are posted here: Part 1 | Part 2

The PR guru Edward Bernays was able to change the buying behavior of the masses, and that created higher and higher levels of consumerism (people spending more money). Then, another thing happened that created even more consumerism: we lost our gold standard.

But what exactly is a “gold standard”?

It's a way to stabilize the value of paper money. You wouldn't want the value of a dollar to bounce around every day. If it did, you'd never know how much money to bring to the store. Would a loaf of bread cost $1 today or $2? Or maybe even $10? If the value of money changes every day, planning becomes difficult. And if the value of money drops every day, we want to spend it quickly before it loses any more value.

The gold standard kept that from happening by linking the value of a US dollar to the price of gold. To make it easy to understand, let's say that back then one dollar was equal to 10 grams of gold. So you could buy 10 grams of gold for one dollar. But there's more to it: each dollar under a gold standard would be redeemable for those 10 grams of gold. So if you had one dollar, you could bring it to the bank at any time and expect to trade it in for the 10 grams of gold backing that dollar.

The gold and the dollar were the same and could be interchanged.

This meant that for every dollar floating around in the economy – for every dollar carried around in someone's pocket – there was a 10-gram gold coin in a bank vault backing that dollar. This is what gave the paper dollar its value and what kept its value stable.

But how did it keep the value stable? The value of gold rises and falls somewhat, so simply being tied to gold's price wouldn't do that. Instead, the gold standard limited the supply of money. The central bank couldn't print more money without new gold to back the new pieces of paper. People were mining for gold all the time, and new gold did enter the economy, but it entered slowly, and that kept the value of money pretty stable.

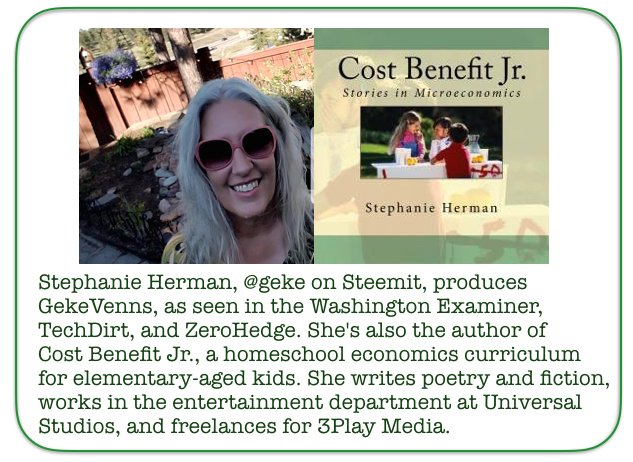

The reason the money supply mattered is because paper money loses its value when too much is printed. And that's because of supply and demand. (For a refresher course on supply and demand, check out Section 2 of Cost Benefit Jr.™: Stories in Microeconomics.) When the amount of the money supply goes up, the price (or value) of money goes down. The more dollars there are in circulation, the less each of them is worth.

So let's go back to our story of the 1920s. After World War I, Edward Bernays was able to convince the masses to shop more. We had higher levels of consumerism. Advertising and public relations were in full swing and these advertising campaigns were very successful at changing peoples' behavior. But in 1929, the stock market crashed and the American economy collapsed.

A new president was elected, Franklin Delano Roosevelt (FDR). He promised to pull America out of the Great Depression that started in 1929. And one of the first things FDR did was to take us off the gold standard. That's because a gold standard encourages people to save their money. When the value of paper money is stable, you can save or hold it without worrying that you're losing value every day.

Without the gold standard, the central bank began to print more money, since it no longer mattered if there was gold in the vault backing it. The dollar began to lose value over time, and it didn't make sense to save dollars that were always going down in value. It was better to spend them quickly while they were worth more. So removing the gold standard encouraged people to spend more money, which fueled more consumerism. And that's exactly what FDR wanted.

But why would an American president want to encourage people to spend money and discourage them from saving it? We'll explore that next time.

This article is one of a series I'm writing for the 30 Day Writing Challenge hosted by @dragosroua. If you want to join, write on a topic that interests you or that you'd like to learn more about and use the tag #challenge30days. As Dragos says, "The key word sequence here is: "write every day."

Interested in a relaxed place

to kick back and chill

with other writers and creative types?

Check out The Isle of Write by clicking below!