Ethereum and bitcoin are crashing this morning, after China confirmed its recent threat of an ICO crackdown (reported here last Monday) when the central bank said on Monday that initial coin offerings are illegal and disrupt financial markets, according to statement on China’s central bank website. The PBOC also asked all related fundraising activity to be halted immediately, issuing the strongest regulatory challenge so far to the controversial if surging market for digital token sales.

The crackdown was announced in a statement on the PBOC's website in which the central bank said that it had completed investigations into ICOs, and will strictly punish offerings in the future while penalizing legal violations in ones already completed. The regulator said that organizations or individuals that completed initial coin offerings should return the money raised, in move "to protect investors’ rights and properly handle risks," though it didn’t specify how the money would be paid back to investors.

Taking the recent SEC crackdown on Initial Coin Offerings several steps further, the PBOC also said digital token financing and trading platforms are prohibited from doing conversions of coins with fiat currencies. Digital tokens can’t be used as currency on the market and banks are forbidden from offering services to initial coin offerings, and are also also banned from offering pricing and information services on coins. Most importantly was the PBOC's determination that "digital token can’t be used as currency on the market" and its warning that "China will strictly punish over sustained offerings and law violations in completed ones."

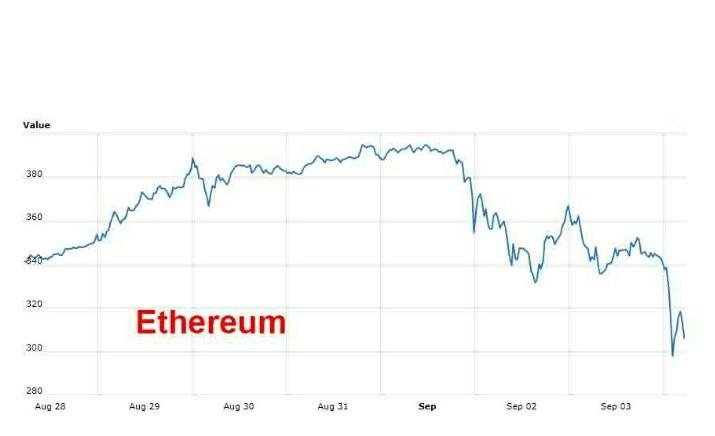

The central bank’s Monday directive made no mention of cryptocurrencies such as ether or bitcoin. Bitcoin tumbled over 8%, the most since July on a closing basis, to $4,480. Ethereum was down more than 11% Monday, to just above $310, after trading nearly $400 last week.

“This is somewhat in step with, maybe not to the same extent, what we’re starting to see in other jurisdictions - the short story is we all know regulations are coming,” Jehan Chu, managing partner at Kenetic Capital in Hong Kong, which invests in and advises on token sales, told Bloomberg. “China, due to its size and as one of the most speculative IPO markets, needed to take a firmer action.”

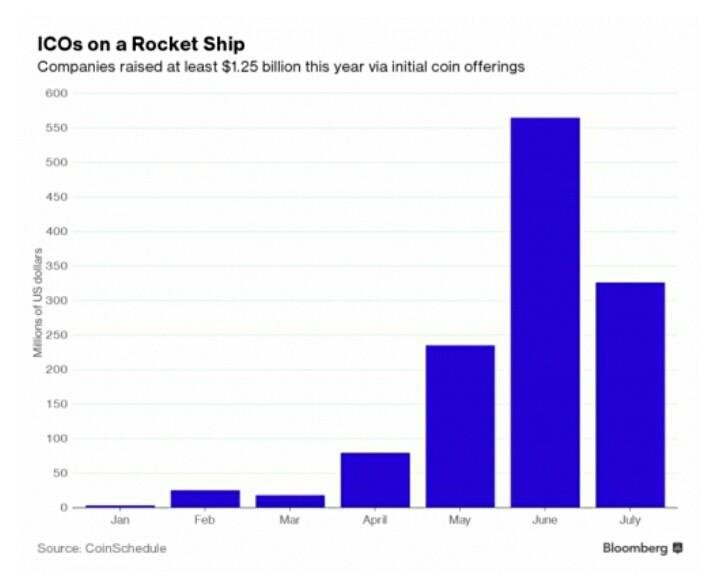

As described previously, ICOs are controversial digital token sales that have seen unchecked growth over the past year, raising $1.6 billion and surpassed traditional venture capital raising pathways. They have been deemed a threat to China’s financial market stability as authorities struggle to tame financing channels that sprawl beyond the traditional banking system. Widely seen as a way to sidestep venture capital funds and investment banks, they have also increasingly captured the attention of central banks that see in the fledgling trend a threat to their reign.

While hardly the world's biggest coin offering market, China accounts for about a quarter of the blockchain based capital raising activity YTD: there were at least 43 ICO platforms in China as of July 18, according to a report by the National Committee of Experts on the Internet Financial Security Technology. Sixty-five ICO projects had been completed, the committee said, raising 2.6 billion yuan ($398 million).

Incidentally, just as we speculated in late July, when the SEC announced its own crackdown on initial coin offerings, a move we deemed would be beneficial in the long run for weeding out the various criminal and ponzi schemes that have proliferated in the unregulated market, so today's move by China is seen by some as favorable for blockchain dynamics:

Indeed, the SEC signaled greater scrutiny of the sector when it warned that ICOs may be considered securities, though it stopped short of suggesting a broader clampdown. The regulator reaffirmed its focus on protecting investors, however, and said issuers must register the deals with the government unless they have a valid excuse. The vast amount of money amassed in a short span of time has also attracted cyber criminals, with an estimated 10 percent of money intended for ICOs looted away by scams such as phishing this year, according to Chainalysis, a New York-based firm that analyzes transactions and provides anti-money laundering software.

China will likely eventually allow token sales, according to Chu of Kenetic Capital, however only on approved platforms, and may even vet projects individually. “I think they will allow the sale of tokens in a format which they deem safe and more measured,” he said.

Source : zerohedge

Salam KSI @steemitaceh @steemitindonesia

Terima kasih Upvote, follow and resteem.