- New Blockchain-Game: Cryptocelebrities get your virtual Star!

- The Lightning Network FAQ for advanced Users!

- Rapper 50 Cent makes Millions by accepting Bitcoin!

- Coinbase earns $ 2.7 Million a Day!

- Canadian Electricity Supplier attracts too many Miners!

- Online Payment Service Stripe throws Bitcoin out!

- Wisekey planning its own Blockchain Platform and Cryptocurrency!

If you found Cryptokitties too childish, you can now try the new blockchain game. With Cryptocelebrities you are dealing with celebrities and pay with Ethers.

Ethereum blockchain-based "Game" Cryptokitties sparked a hype at the end of last year, and turned cat lovers into spending thousands of dollars. The cat collection became so popular that the normal transactional business was almost blocked in the meantime by the necessary entries into the Ethereum network. Now Cryptocelebrities is trying to conquer a kind of Cryptokitties image in the blockchain world, Mashable reports.

With Cryptocelebrities, investors can buy smart contracts for stars like Oprah Winfrey, Kanye West or John McAfee - of course only for the virtual imagery on the platform. Each star corresponds to a unique token, every purchase and sale - paid with ether - is entered in the Ethereum blockchain.

The whole thing works like this: The desired star contract is bought at a steadily rising price. When you buy it determines how much the next prospective customer would have to pay for the smart contract - at the beginning, apparently, just doubled. If someone is ready to pay the price, the owner loses the star token and gets richer by that amount.

Cryptocelebrities: Celebrities can earn money - or donate

For each transaction, platform operators reserve a small share. If one of the stars verifies its own token, he or she will receive three percent of each sale - these can then be donated or retained, it says on the platform.

Ethereum founder Vitalik Buterin can look forward to the dubious honor of the most expensive token. He is currently worth almost 25 Ethers (20,800 euros) in the marketplace. This is followed by the ominous Bitcoin inventor Satoshi Nakamoto (16.5 Ethers) and Donald Trump (16.5 Ethers). The cheapest is currently Carl Barron (0.4 Ethers).

Cryptocelebrities is after Cryptokittens, Fishbank and Cryptobots the fourth game known to me on the Ethereum blockchain.

Check it out and if you like get your own virtual Celebrity.

Disclaimer:

The Cryptocelebrities game analysis is from yesterday night MUT time zone and prices can have changed since.

The information presented in this post is not a recommendation for purchase or sale. It is only an opinion of me the author. They serve merely to describe the project and are not to be understood as an investment analysis.

The Lightning Network is currently moving the Bitcoin scene. For some it will solve the current capacity problem of Bitcoin and be the ramp for a new flight to the moon as it scales transactions almost endlessly. Mainstream, we come! For the others, it's just a bad joke that can not work anyway. Well, as Lightning is slowly becoming real, I try in a FAQ to go a little deeper into the matter.

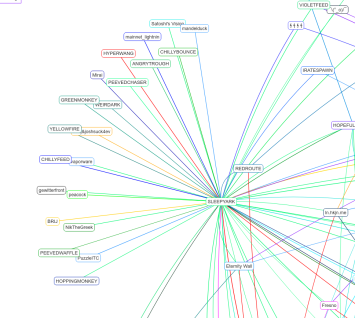

Before we start to address some specific questions about Lightning, you should at least know the basics of what it's about. If you want to take a look at the "real" Lightning network, you can do so with the #recksplorer.

In answering the questions here, Christian Decker helped me in part. Christian became the first "Doctor Bitcoin" with his doctorate at ETH Zurich and has been working for Blockstream ever since. There he develops Lightning-C. If you want to search for him on the #recksplorer, you should look at SLEEPYARK.

Is Lightning ready for everyone?

No, definitely not. Honestly, I do not dare to install a Lightning node myself. All Lightning clients still connect to the Testnet by default because developers do not think that Lightning should be used for real payments right now.

In order to use Lightning you need a Full Bitcoin Node, you have to open the Lightning client, change the configuration file to go into the mainnet and use the command line. If you are confident enough and willing to lose money, you can try the Eclair, C-Lightning and Lightning Network Daemon (lnd) clients.

