What is Litecoin?

“Litecoin is a peer-to-peer Internet currency that enables instant, near-zero cost payments to anyone in the world. Litecoin is an open source, global payment network that is fully decentralized without any central authorities. Mathematics secures the network and empowers individuals to control their own finances. Litecoin features faster transaction confirmation times and improved storage efficiency than the leading math-based currency. With substantial industry support, trade volume and liquidity, Litecoin is a proven medium of commerce complementary to Bitcoin.” Source

History of Litecoin

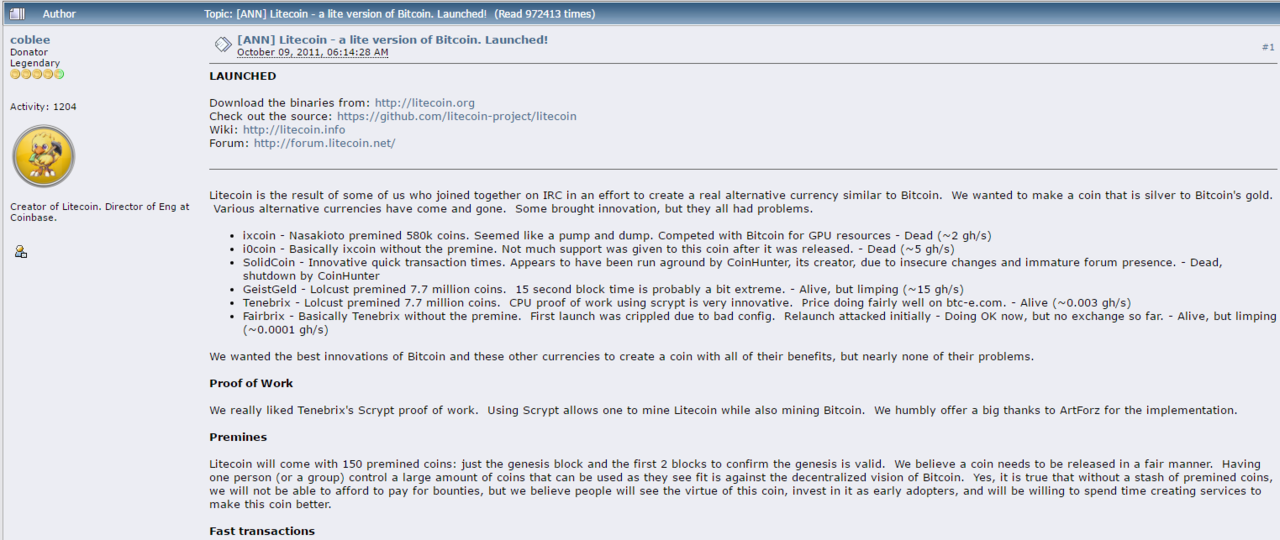

Litecoin was released via an open-source client on GitHub on October 7, 2011 by Charlie Lee, a former Google employee.

Litecoin was created with the intent of becoming “silver to bitcoin’s gold”

“Litecoin is the result of some of us who joined together on IRC in an effort to create a real alternative currency similar to Bitcoin. We wanted to make a coin that is silver to Bitcoin's gold. Various alternative currencies have come and gone. Some brought innovation, but they all had problems.” Source

Charlie Lee, also known as coblee or SatoshiLite is currently the Director of Engineering at the popular digital asset company Coinbase.

Lee is also the managing director of the Litecoin Foundation.

“The Litecoin Foundation (Litecoin Foundation Ltd.) is a non-profit organization (Company Limited by Guarantee without shareholders) registered in Singapore (Unique Entity Number 201709179W). Its mission is to advance Litecoin for the good of society by developing and promoting state-of-the-art blockchain technologies.” Source

How is Litecoin Different From Bitcoin

- The Litecoin Network aims to process a block every 2.5 minutes, rather than Bitcoin's 10 minutes, which its developers claim allows for faster transaction confirmation.

- Litecoin uses scrypt in its proof-of-work algorithm

- The Litecoin Network will produce 84 million Litecoins, or four times as many currency units as will be issued by the Bitcoin Network.

Developments

In a 2013 interview for Coindesk.com, Lee makes a now prophetic statement.

“The bitcoin market is worth $2bn, so they don't want to make any big changes that could lose them a lot of money. We are able to take more risk. Our community is smaller, so it's easier for us to convince a large proportion of people to upgrade.” It’s harder for Bitcoin miners to do that, he points out.

“There are a lot of things that require a hard fork and Bitcoin is wary of that,” he explains. Consequently, the Bitcoin developers sometimes talk to the Litecoin team to see if it will consider an experimental feature for its altcoin, if they are unwilling to take the risk. Source

This in fact has come to pass, Litecoin successfully activated SegWit in May 2017.

Another notable development that occurred today is the Litecoin Foundation announced “After years, the Litecoin team finally got a full-time developer.”

Why You Should Care

Now that Litecoin has successfully activated SegWit they are now able to introduce Lightning Network. The Lightning Network, if implemented could make the following changes.

Instant Payments. Lightning-fast blockchain payments without worrying about block confirmation times. Security is enforced by blockchain smart-contracts without creating a on-blockchain transaction for individual payments. Payment speed measured in milliseconds to seconds.

Scalability. Capable of millions to billions of transactions per second across the network. Capacity blows away legacy payment rails by many orders of magnitude. Attaching payment per action/click is now possible without custodians.

Low Cost. By transacting and settling off-blockchain, the Lightning Network allows for exceptionally low fees, which allows for emerging use cases such as instant micropayments.

Cross Blockchains. Cross-chain atomic swaps can occur off-chain instantly with heterogeneous blockchain consensus rules. So long as the chains can support the same cryptographic hash function, it is possible to make transactions across blockchains without trust in 3rd party custodians.

Litecoin could very well be the testing ground for future changes in Bitcoin. At the moment, while the Bitcoin scaling debate remains unresolved, Litecoin is taking advantage of the opportunity. Several Companies who used BTC for payroll or transactions may now switch over to Litecoin.

More on that soon...

Also, be sure to check out my recent article about the relationship between Bitcoin, Litecoin and Gold and Silver.

If you are interested in buying BTC,LTC or ETH check out Coinbase, you will get $10 of free BTC after your first $100 BTC purchase, using the link below.

Coinbase.com

KeepKey Hardware Wallet, the wallet I use.

KeepKey

If you want to stay up to date on crypto news follow my blog @digicrypt.

DASH: XgQ9NBonMoCPKhF37agY4W8zk7gwQFnwGV

Litecoin: LfqygtBxy3AJgEpTnTMUYGEoTYEcED8YPZ