Finding long term investments for secure coins like Steem is relatively easy, you can get information for these coins from many places since there's already so much recognition for them.

These popular coins get mentioned regularly by youtubers, cryptonews outlets, etc.

However while there's less risk involved in investing in these coins there's also less profit, you wont see a 10000% rise on any of them anytime soon.

"Shitcoins" with unrealized potential is where you can make serious money.

Take for example the former "shitcoin" NLC2 coin before it was discovered by @dhenz. This coin was sitting at 15 satoshi and it rose up to 900 satoshis in a few days and now found a floor at around 600 satoshi, this wasn't just a pump and dump, this was the realization of the potential of the coin because of @dhenz.

You can see in the coinmarketcap chart of the coin that it keeps rising.

The coin has a lot planed for the future, you can read more about it here: @joaol/nolimitcoin-nlc2-has-a-great-future

So, how would you go about finding these coins?

Here are my tips on how to find "shitcoins" that can rise up to take a place next to the popular coins:

TIPS

Look for low market cap

If you're looking for undervalued coins you obviously have to look for the cheap coins, but don't only look at the coins price because the value of a coin is relative to the amount. I've seen youtubers say it's better to buy Ripple than Ether because then you have more Ripple, while it is true that Ripple is only 0.25$ per XRP the amount of circulating Ripple is HUGE compared to the amount of circulating Ether, this is why you need to look at the market cap and not the price per coin because the market cap is [amount of coins TIMES price of each coin] which is what matters when measuring a coin's current value.Check out the website

Does the website look professional, do you get the idea of the project when you enter their website or is there just a big BUY button on the middle of the site, the website design can tell you a lot.Check if the project has a good social presence

This is vital to see if the project is still being worked on, check their twitter, bitcointalk posts, slack, discord, facebook or whatever other social site they say they're in. If the dates on the last posts are months old then that's a sign the project might have been abandoned. You should also interact with the community, ask a few questions.Future expansions

Look for their whitepaper and road map, try to judge how promising the project is and if the prospects are attainable. Find what exchanges they are on, if they plan on moving to a big exchange site. The price could go up if they get into an exchange like bittrex.

And there you have it!

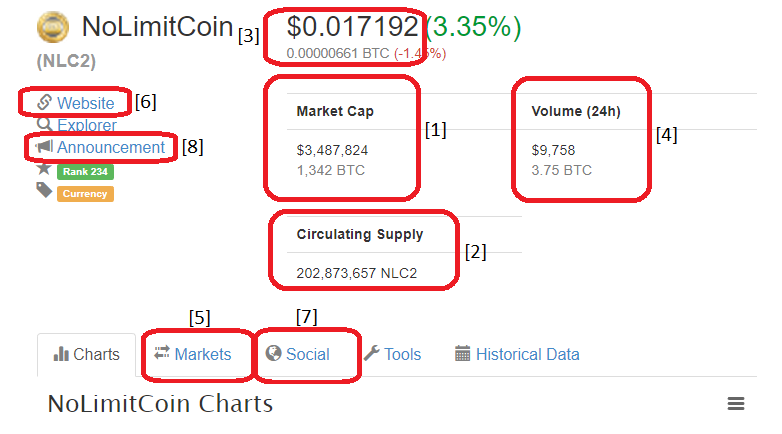

By the way, you can use coinmarketcap to see the market cap[1], circulating supply[2], price[3], 24h volume[4], the exchanges the coin is on[5], the coin's site[6], the twitter feed[7] and the announcement page[8] on bitcointalk where you can click the profile of the dev and see his latest posts.

That will be all, peace out.