Neither the software nor the network are ready for general payment transactions. Christian Decker does not want to say when this will happen. "We work as fast as we can, but we also want to be sure that users' money is not lost before we make it easy for everyone to use it. The difficulty of setting up LN is deliberate right now. "

How do Bitcoins get into the channels - and how to get out again?

Actually, that's extremely easy. You make a Bitcoin transfer. You transfer the sum of Bitcoins you want to put into a channel to an address calculated by your client. This is as easy or hard as a normal Bitcoin transaction, and the Bitcoins that are now in this channel are the same Bitcoins as normal transactions. You can transfer them back out of the channel at any time with a transaction.

In the examples with which payment channels are explained, one mostly assumes two-sided deposits into the channel, ie that both partners of a payment channel together fill the channel with coins. In fact, Lightning currently supports only a one-sided funding. "Right now, the initiator is delivering the coins that will be sent back and forth on the channel ... But during a channel's lifetime, that money will be distributed to both endpoints and it will come to equilibrium." In the future It may also be possible to fill channels by both parties, but this is also not easy from the point of view of usability.

How can you receive money with Lightning?

The one-sided funding of channels could be a problem here. Let's take another look at the nodes in #recksplorer. Do you see the twenty nodes that have only one channel with blockstreams SLEEPYARK? These have opened a one-sided channel with blockstream and have advanced all the money that can flow through the channel. How can they receive something via Lightning?

First, the user could change the balance of the channel. In other words, he buys even more stickers in the shop at Blockstream, or he uses Blockstream as a stopover to buy some from BitRefill gift cards. With the channel, he can then receive as much money as he has spent.

"The simplest option," explains Decker, "in this case, however, is that the broadcaster builds a new channel into one, and uses it for that payment and all future ones." That sounds like a start, but one should remember that the more channels there are, the better the Lightning network becomes. If you have an incoming and an outgoing channel, you will have sufficient capacity to receive and send money at best.

Is it possible to receive only certain amounts?

Yes. Spontaneous payments are currently not possible, you need a money order, which also contains the amount. The reason is that you need "a hash for secure forwarding to which the recipient has a pre-image." You do not need to understand it in detail. Think of it as a receipt that every node involved in a payment needs. "But we are also working on a system with which the sender of this pre-image created and the recipient safely. Thus, such spontaneous or repeated payments are possible, such as for donations. "Currently, however, this is not yet possible.

How many transactions are currently being processed by Lightning?

Well, we do not know, and we'll never know. You can see the original transactions with which a channel was formed. "As for the current status, so who knows the two endpoints how much, that is not visible," explains Christian Decker. The reasons are that the balance within a channel is changing very fast, and that this is not wanted, as it would be a privacy leak: "If I can track which channels in turn move Satoshi's, I can see from where and where the payment went. "And that is not the case.

Is there a routing algorithm or not?

One of the major criticisms of Lightning is that there is supposedly no decentralized routing algorithm yet. You can build payment channels, you can even send payments through a chain of payment channels, but there is still no recipe for finding a route through the channels without the help of a central super node. Or?

"That's not correct," says Decker. "Today's implementations have a working gossip mechanism that allows the nodes in the network to get information about channels and other nodes." So every node in the network asks around the network to get a complete picture of all nodes and channels. He does not need a central instance for this.

However, this model has two problems: First, it could eventually lead to problems with scalability. The larger the network, the more information the nodes must exchange and store in order to find routes. On the other hand, the nodes can only know if there is a channel - but not what its balance is. This is, as we have just learned, private. On the "map" that each node forms, it therefore assumes that the channels are balanced. "If this is not the case, the route will fail, but the transmitter will automatically try another route until it works."

Is Lightning more central than Bitcoin?

