In my video review about Qtum I describe it’s technology, talk about history, express my thoughts and concerns about it. You could also read the text version below.

In one sentence, Qtum is the hybrid of Bitcoin and Ethereum based on proof of stake consensus. Qtum developers took Ethereum smart contracts and put them on Unspent Transaction Output model from Bitcoin (as opposite to account model in Ethereum). I would say that Qtum is much more resembles Ethereum: Ethereum Virtual Machine used, smart contracts are compatible with Ethereum blockchain, same conception of Gas but transactions are written differently to the blockchain.

Let’s get into details.

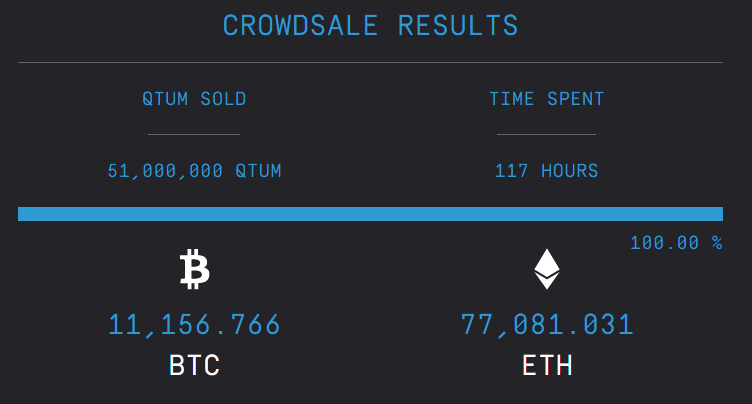

Crowdsale of Qtum took place in March 2017. It was sold 51 million of Qtum tokens through 6 exchanges (5 of which are asian and 1 is canadian). So majority of crowdsale investors must have been from Asia.

Roughly 14000 of bitcoins were earned in total. It’s the average price of 3700 Qtums per 1 Bitcoin and now it’s around 250 per Bitcoin. Since the crowdsale price has grown by 10 times bitcoin-wise and by 30 times to real money currencies. And it’s only just half of the year elapsed.

At first that were so called IOU (I owe you) tokens. And in July Qtum foundation issued ERC20 Qtum tokens in Ethereum network. And these tokens are possible to transfer, sell on Exchanges and so on. So 51% were sold to community, 20% are holded by founders, investors and developers, 29% is reserved to operational costs of Quantum foundation for the next 4 years.

Main network hasn’t been launched yet and after the launch which is planned to September 2017, ERC20 tokens will be changed to Qtum tokens on Qtum blockchain.

100 million tokens will be isssued in the very first genesis block. So people holding ERC20 Qtum tokens will get their Qtum mainnet tokes. It’s not clear when it will happen though and how this exchange will be fullfilled.

Moving next to technology behind QTUM. Key factors from the white paper. It’s proof of stake, so no mining blocks. No masternodes as well. Anyone with any amount of coins will be able to run a node, create a new block in the blockchain and get block reward. Chances will be bigger the more coins you hold. They call it Proof of Stake version 3. There is some formula where node calculates new block hash every 16 seconds. And this hash is compared then with target difficulty number. And more coins you have in your balance, the bigger your difficulty number, and more easy for you to get a successful hash.

Another key fact, basically Ethereum virtual machine is used, so Ethereum contracts will be possible to run on Quantum with some minor adjustments. In addition to Solidity Qtum blockchain will use Quantum Smart Contract Language, which is going to be constructed in the future.

Another key fact, the blockchain is based on Unspent Transaction Output Model (like in bitcoin). But smart contracts still are accessed by address like Ethereum. And gas model is very similar to Ethereum. It looks like they build Account Abstraction Layer above the bitcoin-type blockchain. So you could handle smart contracts like in Ethereum and this layer will write transaction to non-Ethereum blockchain. You can read more technical details from the blog Earlz.net, lead developer of Qtum. He provides us with reasonable critics of Ethereum Virtual Machine, explains Proof of Stake version 3, gives us an example of Qtum smart contract. And he is probably nice guy from what I’ve read.

What have developers done since the start?

