5 Altcoins With The Best Chance Of Going Parabolic [Original Content | Investing | 10 Minute Read]

Written by: DogGuy

Hello steemit community! Thank you for checking out my latest post where we discuss 5 altcoins that have the best chance of going parabolic. Now when I say parabolic we're talking x5, x10 sometimes even x20 returns on a coin. STEEM is actually a perfect example of this as it went parabolic around 3 weeks ago.

Disclaimer

The following article is the expressed opinions of only myself and should not be taken as investment advice. At the time of writing this article the author (myself) holds a long position in mentioned MaidSafe and holds no other interest in any of the other coins shown or mentioned. Please invest at your own risk and PLEASE do your research prior to making any investment decisions.

#5. BitShares (BTS)

Unless you're brand new to altcoins, you probably have at least heard of BitShares. It's one of the longer standing projects in the altcoin space and their primary focus at this point in time are market pegged assets. This is a great article that discusses some of the current upsides to the project and while the article seems to be a little over biased, I would say provides some good information.

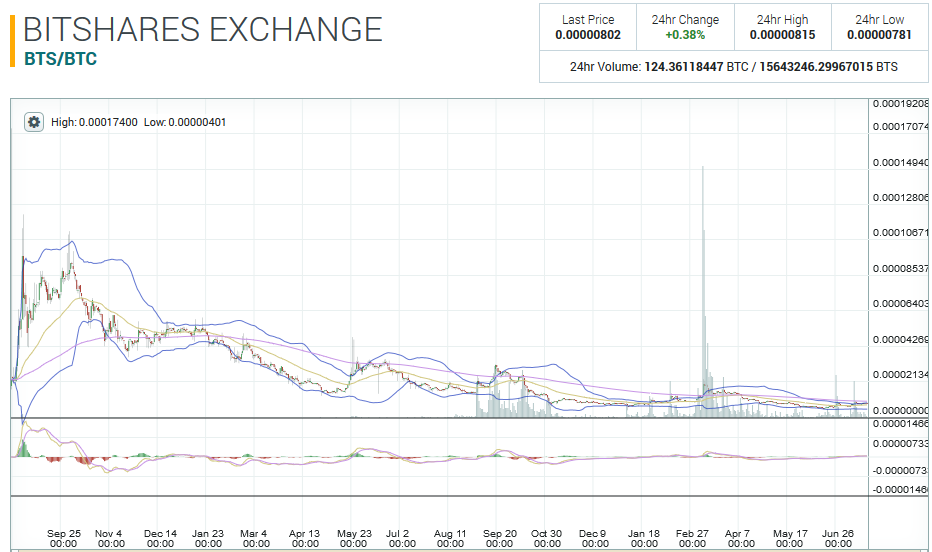

Now if we look at this price history of BitShares you'll see they have more/less been in a downtrend going back over a 2-3 year period. No question BitShares has been a disappointing investment for many traders over the last few years but if we look at BitShares today, it's currently near it's all time low (0.00000401 BTS/BTC) and with it's involvement in both STEEM and OpenLedger projects to me has a bright future.

As an example, a x10 return would put BitShares' market cap at $130,000,000 which would place them #6 overall. I don't think that is unrealistic but in order for this to occur they are going to need to setup their adoption rate for OpenLedger (their trading platform) and continue to show a strong integration into STEEM. Strategic partnerships play an important role for this coin and the success of their related projects is critical.

Overall BitShares comes in at #5 on my list for their low price relative to historic averages and the strong technology behind the project.

#4. Radium (RADS)

With an overall market cap of $1.21 million, Radium is going to be the smallest project on my list today. Their Wiki page provides a pretty thorough breakdown of the technology and if I were to simply what the Radium/their SmartChain technology provides; it would be smart file sharing. What this allows is for a verification process linked to file sharing that in theory would prevent any malicious tampering to a downloadable file. A good example they provide is when the Linux Mint website was hacked and a the iso files were injected with a dirty file. If they had been on the SmartChain with their original file verified, users would have seen the files had been tampered with and prevented any further damage.

If we look at the historic pricing of Radium it's currently at or close to a 6 month average. An important thing to note when discussing Radium is that the coin did go through a rebranding phrase in early 2016 and previously was valued at a significant discount to current prices. However, regardless of that fact - they have a working product in the SmartChain, their main developers (Tim-Tim2013 & jj12880) are very active & responsive to the community and truthfully there is no reason why every company/website in the world isn't using the SmartChain technology at this point already. Adoption plays a major role in this team's success and as a small team with limited resources they have a uphill fight to get to a point where they are well known in the crypto space.

