In the aftermath of recent Bitcoin Exchange-Traded Fund (ETF) approvals, the cryptocurrency market has experienced a notable shift in dynamics. Large Bitcoin wallets, in particular, have been swiftly transferring older coins, significantly lowering the average age within these wallets. This article explores the implications of this movement on the current bullish cycle and delves into the options data and ETF impact on Bitcoin's price.

Large Bitcoin Wallets Moving Older Coins:

On-chain data from Santiment reveals a distinctive trend in the wake of approved Bitcoin ETFs. Major Bitcoin wallets have been actively moving older coins at an accelerated pace. This has led to a substantial decrease in the average age of coins held in these wallets, prompting speculations about a potential pause in the ongoing bullish cycle.

While there are indications that the movement of older coins might have temporarily subsided, Santiment suggests that actions by influential whales could reignite the market. This might result in a further decline in the mean dollar invested age of Bitcoin, potentially triggering another upward wave with price targets around $45,000 and even $50,000.

Options Data and ETF Impact:

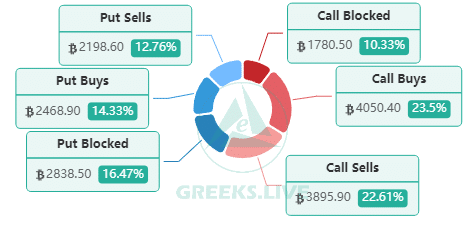

Greeks.Live provides insights into the current focus within the financial landscape, highlighting the impact of U.S. stock ETF trading on cryptocurrency prices. Notably, a significant $120 million, constituting 16% of the total, was transacted in large put options. This unusually high volume of put options raises questions about the short-term market sentiment.

Examining individual block trades exceeding $5 million, a trend emerges, indicating a prevalence of short-selling through short-term put options. Simultaneously, smaller orders tend to lean towards buying short-term puts. Despite these bearish signals, there is a growing sentiment among large traders that the market may have found stability, providing a glimmer of optimism amid uncertainties.

Long-Term Significance of Bitcoin ETF Approval:

While the impact of Bitcoin ETF approval may not be immediately visible, market analysts, including popular crypto analyst Michael van de Poppe, emphasize its significance over the long term. Despite a negative return since its initiation, the ETF has witnessed a massive net inflow, surpassing $600 million on the first day alone. Analysts anticipate the real impact of the ETF to manifest in the coming years, labeling it a "mega bullish event."

The intersection of large Bitcoin wallet movements, options data, and the long-term implications of ETF approval creates a complex narrative for the cryptocurrency market. Investors and analysts alike are closely monitoring these developments, as they hold the potential to shape the trajectory of Bitcoin's price in the short and long term. The interplay of these factors underscores the dynamic nature of the cryptocurrency market and the need for a comprehensive understanding of on-chain and off-chain data for informed decision-making.