A current report (PDF) from the Foundation for Defense of Democracies' Center on Sanctions and Illicit Finance and blockchain investigation organization Elliptic investigated the "bitcoin washing" biological system. In the investigation, Elliptic's measurable examination of the Bitcoin blockchain and other openly accessible information were utilized to track the streams of unlawful assets from 2013 to 2016.

"This examination expected to distinguish where people hand over a request to money out or transmit bitcoins (BTC) obtained from illegal substances and to find typologies for crooks 'laundering' bitcoins," the report says.

The investigation portrays bitcoin laundering as an extraordinary kind of illegal tax avoidance that exists inside the Bitcoin arrange where a client moves some bitcoins to another address in a way that darkens the first wellspring of assets. The transformation of bitcoins into fiat cash on trades that need sufficient against illegal tax avoidance (AML) and know-your-client (KYC) approaches can likewise fall under the classification of bitcoin washing.

Notwithstanding portraying the basic instruments for bitcoin washing and clarifying that this kind of movement is a little level of all exchanges sent to trades and other transformation benefits, the investigation likewise offers a few proposals for law requirement as far as keeping the veiling of illegal finances on the Bitcoin arrange.

It ought to abandon saying that any examination identified with the dim web or illegal utilization of the Bitcoin organize should be taken with a grain of salt on the grounds that evading location is the entire explanation behind a criminal to utilize these sorts of stages in any case.

The Bitcoin Laundering Ecosystem

A great part of the investigation, which is titled "Bitcoin Laundering: An Analysis of Illicit Flows Into Digital Currency Services," rotates around the utilization of "change administrations." Conversion administrations are fundamentally stages where clients change over bitcoins to fiat cash (a Bitcoin trade) or another cryptographic money (a crypto exchange), or move the bitcoins to another Bitcoin deliver available to the client. These outcomes in a stream of assets that can't be seen or followed specifically on people in general blockchain.

As indicated by the investigation, darknet markets are the primary wellspring of assets that are sent to transformation benefits in bitcoin washing endeavors.

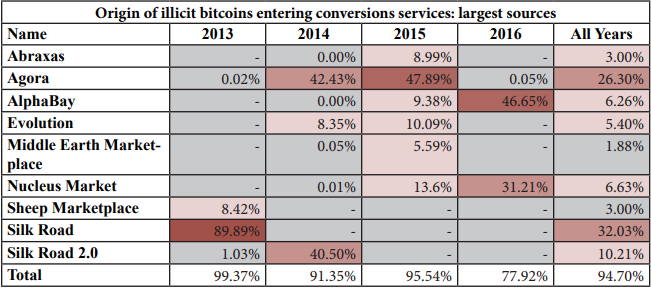

Furthermore, the quantity of unlawful administrations that could be the wellspring of "filthy bitcoins" sent to a change benefit expanded fivefold from 2013 to 2016. Having said that, the examination finds that the wellsprings of unlawful assets entering transformation administrations are very brought together.

"Just few substances represent the dominant part of unlawful action in our example," the investigation says. "Nine of the 102 illegal elements were the wellspring of more than 95 percent of all washed bitcoins in our examination. Every one of the nine were darknet commercial centers."

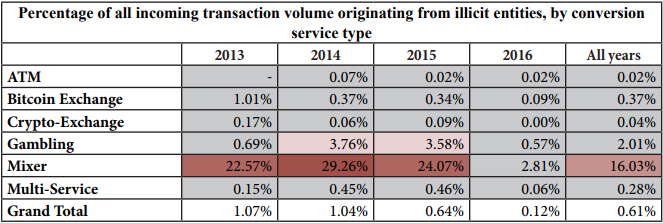

While trades are the most normally utilized kind of transformation benefit, bitcoin blenders and betting locales have considerably more unlawful assets coming into their stages as a level of their general exchanges. As potential courses for bitcoin washing, these two kinds of transformation administrations advantage from covering their nation of activities and keeping away from implementation of AML controls.

"Less than 10 percent of all exchanges general went through obscure purviews ... while 52 percent of unlawful washing experienced them," the investigation says.

Much like the wellsprings of illegal assets, the change administrations where these assets are sent are additionally exceptionally concentrated, the investigation finds. The information shows that 97 percent of illegal exchange volume at blenders and betting destinations experiences three unique substances. Furthermore, two stages in Europe represent half of every single unlawful move that go igoeso trades.

Very little Bitcoin Laundering Activity Overall, and It's on the Decline

Another striking part of the investigation is that the information demonstrates a low level of bitcoin washing as a level of all installments sent to transformation administrations.

