- Blockchain against Blood Diamonds!

- Nigerians spend $ 4 Million a Week on Bitcoin!

- Will OmiseGo soon be an Official Online Payment System in Thailand?

- Venezuela: Petro Pre-Sale starts Today!

- Record at Telegram ICO: $ 850 Million in successful Pre-Sale!

- Russia: Industrial Mining Farms in the Starting Blocks!

- Lenovo goes Blockchain: Patent filed for Validation of Documents!

The South African diamond giant De Beers wants to secure the future of its diamonds using a blockchain and thus block blood diamonds market access. This announced CEO Bruce Cleaver last week to the English-speaking news service Reuters. A similar approach has already been taken by Everledger.

The first blockchain in the diamond industry. This is the ambitious goal set by the diamond giant De Beers to guarantee the origin of its diamonds. The investment business for diamonds is currently enjoying great interest. Blood diamonds originating from war zones still find their way into the jewelery shops and stock exchanges of this world, fueling mostly African violent conflicts. With the help of the blockchain every precious stone will be traceable in the future, from the prospecting to the final purchaser.

CEO Bruce Cleaver talks about the benefits of blockchain:

It creates new transparency and would thus secure the financing of the industry through reinsurance to banks, for example, Cleaver continues.

The blockchain for help

Above all, however, he hopes to achieve particular success by making technology available to the entire industry for use and participation. Because the overall goal of the diamond block chain is to support the so-called Kimberley process:

Launched in 2003, the United Nations initiative aims to prevent blood diamonds from finding access to the market. Currently, 81 countries are promising to secure the diamond trade with KP certificates of origin. However, its effectiveness leaves many in doubt that the initiative is always confronted with criticism.

In 2016, there were first attempts at blockchain implementation in the context of the Kimberley Process. De Beers, the world's largest diamond producer, wants to make a difference with its public blockchain. However, similar efforts already exist. For example, the start-up Everledger has created a blockchain solution that provides a shared digital global ledger for tagging and tracking diamonds. With a unique fingerprint, diamonds are provided so that the authenticity, the value and the origin are traceable.

Interest in Diamonds increases

Meanwhile, the demand for diamonds as investment assets continues to rise in recent years. Interest in diamonds, for example, has grown in popularity as a result of political and financial disputes and crises.

According to Statista, around 128 million carats of diamonds were mined worldwide in 2016. Australia, the Democratic Republic of Congo, Botswana, South Africa and Russia are among the most important producers. Australia also has the largest diamond reserves in the world.

Discussion about Blood Diamonds does not stop

Away from the major producing countries, however, so-called blood diamonds originating from war zones continue to find their way into the worldwide jewelery trade. According to the definition of the Kimberley Agreement, such gems are blood diamonds whose sale finances violent conflicts. They are usually illegally mined and brought via middlemen on the world market. Especially in the 1990s and early 2000s, they represented the main source of finance for African civil wars, as in Liberia.

While increasingly signals are being heard that the era of blood diamonds is over, human rights organizations continue to criticize the current situation. For example, there are reports that from Zimbabwe or from the Central African Republic, rough diamonds continue to flow onto the market, fueling the conflicts there with financial force.

In addition to all blockchain hype, the initiative of world market leader De Beers revealed: The fight against blood diamonds is far from won.

Nigerians spend almost $ 4 million a week on Bitcoin despite warnings from authorities. Experts therefore call on the government to reconsider its use of cryptocurrencies. They want legislation that allows "innovation to make progress".

Warnings have no Effect on Nigerians

Nigerian regulators and legislators have a clear stance on cryptocurrencies. Only recently, the country's Senate had ordered a review of Bitcoin trade. Furthermore, various authorities issued warnings. The central bank, for example, said last year that "virtual currencies" are not a legal tender and that banks would trade at their own risk when entering into transactions with crypto exchanges. In addition, a deposit insurance company said that its protection would not apply to cryptocurrency trading.

