Content adapted from this Zerohedge.com article : Source

China might be a House of Cards that is proping up the economies of the world.

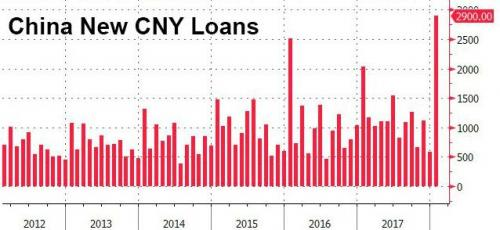

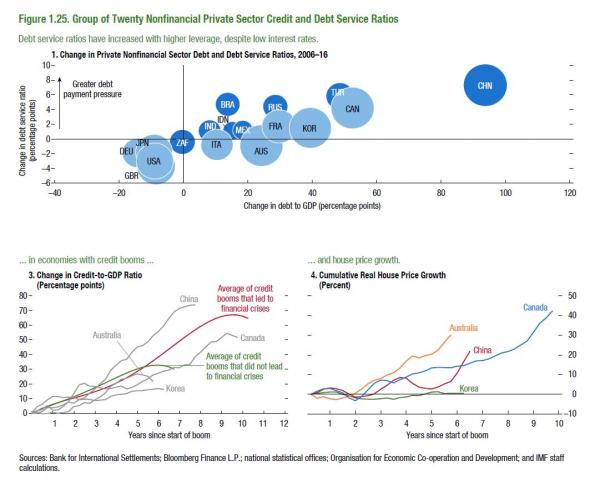

In 2017, China was the undisputed creator of debt causing an inflationary burst on a global scale.

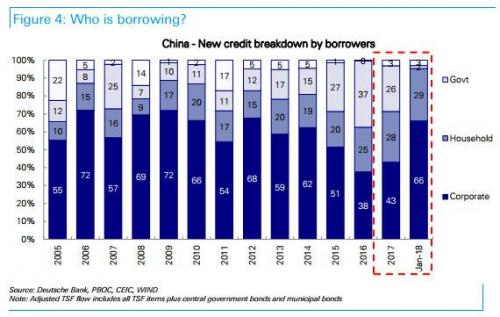

According to Reuters, the credit boom has been fueled "by strong economic growth, a robust property market and a crackdown on riskier shadow lending, which has forced banks to shift some loans back onto their balance sheets." But mostly it has been forced by an implicit demand on Beijing to keep the global reflationary impulse strong at a time when the Fed is shrinking its balance sheet - a highly deflationary, if only for circulating monetary aggregates, exercise.

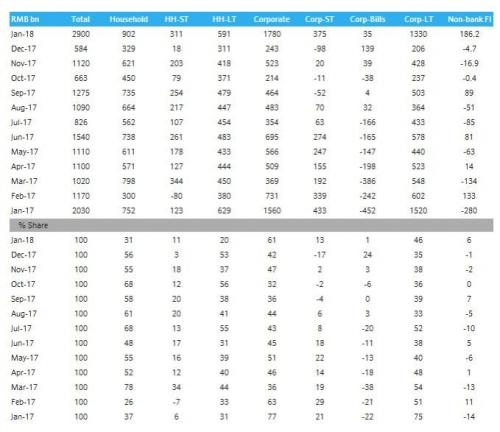

A positive is that household and corporate credit was strong indicating robust consumption and investment.

Last year China’s total new loans hit a record 13.53 trillion yuan, 7 percent more than the previous record in 2016.

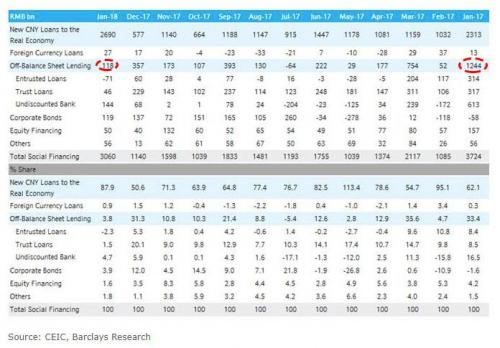

While new loans to the real economy (excluding loans to non-bank financial institutions) and corporate financing increased to CNY2690bn and CNY119bn, respectively, from CNY2313bn and CNY-58bn a year ago, they were dwarfed by the slide in off-balance-sheet lending to CNY118bn from CNY1244bn last year.

The Chinese authorities are walking a fine line. Crackdowns on the off-balance sheet items is meant to stem riskier activities-but not too much. All central banks have this challenge when trying to manage the economy.

Meanwhile, with the fate of the US capital markets in the hands of the inflation/deflation debate, the real answer what happens next will not be found in the BLS seasonally adjusted average hourly earnings dataset or the Wednesday CPI print - these are merely measurements of the underlying credit dynamics - but half way across the world, in Beijing, which decides month after month, what is the proper level of new credit with which to lubricate not only China, but the rest of the world as well.

Non-adapted content of this Zerohedge.com article: Source