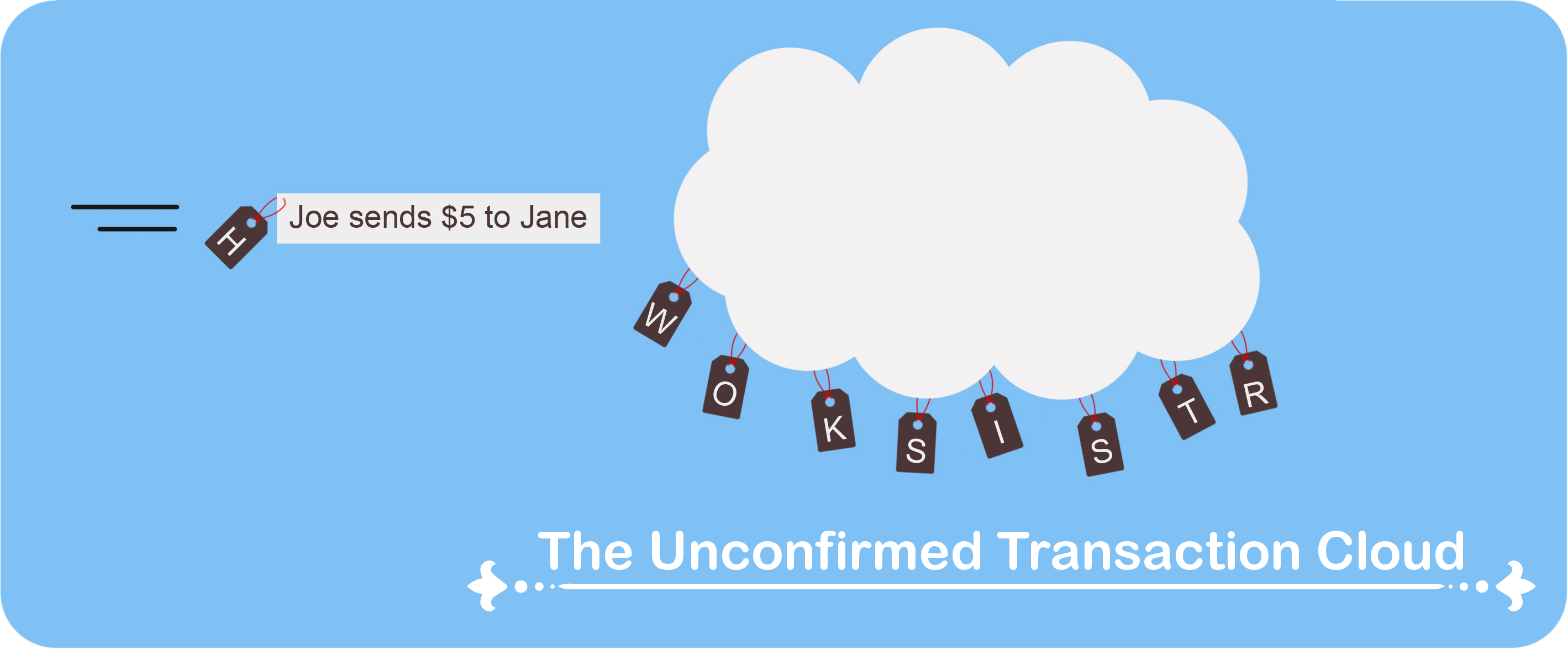

As computers on the blockchain network receive this message it goes to a special place called the unconfirmed transaction cloud.

Every computer on the blockchain network is continuously playing with the unconfirmed transaction cloud, trying to order the messages in such a way that it is solves a special puzzle (more on the special puzzle in Post 4) .

When a computer manages to find a way to solve the special puzzle they broadcast it out to the rest of the blockchain network and receive a prize for being the first computer to solve the puzzle.

The messages in the unconfirmed transaction cloud then turns into a neat block (spreadsheet) and each computer appends this block to the blockchain after verifying that the solution does indeed solve the special puzzle.

Each computer node has the entire blockchain stored on their hard drive and can verify incoming messages and blocks independently of the other nodes on the blockchain network. This makes the entire system decentralized with no single point of failure.