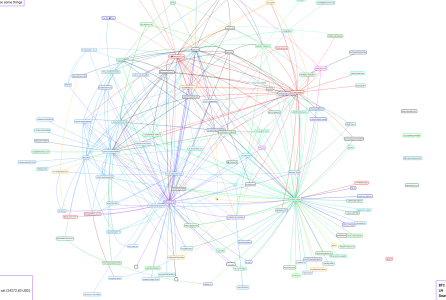

If you look at the Lightning network in the #recksplorer, you will not be able to avoid perceiving certain centralistic tendencies.

There are 168 nodes and a total of 400 channels. This low ratio of vertices and edges results in an extremely sparse network. In Bitcoin, however, 168 nodes have at least 1400 and a maximum of about 10,000 connections (each node has at least 8 and a maximum of 125 peers).

A small handful of nodes - currently five - have more than ten channels, some even more than twenty, and another group has 5-10 channels. However, by far the largest part of the nodes has only one or two channels.

This makes the network much more centralized than Bitcoin. For example, if the block-streamed node breaks SLEEPYARK, about 20 other nodes will lose all access to the network. In addition, if three to four more super hubs fail, it will hardly be possible for almost all participants in the network to even send any transactions. With Bitcoin, however, it would not be noticeable if some of 168 nodes fail. Thus Lightning fulfills the definition of a central system.

However, this is not bad. The base layer of Bitcoin, the P2P network, remains completely decentralized, and Lightning helps to keep it that way. The network of payment channels is just a patch layer that allows for a very large number of almost free transactions. Since Lightning is also built in such a way that the big hubs can neither monitor nor steal coins, centralizing this network in itself is not a fundamental problem. It is even to be welcomed as it helps accelerate the genesis of the network.

Do I always have to be online when using Lightning?

Generally, yes. Because the counterpart could close the channel with an old state and thus cancel an already made payment. Suppose I sent you 100 in a channel, then 200, then 300, then 500 Satoshi. Theoretically, I could now just publish an old transaction and close the channel not with the most recent, but with an outdated state, as I have even less to you.

Fortunately, Lightning is now designed so that the one who cheats the other one has the opportunity to dissolve the entire channel in his favor. Say: Who is caught cheating, loses everything.

The reason that this is possible are smart contracts, which ensure that the Bitcoins transferred in a transaction closing the channel can only be reissued after a certain number of blocks, and that there is a mechanism under certain circumstances, it allows the other one to issue this Bitcoin before. If you are interested in the details, you should read the article on building the channels.

If you set the transaction so that the Bitcoins can only be spent after 144 blocks, it is enough if you go online once a day to prevent any kind of fraud (and in case of even benefit from it). If you want, you can increase the threshold to one week. This has the disadvantage, however, that the Bitcoins you put into a channel are not quite as flexible as normal Bitcoins.

How long this time is depends on the implementation. "C-lightning has a default of 6 blocks, so about 1 hour ... The reaction is automatic in all clients, and you just have to let the client run, so do not intervene." Christian Decker says the risk is rather low : "The timer only starts from the moment it sends the old state to the network, and if you're back online before the timeout, the attacker loses all his credit in the channel." The game theory works for one and against the attacker.

Will there be a light wallet, or does everyone need a full node?

So far there is no light wallet. Lightning works only with a full node. However, the Light-Wallet is already "strong in development". It is planned that "the critical information that happens on-chain will also be forwarded via the overlay network". In addition, it should be possible to make today's existing SPV wallets (a form of light wallets) compatible with Lightning. But this will take a while.

Rapper 50 Cent decided in 2014 to accept Bitcoin as payment for his album "Animal Ambition". A good choice that surprisingly earned him millions.

It is another chapter in the book of curious stories about the Bitcoin: The US rapper 50 Cent had decided to accept for his last, in 2014 released album "Animal Ambition" Bitcoin as a payment option. Although the album did not sell nearly as well as its predecessors, the Bitcoin gimmick should have paid off for 50 Cent.

Bitcoin millionaire 50 Cent can be happy about his decision. (Image: 50 Cent / Facebook)

According to a report from the US gossip portal TMZ.com confirmed by 50 Cent via Instagram, the rapper can look forward to an additional income of more than seven million US dollars. He has taken about 700 bitcoins for his album. At the time of the album release, a Bitcoin was worth about $ 600, which was over $ 400,000. Not bad for the fact that only 205,000 units have gone over the counter to this day.

