At this time of year, every shop you go into is playing carols or songs like “It’s the most wonderful time of the year”. But the truth is that for many people, it’s a very stressful time of year - for a variety of reasons.

Last year I shared a few techniques for coping with the pressures of this time of the year. Let’s revisit them for those of you who are getting stressed to the max.

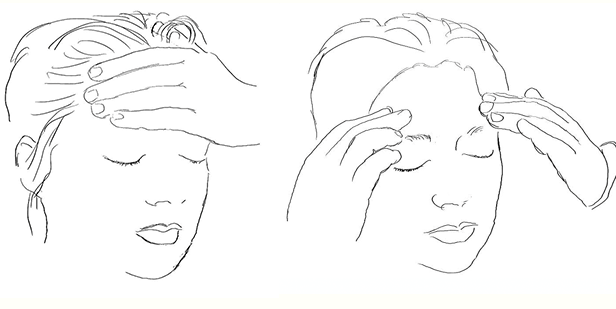

Emotional Stress Release

This one is really easy as it doesn’t take any special knowledge, and can be done anywhere, any time. In fact you probably do it automatically when stressed. It’s simply holding your forehead and taking a few deep breaths.

To see how to do it in more detail, read this post

Emotional Freedom Technique

I’ve done a few posts about EFT.

In the first one I talked about the background of it, and how I started using it.

My second post is an intro on how to start using EFT.

My third, Christmas, post has a number of tapping videos to tap along with. Each covers a different type of Christmas stress.

If you haven’t heard of EFT before, take a few minutes to learn how it can help you.

Bonus tips for crypto trading stress

This part isn’t any help for anybody who took a beating in the last few days, but may help people thinking of buying cryptos now. Many years ago @sift666 and I read a book called The Zurich Axioms – about the rules used by Swiss bankers for investing. I can’t remember them all, but let’s call our list the Kiwi axioms:

Only invest what you can afford to lose. If you can’t think about the possibility of losing the lot without breaking out in a cold sweat, you’re not suited for the game.

Educate yourself about the market, and your potential purchases

Don’t follow the masses – if they’re talking about it on the news, you’re too late. Listen to people who have experience and watch what they’re buying now. Look for the next trend. Sometimes you might be a bit too far in front, but sometimes you’ll get it perfectly right.

Diversify your portfolio

When the market is volatile, watch it every day (but taking your phone into the shower is probably overkill)

Buy low, sell high

Take some of your profits to make your life more meaningful or enjoyable

Have a back out plan (We’re skimming some profits and putting them into gold. More on that later.)

Markets go up and markets go down. When there’s a 20% drop, it’s not necessarily a crash (though it MIGHT herald one). In a hockey stick market, it’s possibly just a correction.

But don’t be attached to any one Altcoin, or to your beliefs about it. When it becomes clear that it’s a drop, not a correction, don’t HODL but remember your exit (or diversification) plan.

Remember that it’s a game and enjoy the crazy ride.

Right, time to get my arse off this computer and into the kitchen. It’s Christmas Eve morning in New Zealand. @sift666’s mum will be arriving for lunch in three hours and I want to treat her to some delicious goodies.

Then tomorrow we’ll be off to Christmas with my family at my brothers, and I still have a bit of food prep for that.

So I’ll love you and leave you. Have a wonderful Xmas or whatever you celebrate, and I’ll see you on the other side. Xx

Thanks for reading and hope these help make your Xmas a healthy, happy one.

Photos by myself, @sift666 or from Pixabay, unless otherwise stated.

Follow me for more health, nutrition, food, lifestyle and recipe posts.