As the latest numbers on the purchase of cryptocurrencies show, all these warnings seem to leave Nigerians cold. As the Leadership reported, the value of Bitcoin has been declining since December, but the interest in the digital currency is greater than ever. Nigerians continue to invest in the cryptocurrency. In February, they spent up to 1.389 billion Naira weekly, which equates to approximately $ 3.8 million. In December, there were only about 1.299 billion Naira.

Innovation before Regulation

There are currently 13 crypto currency exchanges in the West African state where Bitcoin and other currencies can be purchased. Other crypto currencies are also attracting investors. Emeka Okoye, software developer at Cymantiks, said that around $ 4.7 million a week will be spent on other digital currencies. According to him, the government should reconsider its attitude towards cryptocurrencies. Criticism would drive speculation and convince criminals to use digital currency. Okoye advises the Nigerian authorities to "smart regulation" instead of a ban:

If the competent authorities forbid cryptocurrencies, they would ban a technical tool, the expert explained. Then "criminals will use these tools and you have no control over them and people have to live with the consequences". It is also important that government regulators properly assess the situation before taking action.

"Do you understand how it works? I could start a crypto exchange which is not based in Nigeria and they can not regulate it. I also have a foreign [credit] card and they can not control what I do with it, "said Okoye.

While Emeka Okoye does not think that cryptocurrencies will completely replace paper money, he hopes that digital currencies will complement money and make transfers easier and more comfortable. In his opinion, the current trend of cryptocurrency speculation driving Bitcoin's course is a distraction from the real potential of the digital currency.

A few hours ago, the Thai Ministry of Digital Affairs and Omise signed a memorandum of understanding ("Memorandum of Understanding"), in which both parties declare their will to develop a nationwide online payment and identification system based on the OmiseGo technology.

This would soon make Thailand one of the first countries in the world to officially implement blockchain technology for its people. The aim of the cooperation is to develop an identity verification and authentication system, both online and offline, as well as for the public and private sectors. In addition to developing a digital ID, the OmiseGo Blockchain will also be used to develop an online payment system.

This is what OmiseGo founder Jun Hasegawa shared on Twitter:

The Digital ID aims to protect Thailand's population from fraud both online and offline in contact with businesses. The payment system is designed to help people in Thailand who do not have access to a bank account in accordance with OmiseGo's "Unbank the Banked with Ethereum" policy.

On the other hand, the population should be allowed a more convenient and quick exchange of monetary values. OmiseGo founder Jun Hasegawa also highlighted these positive effects on the Thai population on Twitter.

It should be noted in our view that this is only a declaration of intent. This does not mean that OmiseGo can be used by the Thai population in a few months.

It will certainly take some time before both parties have developed a system that works for both sides. A time horizon has not yet been announced.

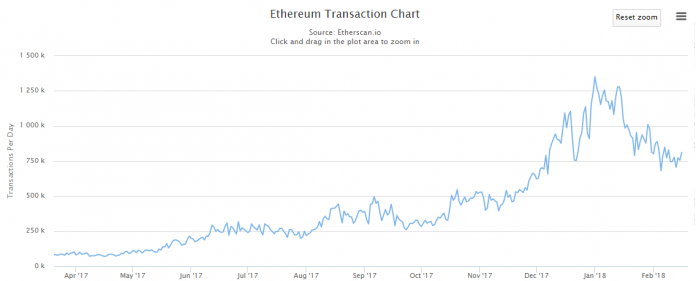

Scalability of Ethereum Blockchain

One problem that OmiseGo and the entire Ethereum network will surely have to solve before it can be used productively in Thailand is scalability. As we have reported many times before, there were scaling issues at the Ethereum blockchain during boom times at the end of December 2017 and the first days in January 2018. The number of Ethereum transactions at that time increased to more than 1.34 million per day. The transaction costs and confirmation times have increased relatively critically.

If only a fraction of the approximately 70 million people in Thailand use the network, it is to be feared that scaling problems of unprecedented size could occur for Ethereum.

