Abu Dhabi Partners with Mastercard for an Improved Fintech Solutions in the Region

The international financial center of Abu Dhabi or the Abu Dhabi Global Market (ADGM) is currently in collaboration with payments giant company, Mastercard to develop and speed up Fintech solutions in the region.

The partnership will allow both companies to exchange expertise and knowledge at the same time cooperating on Fintech projects as the ADGM is aiming to further improve its reputation from an international financial center into a Fintech hub in the region.

Mastercard has already invested to a cryptocurrency entrepreneur Barry Silbert's Digital Group and has actively develop payment API solutions backed by blockchain technology.

This ADGM's project with Mastercard comes within days of the UAE government releasing regulation guidelines on cryptocurrencies and ICOs.

Through its financial markets regulator FSRA, they will only regulate ICOs which tokens shows characteristics similar to that of securities.

Playkey, A Cloud Gaming Solution to Launch a Decentralized Platform Powered by Blockchain

Playkey uses a cloud gaming solution which allows gamers to play hard core games using any device regardless of GPU and CPU requirements.

The gaming company has already worked on a platform with more than 120 servers in Europe with 1.5 million visits per month and earns millions of revenue per year.

It is also currently looking for ways to raise funds to launch its decentralized, blockchain-based, peer-to-peer platform in exchange for Playkey (PKT) tokens.

These tokens are Ethereum-based which will be used by gamers to buy daily, weekly, and monthly subscriptions and also to pay for 3rd-party gaming services such as streaming, servers, in-game purchases and more.

Playkey will launch ICO which will start November this year.

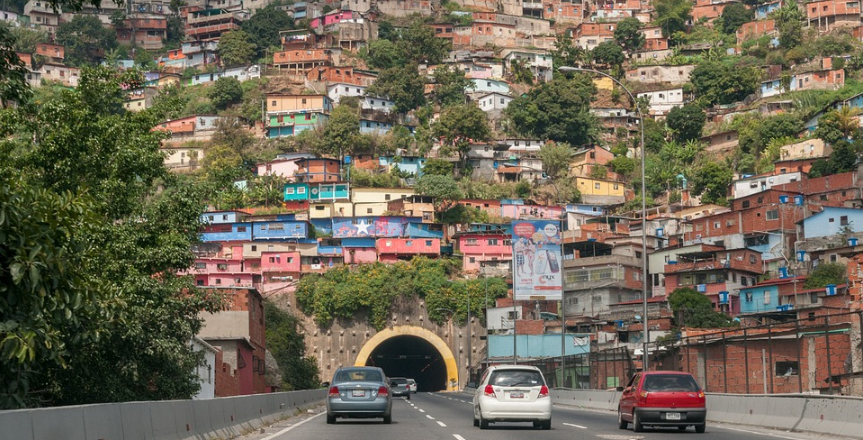

LocalBitcoins had 4x Increase in Bitcoin Trading Volume in Venezuela

Locabitcoins decentralized trading platform has seen 4x increase in its trading volume in Venezuela since June this year.

This shows that there is currently a massive demand growth in the country and other rising markets.

The increase in the last three months has increased to 9 billion to 40 billion Venezuelan bolivars.

The increase occurred even though there is lack of clear regulations and policies regarding cryptocurrencies in the country.

The increase is due to Venezuelan banking and financial systems continuously suffering from rapid devaluation and hyperinflation of its national currency over the last year.

Headlines for the world of Cryptocurrencies - October 18, 2017Zcash Privacy Tech Integrated to JPMorgan's Quorum Blockchain / Microsoft Provides Blockchain Use for the U.S. Government / OKEx Bitcoin Exchange in Hong Kong Announced Support for Segwit2x Futures Market |

|---|

Headlines for the world of Cryptocurrencies - October 17, 2017Bitcoin Adoption in Australia Increased after Regulatory Amendments / Wirex to Integrate DASH Allowing 40 Million Merchants Accept the Cryptocurrency / Byzantium, Ethereum's Hard Fork was a Success |

Headlines for the world of Cryptocurrencies - October 16, 2017IBM Announced Partnership with Stellar Lumens for Cross-Border Payments Using Cryptocurrency / Russia to Issue Its Own Official Cryptocurrency – CryptoRuble |