Clever: 50 Cent left his Bitcoins in the Bitcoin wallet

Even better, however, was the - presumably unconscious - decision not to exchange the earned Bitcoins immediately in dollars. Because currently the 700 Bitcoins are worth 7.7 million dollars. He even had close to $ 14 million in December when a Bitcoin was worth up to $ 20,000. Whether he brings his Bitcoins now dry in view of the rather bleak prospects for the cryptocurrency at least in the short term, or sets on a further increase in prices, is not known.

Running a cryptocurrency exchange can be a logistical nightmare on some days, yet you will be well rewarded. Information released to Coinbase shareholders indicates that the crypto exchange made $ 1 billion in sales last year. That's the equivalent of $ 2.74 million a day and $ 2,000 a minute.

Coinbase makes sales through fees

Coinbase is the largest crypto exchange in the United States and takes the largest part of the money that flows into the crypto market. The past year was a year of records. Many exchanges had to cope with the onslaught on cryptocurrencies and had to hire new staff. Of course, the great demand for Bitcoin and Co. also led to higher revenues.

According to Recode, the crypto exchange took in more than $ 1 billion last year. Most of the profits came from transaction fees. These are between 0.25% and 1% on the crypto exchange. With a large number of transactions or high transfers, this quickly leads to large sums.

Coinbase shares are in demand

But not only the cryptocurrencies on Coinbase are sought after, also the shares of the company are in demand by investors. Shareholders reported that new investors are interested in buying their shares. Coinbase, however, has signed contracts with its investors, which prohibit exactly that.

Selling shares on secondary markets is prohibited for a variety of reasons. One of the reasons is that there is no complete information for the market, it said in a statement of the crypto exchange. "We will take reasonable action if we find out that people have sold their Coinbase shares, contrary to the agreement not to do so."

A few weeks ago, Hydro-Québec, a Canadian utility, called on miners to move to the province of Quebec to boost the regional economy. 5,000 megawatts of energy are left for that. Now it became known that the demand for this offer is so great that the required power can not be met.

The campaign, which Hydro-Québec wanted to lure crypto miner into the region, was apparently a bit too successful. The magnitude that interested miners would need would be unmanageable. Hydro-Québec will not be able to meet expected demand over the long term, company spokesman Marc-Antoine Pouliot said.

projects have already been announced. Laurent Feral-Piersens, who works with miners in the region, has suggested that recent expressions of interest in Hydro-Québec are just "the tip of the iceberg". Demand in the mining industry is much higher. But what exactly is the miner pulling into cold Canada?

China drives miner to Canada

Hydro-Québec is Canada's largest energy supplier, but also a faltering one. Higher energy consumption in the region could secure the survival of the company. According to Eric Martel, CEO of Hydro-Québec, miners could expect several benefits in Canada. On the one hand, the electricity is very cheap and the cooling of Québec's snowy winter is almost free. On the other hand, Canada is a politically stable country with no restrictions on miners. Expectations of a crackdown in China, one of the world's largest sources of cryptocurrency mining, make Québec an attractive location for businesses.

But the local population could also benefit from miners. Hydro-Québec has not only been trying to get crypto miners into the area. Entrepreneurs were also asked to set up data centers - thereby creating more employment opportunities. The company estimates the region will produce an energy surplus of about 100 tera watt hours over the next decade - the energy needed to power 6 million households for a year.

The miners who got called ...

David Vincent, Director of Business Development at Hydro-Québec, said recently, "We have at least three or four out of the world's five largest blockchain players." But who exactly that was, he did not explain. However, Reuters recently reported that mining hardware maker Bitmain had discussed a number of potential locations in Quebec. The largest mining company could be one of those who want to move to Canada.

Hydro-Québec wants to reconsider its commercial energy strategy given the huge demand. The company will not be able to supply all projects. But refusal will not be granted for the time being. Given the optimistic forecasts for future energy surplus, the utility seems to have a lot in store. So there is still the possibility that Canada could become one of the largest mining pool centers - replacing China.