"The measure of watched Bitcoin washing was little (short of what one percent of all exchanges entering transformation administrations)," takes note of the investigation.

The report clears up that the genuine volume of unlawful Bitcoin exchanges sent to transformation administrations is "most likely to be altogether bigger" than what the information in the examination indicates on the grounds that transitional exchanges are not tallied. At the end of the day, the report just covers exchanges made specifically from an unlawful source, for example, a darknet advertise, to a change benefit.

The investigation likewise demonstrates an abatement in illegal Bitcoin exchange volume going to change benefits after some time.

"It is likely that unlawful bitcoins fell as a level of aggregate volume entering change benefits because of the digital money's expanding prevalence as a theoretical speculation and also new laundering systems," the investigation says. "The drop may likewise reflect better AML/CFT consistence by transformation administrations, including the utilization of blockchain examination administrations to decide clients' wellspring of assets."

The examination later includes, "Our investigation, the first of its kind, demonstrates that while most sorts of transformation administrations have gotten some bitcoins from unlawful action, by far most of the assets they get don't seem, by all accounts, to be illegal."

Proposals for Law Enforcement That Will Likely Fall Short

The report offers proposals for law requirement as far as what they can do to battle the viability of bitcoin washing.

To begin with, the investigation says legitimate KYC and AML approaches should be upheld on the bitcoin blenders and betting locales that take into consideration unknown utilization. It takes note of that the three change benefits that record for 97 percent of bitcoin washing on these sorts of stages ought to be focused by money related experts.

"The way that most blenders and betting locales shroud their area of tasks demonstrates they presumably look to dodge the fundamental directions set up to maintain straightforwardness and monetary honesty principles in many wards," includes the examination.

Obviously, it ought to be noticed that focusing on these sorts of administrations will turn out to be about unimaginable as they turn out to be more decentralized after some time. Decentralized stages like JoinMarket, TumbleBit and ZeroLink evacuate the capacity for experts to brace down on bitcoin blending in a compelling way, as these arrangements demonstration more as programming than administrations.

Second, the report additionally calls for expanded AML and KYC consistence at European trades.

"Numerous vast European Bitcoin trades do execute powerful AML arrangements," says the investigation. "Nonetheless, this is out of decision as opposed to commitment, and there are some who pick not to, perhaps to draw in business from culprits."

The investigation includes that the European Union is now moving the correct way by means of a refresh of their 2015 Anti-Money Laundering Directive to incorporate fiat-to-digital currency trades, however in the perspective of the creators of the paper, crypto-to-crypto trades should likewise be managed in this way.

Once more, it should be called attention to that more hazardous innovation — at any rate from law authorization's perspective — is not too far off as decentralized cryptoexchanges. Using cross-chain nuclear swaps by means of the lightning system, clients will have the capacity to in a split second exchange between various cryptoassets without the requirement for a trusted outsider.

Third, the examination requires a kind of promulgation crusade against the utilization of darknet showcases by offenders and the overall population on the loose.

"Law authorization should expand client distrust about [darknet market] destinations' honesty and lessen the apparent security of such stages by uncovering their vulnerabilities freely," says the examination.

The report includes that law authorization should influence it to understood that they're sneaking on these darknet markets to additionally shake trust in them.

Darknet markets are another region of the Bitcoin environment that are winding up more decentralized through stages, for example, OpenBazaar. While unlawful action on the OpenBazaar arrange gives off an impression of being constrained right now, it could possibly detonate in prominence as a response to law implementation's speculative crusades against the unified darknet markets.

Fourth, the report adulates the choice by budgetary experts in the United States to control trades as Money Service Businesses. The creators of the paper might want to see this kind of arrangement took off around the world.

Last, the examination noticed the need to keep the unlawful utilization of bitcoin and different cryptographic forms of money to get around financial approvals forced by the United States or different countries.

"Notwithstanding relieving illegal fund dangers like criminal tax evasion, there will probably be a need to create techniques to counter state on-screen characters expecting to utilize digital currencies to go around U.S., EU, and UN sanctions."

As of late, there have been reports of North Korea, Russia and Venezuela all investigating separate systems for keeping away from monetary endorses using cryptographic forms of money.

You may want to read some of my articles

TALKS/OPINION: South Korea Has No Plan On Banning Cryptocurrency Exchangers.

Cryptogee Photomash Logo Challenge: My combination of photos

AdoptaMinnow - Adopt a Minnow - Make a logo contest. Here is my Entry