“Proof of Work”

To borrow an appropriate phrase that one may assign to my long standing wave counts, which may be ascertained and reconciled from my Monthly chart down to the weekly and intraday charts as my “proof of work” as it were, I provide you with the following.

In maintaining such discipline and historical “proof of work,” this not only keeps me grounded as an objective analyst as to the accuracy, reliability, and efficacy of my ongoing technical assessments, but it also provides readers and followers of my work a historical and ongoing record of my observations relative to Elliott Wave analysis on the price of BTC.

…Key Statement:

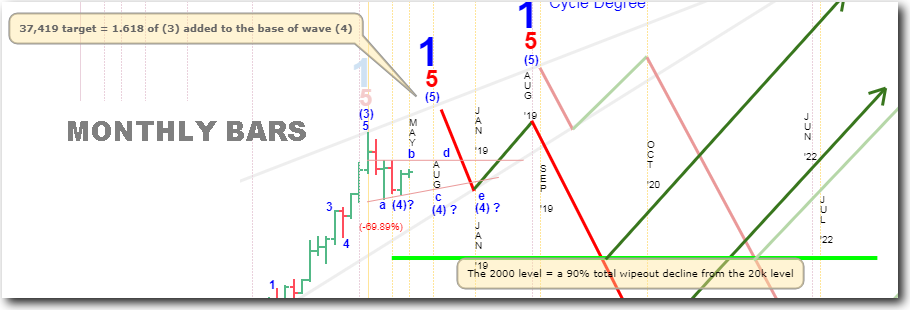

May is a Fibonacci turn-month (+/- one bar), and as such, it appears that May or June could mark a short to an intermediate-term high of sorts in the grander scheme of things. The next Fibonacci turn-month (+/- one bar) occurs in August.

The 50% advance from the April low appears constructive, bullish, and impulsive by every measure.

Be that as it may, there are indeed viable bearish alternate counts that must be taken into consideration despite this recent bullish move higher.

| Short-Term | Bias | Target | Sup-1 | Sup-2 | Res-1 | Res-2 |

|---|---|---|---|---|---|---|

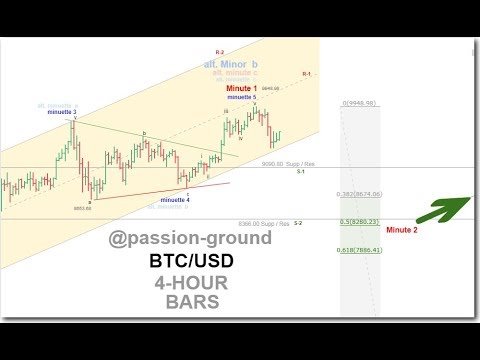

| 4-Hour Chart | Bearish | 8,816 | 9,090 | 8,366 | 10,234 | 10,925 |

| Medium-Term | Bias | Sup-1 | Sup-2 | Res-1 | Res-2 |

|---|---|---|---|---|---|

| Daily Chart | Bullish | 8,816 | 7,675 | 9,949 | 11,688 |

| Long-Term | Position Bias | Date | Price |

|---|---|---|---|

| Weekly Chart | Long | 4-23-2018 | 8,781 |

| SECULAR | Bias | Low 2018 | Target 2018 |

|---|---|---|---|

| Monthly Chart | Bearish | 5,920? | 12,235 min / 37,419 max |

…Weekend Update & Review

Right Click and open in new tab to view full size image.

…Video Update

Select HD and “Full-Screen” for the utmost clarity in viewing this video update.

I trust that the preceding analysis was generally objective, explicitly actionable and informative, and of relative and meaningful value for all those who perceive such analysis as a backstop to their individual ends.

Until next time,

Peace, Love, and Justice for All

DISCLAIMER: This post and all of the analysis contained herein serves general information purposes only. I am not a registered financial adviser. The material in this post does not constitute any trading or investment advice whatsoever. The trend-following strategies explained herein are for example only, and should not be construed as trading or investment advice in any way. The same thing goes for anyone subscribing to the Long-Term Trend Monitor. The subscription simply shares with subscribers what several automated trend-following systems are doing, and that’s all. The bullish and bearish alerts provided therein are for information purposes only, and they are not to be construed as advice to buy or sell. At the time of this writing, the author holds a small position in BITCOIN and several other cryptocurrencies. Please conduct your own due diligence, and seek counsel from an accredited financial advisor before making any trading or investment decisions. Should you decide to mirror or copy any investment or trading examples from this or any other related source, the decision to do so is entirely your own - as are the inherent risks involved in doing so. I am not responsible for any of your losses. By reading this post, you acknowledge and accept to never hold me accountable for any financial losses. Thank you.