And that is essentially how the Bitcoin blockchain works:

- Users broadcast transactions to the blockchain network

- Computers nodes compete to package up the transactions in a way that solves a special puzzle

- When a node manages to package up the transactions correctly they broadcast the solution out to all the other nodes on the network

- Each node independently verifies the solution

- If the solution works and the block only contains authentic transactions, each node independently appends the new block to the blockchain

The advantages of a blockchain compared to traditional accounting systems are:

There is no single point of failure: If one computer is suddenly switched off or hacked it doesn’t disturb or harm the rest of the network. The rest of the computers will happily continue to add spreadsheet blocks to the blockchain.

The entire system is decentralized: A record of ownership based on blockchain technology is not controlled by one single entity or organization. Hence there is no central authority which can freeze or take control of your assets should they want to.

The system is super efficient: No human labor is involved in authenticating incoming messages. No intermediaries or middle-men are required to establish trust. Everything is done through computer code and integrity is achieved through networks of independent, publicly owned computers.

The system has complete transparency: Every single row on every single spreadsheet is stored on every single node on the network. Hence all the information in a blockchain is publicly available and can be examined and scrutinized by anyone if wrongdoing is suspected.

Participants can remain pseudo-anonymous: No names or personal information is stored in the blockchain. Transactions and account balances are public; however, accounts are not linked to any identifiable information.

Blockchain safety

At this point you probably have a lot of questions. The idea of a worldwide network of computers keeping track of ownership rather than a single entity probably sounds enticing and offers some clear advantages, but you might be asking yourself some big questions.

The answer to both of these questions can be found in the cryptographic protection built into the blockchain. To appreciate how difficult it would be to actually hack a blockchain you have to understand some of the underlying technology. Most blockchains use a combination of two separate cryptographic techniques; cryptographic hash functions and digital signatures, to achieve two separate objectives:

- Ensure that blocks are immutable. That is, to ensure that each block has a specific spot in the blockchain and that changing the order or altering the content of a block is impossible.

- Enable the entire blockchain network to verify that a broadcasted transaction actually came from the holder of the Private Key of an account.

The inner workings of these protection mechanisms are extremely interesting and will be covered in a lot more detail in Post 4.

Many people think that cyber security is inherently insecure and that given enough time and incentive, super clever, malicious hackers will always find a way to steal your information.

This is not true. The type of cryptography used in most blockchains has never been successfully cracked when implemented properly. There is widespread agreement among experts that current best practice encryption methods are impenetrable to normal computers (though we may have to update our technology when quantum computing becomes widely available). If someone did find a reliable way to hack through these systems, blockchain applications would be the least of our worries as the entirety of our financial system is currently protected by the exact same cryptographic techniques.

Perhaps the best testament to the resilience of blockchain cryptography is its track record. Bitcoin, the worlds first and currently largest blockchain cryptocurrency, went live in January 2009. Since then its market cap has grown to more than USD$40 billion and roughly 300,000 Bitcoin transactions happen every single day. Despite this, there has not been a single breach in the fundamental Bitcoin algorithm. Unfortunately for the industry, there have been plenty of cases were websites acting as market places for the sale and purchase of Bitcoin have been hacked. Bitcoin itself however has never been hacked and continues to maintain a 100% track record of performing exactly as intended by its creator(s).

This is not to say that the handling of Bitcoin is without risk. To properly handle any cryptocurrency, you need to take a few precautions to ensure that those super clever malicious hackers don't gain access to your account. Blockchain security will be one of the key topics of this blog as we strongly believe that empowering people to work safely and confidently with blockchain technology is essential to bring about mass adoption of the technology.

We hope you join us over the coming months and years as blockchain technology matures and our society starts to realize the advantages of blockchain over traditional accounting methods. We truly believe that this technology has the power to change the world in a significant way and we are excited to be part of this journey at such an early stage.

So, whether you’ve never heard of blockchain before, you’re an enthusiast looking to learn more about the technology or you’re an investor looking for new opportunities, you have come to the right place. We will endeavor to update our blog regularly and provide a nuanced, unbiased view of the various aspects of blockchain technology.

Did you enjoy this blog post? We would love to hear from you on our message board below! If you find any mistakes or errors in our content, feel free to let us know and we will correct it promptly. Our next post will provide you with a brief overview of the history of blockchain and Bitcoin. Hope to see you there!

Disclaimer. The contents of this blog is purely our personal opinion and should not be taken as investment advice of any kind. Please ensure you do your own research before investing your hard-earned money in anything. If you are after investment advice, we recommend that you to seek out a licensed professional.