A scaling solution for the Ethereum Network will certainly be one of the priorities of the Ethereum Community Fund, which was founded last week. In this respect, it remains to be seen whether and which scaling solution for Ethereum will be published in 2018, Plasma or Raiden.

OmiseGo is traded at the editorial time for $ 17.850291 per OMG. Within the last seven days, the OMG share price rose by 44 percent.

Venezuela has begun with the introduction of its new digital currency Petro, with which the of head of state Nicolás Maduro wants to resist a "financial blockade" from the USA. As the authorities of the heavily indebted South American country announced on Tuesday, the sale of initially 38.4 million Petro was started.

In total, the Venezuelan leadership wants to circulate 100 million coins of the cryptocurrency. The Petro will create "confidence and security in the national and international market," said Vice President Tareck El Aissami in the Presidential Palace in Caracas.

The price of one Petro is equivalent to a barrel of oil and was initially set at $ 60, but should adjust to fluctuations. On March 20, another 44 million Petro will be circulated. The virtual money is to be secured through an oil field in the Orinoco region.

With the cryptocurrency, Venezuela wants to regain more financial freedom. The South American country is in deep crisis and sanctioned by a serious political conflict between the government and the opposition.

Some rating agencies have already classified Venezuela and its state-owned oil company PDVSA as partially insolvent. The national currency Bolívar has recently lost a lot of value.

Maduro repeatedly blamed US sanctions on the country's situation, announcing in early December that Petro would boost the country's economic and social development despite the "financial blockade".

The messenger service Telegram has successfully launched the first part of its ICO. In the pre-sale, which was primarily involved with major investors, the company could take a total of 850 million US dollars for the issue of his token. When exactly the second, public round of the Telegram ICO starts, is not yet finally clarified.

At the end of last year, the Russian company Telegram announced an initial coin offering with great media coverage. The new cryptocurrency is to be embedded in its own blockchain platform, which should enable extremely fast transfers. The project is called Telegram Open Network (TON) and should build on the popularity of the software. The end-to-end encryption platform enjoys a high level of popularity, especially in anonymity circles.

In the past week, the pre-sale of the GRAM token had started and earned a record amount of 850 million US dollars. Thus, already in the first round of the ICO the previous record of 257 million US dollars, set up in September last year, the start-up FileCoin, far exceeded.

However, in contrast to the FileCoin ICO, the second round of the Telegram ICO is still to come, which makes the sum that has been collected even more impressive. Thus, the pre-sale was only accessible to an exclusive group of 81 selected investors - those who participated in the token sale with at least a sum of 20 million US dollars. It is expected that the second round of the ICO, which will be held as a public crowdsale, will once again flush a higher sum into the coffers.

The official revenue target was $ 1 billion, with $ 600 million earmarked for the first round. Since this sum could be significantly exceeded, the ICO can already be considered a huge success before the actual main round. With the 850 million dollars, the stated sum has already been reached at 85%. When exactly the crowdsale will start, is not yet announced binding, in the community circulate the months of March and April as a period. The total supply of GRAM tokens is 5 billion, of which 2.2 billion (44%) are available for sale.

The Telegram Blockchain (TON) and the GRAM Token

Telegram plans to use the revenue to develop a blockchain, which should make the current top dogs Bitcoin and Ethereum considerable competition. The native token should be named GRAM.

In the Telegram app, a cryptocurrency wallet is to be integrated, with which the GRAM can be transferred and used for payment within the app. In addition, the app should offer a way to exchange other currencies in GRAM.

In addition to the messaging app Telegram, according to TechCrunch, also wants to develop a number of other services based on the blockchain technology. Thus, the Telegram Blockchain should also be used as a distributed file storage (similar to Filecoin) and as a proxy service for creating decentralized VPN services. Furthermore, decentralized apps (DApps) and smart contracts are to be developed on the platform.