The international financial services provider Stripe announced yesterday that it will finally say goodbye to Bitcoin on April 23 as a means of payment. The decision is deplorable to the community, Stripe was the world's first major payment service provider to accept this cryptocurrency in 2014.

In three months, Bitcoin support for all customers ends with the American online payment service Stripe. The original hope of the company based in San Francisco that the Bitcoin is permanently suitable for financial transfers, unfortunately did not come true. Stripe wanted to see a decentralized cryptocurrency instead of the now usual credit card transfers or transfers between different checking accounts. But the conditions of Bitcoin for a payment service are anything but favorable. It may take a few days for a transfer to complete. In each case, the question arises how to handle the price fluctuations in the meantime. Also, nobody wants to wait long for his money. In addition, there are the high transfer costs, which make the Bitcoin simply not attractive for this area of application. This is at the level of the cost of a transfer between two international banks. Accordingly, the number of Bitcoin users in Stripe has fallen sharply in recent months. Until the suspension of BTC support on April 23, 2018, the provider wants to do everything to make the transition as pleasant as possible for its users.

Nevertheless, the company is open to cryptocurrencies with over 700 employees. Possibly you will include the payment system Stellar in your own repertoire. The transfers should be very inexpensive and completed within a few seconds. The move would be logical as several senior executives at Stripe are involved in the Stellar open source payment system. Stellar was founded by the creator of the file sharing network eDonkey, Jed McCaleb.

So far, Stripe has decided for no other ecosystem, which should replace the Bitcoin from the end of April. Currently they are looking in all directions and watching the Lightning network, the payment platform OmiseGO or, for example, the cryptocurrency Ethereum, because they can see in all projects according to the blog post very much potential. The more than 100,000 corporate customers of the payment processor will have to wait a little until the final decision.

Wisekey plans to launch its own blockchain platform and the cryptocurrency "WiseCoin" with the contactless, hardware-enabled wallet "WiseCoin-Wallet".

The introduction is to take place via an Initial Coin Offering (ICO) via a conduit called WiseCoin SA, the company announced on Wednesday. The upcoming private presale is scheduled to begin in May 2018 and the ICO is scheduled for the third quarter of 2018. The project will be presented this Wednesday at the World Economic Forum in Davos.

The WiseCoin offering will be tested over the next six months in select countries that are currently using Wisekey Blockchain technology. After that, it will gradually be offered to the market.

WiseCoin's ICO is said to be executed on the basis of thorough due diligence and a rigorous approval process, as well as a high-quality digital asset exchange. The ICO is designed to help governments and central banks use cryptocurrencies to provide financial institutions with a secure way to conduct a full suite of secured asset transactions on a blockchain, the company continues.

With its partner ecosystem, WISeKey is well positioned to meet different types of blockchain requirements for customers worldwide. WISeKey has partnered with Microsoft and IBM for BaaS solutions and other companies Lykke, Stratumn, BigchainDB. WISeKey strives to uncover the limitless possibilities in this blockchain arena to enhance the business and quality of life associated with WISeKey security solutions.

Bikramaditya Singhal, Practice Head- WISeKey said:

WISeCoin uses the latest blockchain technology and works as part of the payment system with WISeKey Blockchain-as-a-Service ("BaaS") technology offerings. To enable a seamless cryptocurrency, WISeCoin is complemented by high-security solutions such as biometrics-driven hardware wallets, integrated exchange platforms, MicroChip's blockchain-enabled semiconductors, and NFC-based contactless payment solutions. WISeKey's goal with WISeCoin is to become an emerging powerhouse in the global cryptocurrency market by supporting the development of economies based on blockchain technology.

Disclaimer:

The information presented in this post is not a recommendation for purchase or sale. It is only an opinion of me the author. They serve merely to describe the project and are not to be understood as an investment analysis.

In case you missed my last news just click here!

I wish you all a great Thursday!!!

ⓁⓄⓥⒺ & ⓁⒾⒼⒽⓉ

Best regards

@danyelk