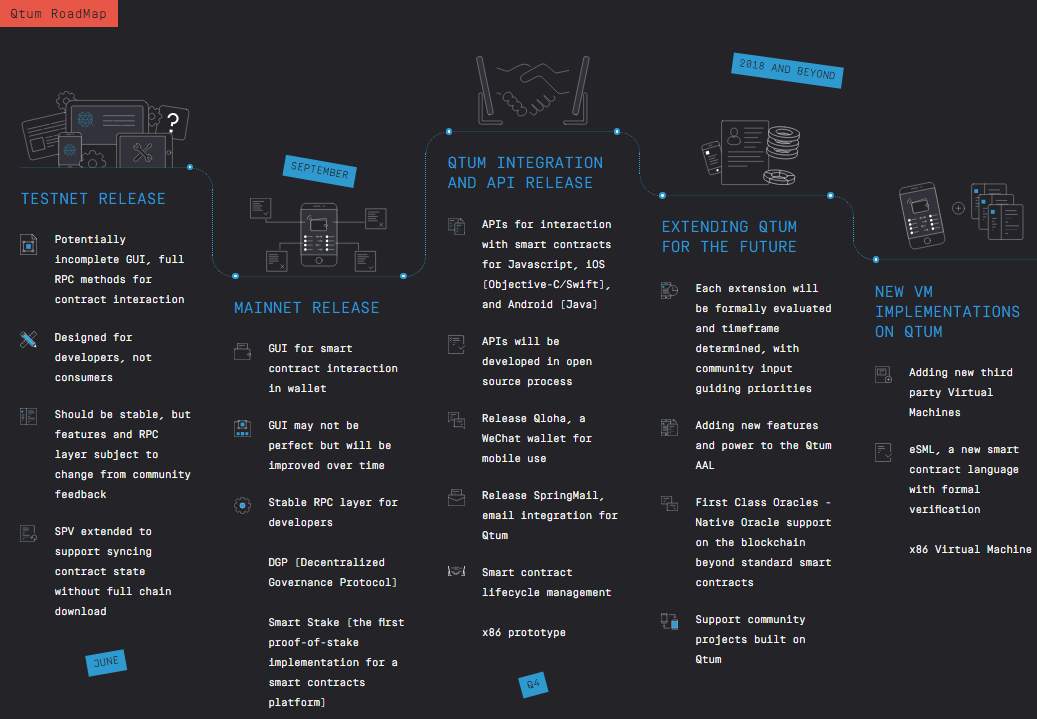

According to the roadmap we must have had a testnet in june. Do we have it? Yes we do. First testnet was released 28th of June under the name Sparknet, then the 2nd testnet Skynet was released on 16th of August 2017. So they keep their promises so far. Link to their github releases page.

And from the latest news we know that the main net will be launched 13th of September. So everything goes as planned. And this is a very good thing.

Another good thing is that quantum has been backed by the whales of CryptoSpace. Roger Ver invested in it, also the founder and CEO of Jaxx wallet Antony di Iorio, some big chinese investors.

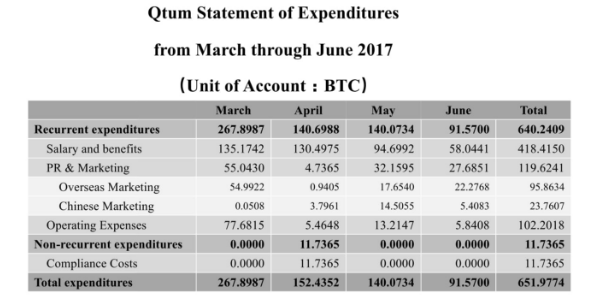

One more good thing about Qtum: they published their expenditures for the first 4 month, though not very detailed breakdown provided. But still it’s better than nothing.

What are my worries?

First, we've got an article with a title “Blockchain UTXO Model is a Dead End for General Purpose Applications” by @dantheman. In short author is pointing at some issues with UTXO model, and warns that Smart Contracts build on this model has some serious limitations. It’s a good point, because Ethereum platform refused to use UTXO model. And Qtum decided to return to it in their platform. This may be step back in technology, but maybe developers will turn it their way. However, this is gonna be complicated and challenging at the start.

Next concern, very shady past of Qtum founder Patrick Dai.

He was involved in the BitBay project previously under the different name Steven Dai. In February 2017 Patrick Dai accepted this fact on BitcoinTalk forums and later tried to explain the situation. You can read his explanations here. So, this guy changed his name, allegedly to not be connected to Bitbay. But this went public.

A lot of chat logs from the Bitbay founders are public now on Bitcointalk. David Zimbeck who is the lead developer of Bitbay is accusing Patrick Dai in stealing 200BTC from BitBay project. We can’t prove that fact though. But from the chat logs we can make assumptions of Patrick’s participation in pumping and manipulation with BitBay price on BTer Exchange. If you interested more about the situation and accusations you could read the thread up and down from Zimbeck's post.

Next concern. What are Qtum tokens about? Why someone will need them? From the prospectus of Quantum crowdsale we can find it out: needed as virtual crypto fuel for using certain designed functions such as executing transactions and running the distributed applications In some jurisdictions, cryptographic tokens in various distributed ledgers like QTUM are legally categorized as virtual commodities. The Qtum Foundation views Qtum as a kind of consumable virtual goods without any specific outlook or expectation on its merchantability or market price. These statements are the same as Ethereum foundation’s about Ether.

Basically, we will need Qtum tokens as a fuel to running decentralized applications. No promise to be a digital currency or something. But that caution in the statements can be caused by not clear status of crypto ICO’s in general.

Another concern is regarding the price. Price of Qtum has grown 10 times in 5 month since ICO and it could be a subject to a big speculation.

My conclusions:

Quantum is being created as a hybrid of two major blockchains. Nobody knows if it will become useful combination of technologies or is it only sounds good. There are big goals as usual and a lot of work to do in the future. But they managed to keep promises about their plans so far.

Some concerns we have about Patrick Dai and his shady past, also we have concerns about the need of Qtum token besides being the fuel for smart contracts.

So it’s very vague in the long run. In the short term though, if they manage to launch their blockchain in September, it can be some starting hype. But be cautious, price manipulation warning!

Hope my review of Qtum was helpful, leave comments, share, subsribe!