The reason for the hype around the project is obvious. The Telegram app is currently used by over 180 million people. The range that the GRAM could have in one fell swoop would be huge. Over 180 million people would be able to transact transactions and payments through the GRAM.

According to TechCrunch, the first "MVP" (Minimum Viable Product) version is expected to be released in the second quarter of 2018. The launch of a final version (no trial version) is scheduled for 2019. Telegram is currently developing the underlying technology.

The governors of Kaliningrad and Leningrad want to promote "Bitcoin production" in Russia. The required resources for large-scale mining farms are given, but now the Kremlin needs to create the legal framework.

At the Russian Investment Forum in Sochi, which took place on 15 and 16 February, Kaliningrad Oblast Governor Anton Alihanov announced that many residents of the Kaliningrad region would be interested in cryptocurrencies. The interest is also in the direction of mining. Due to the lack of know-how, many would not dare to mine themselves. However, the governor is optimistic about RIA Novosti's future of Kaliningrad in the crypt world:

There is already a "mining hotel" that can be used for remediation, while knowledgeable staff with the necessary knowledge of cooling systems & Co. are on hand to help.

Year-round Strawberries thanks to Mining Heat

The governor draws an interesting link between crypto-mining and strawberries. The Kaliningrad Oblast produces tons of strawberries. Given the local average temperature of 10.6 ° C, this mass production can be surprising. But the region has built up an enormous greenhouse sector that allows year-round strawberry cultivation. Since the greenhouses need to be heated most of the year, the heat that mining farms produce could be inexpensively combined with strawberry cultivation.

However, Alihanov himself refrains from investing in cryptocurrencies. He has already gained experience in stock trading and knows that, because of the associated risk, investments should always be made from expendable funds. However, he has no means to do without, and will therefore wait until the crypto markets stabilize.

Mining Farms in former Nuclear Power Plant

The Leningrad Oblast, which borders on the city of St Petersburg, is also involved in the mining of mining farms. Governor Alexandr Drozdenko, for example, told RIA Novosti to set up a technology park on the site of the nuclear power plant in Sosnowy Bor. The plant is scheduled to be shut down by 2021. Then there is not only enough space for mining farms:

Drozdenko said:

Regulatory Framework required

Both the Kaliningrad and Leningrad areas thus provide the resources needed to industrially organize crypto-mining and attract foreign investors. The Leningrad governor has set himself the goal of getting Russian miners out of their garages and taking the mining process to a "serious level". At the moment, however, there is still one big hurdle in the way: the Kremlin. Thus, the governors demand as soon as possible clear rules that open their way the way. The chances are basically not bad. For example, the Russian authorities could combine their desire for mineral registration with large-scale industrial mining farms.

Will Lenovo be the next company to use a Blockchain application? As a recent patent suggests, it looks very much like it. In the now publicized letter, there are indications of an implementation of blockchain features in the validation of documents.

Last week, the US Patent and Trademark Office (USPTO), the United States Patent Office, issued a document stating that Lenovo might be working on the implementation of blockchain plans in the near future. Specifically, the patent aims to verify the authenticity and validity of documents and protocols using a blockchain-like mechanism.

Thus, the Chinese technology group describes in the form a mechanism in which a digital signature is encoded in a document. By using such a coding instead of a physically printed tag, the recipient can be sure that the document has not been altered after being created. A computer should later decode the signature and make it comparable to a physical document.

This technology should build a bridge between the digital and the analog world. Through the presented and now patented mechanism, it should be possible in the future to cryptographically encrypt even physical and non-digitized documents. This is to prevent physically printed documents from being manipulated after being signed.

It says in the patent of Lenovo:

Image sources:

- Post header created by myself

- Article headers created by myself

- twitter.com/@JUN_Omise

- etherscan.io/chart/tx

Video source:

If you missed my last crypto news just click here!

I wish you all a great Tuesday!

ⓁⓄⓥⒺ & ⓁⒾⒼⒽⓉ

Best regards

@danyelk