As an example, a x10 return would put the price of Radium at roughly 0.0066 RADS/BTC which would only be x3 greater than the coin's all time high price (.00248 RADS/BTC). However if we look at this from a market cap point of view, a x10 growth would still only value the coin at $12.1 million which would still put them at #20 overall in the crypto space. Given they have a working technology and active development team -- I don't think that is asking too much.

Overall Radium comes in at #4 due to their working technology and the fact they are only ranked #72 regarding market cap size with a valuation of $1.2 million.

3. SYScoin (SYS)

SYScoin comes in on my list at #3 as the self proclaimed "business on the blockchian". SYScoin is best categorized in my eyes as an e-commerce solution cryptocoin as they work on integrating traditional e-commerce platforms (like WooCommerce & Magento) with that of the blockchain. A lot of people compare them to Open Bazaar and given OB has a working client - see SYScoin as the long shot to taking over the space. They already have a working relationship with Microsoft (MSFT) on their Azure project and there are rumors to be that SYScoin and Microsoft have been in talk of a future partnership regarding their soon to be released Blockmarket platform. The fact that SYScoin clearly is working towards partnerships with already developed companies is what gives me optimism they have the potential for large returns.

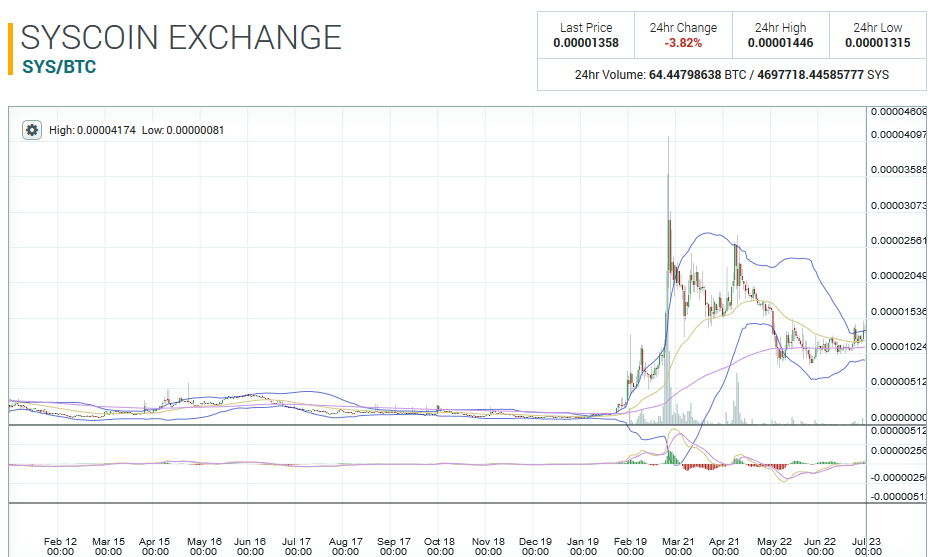

If we look at the historic pricing of SYScoin we'll see first of all they experience a parabolic rise back in early March of this year with the release of their 2.0 interface. Yet at today's current prices of 0.0000135 (SYS/BTC) SYScoin it's still about 1/3 of the all time high (0.000041 SYS/BTC) and if a partnership with Microsoft ever comes to fruition, jumping x10 in size doesn't seem out of the realm at all.

As an example, a x5 return based on the current market cap size of $3.77 million would put SYScoin at #18 overall with a $18.85 million market cap. With the goal of becoming the big player in the blockchain/e-commerce space - if they are able to continue building out the technology, work on partnerships, not only with Microsoft but other platforms like WooCommerce & Magento -- I would say they have a great chance of seeing high returns.

SYScoin comes in at #3 due to their future tech with their Blockmarket platform and potential strategic relationships with well developed tech companies.

#2. Ethereum (ETH)

Second only to bitcoin in regards to both market cap and daily trading volume, Ethereum stands today (in my option at least) to be the best altcoin in crypto to dethrone bitcoin as the #1 cryptocurrency overall. Ethereum's potential is in that of the decentralized applications (DAPPs as they are called) that are built on top of their platform. Ethereum has such a strong following, many of its community members get upset when you refer to it as an "altcoin" due to the diluting nature of that term.

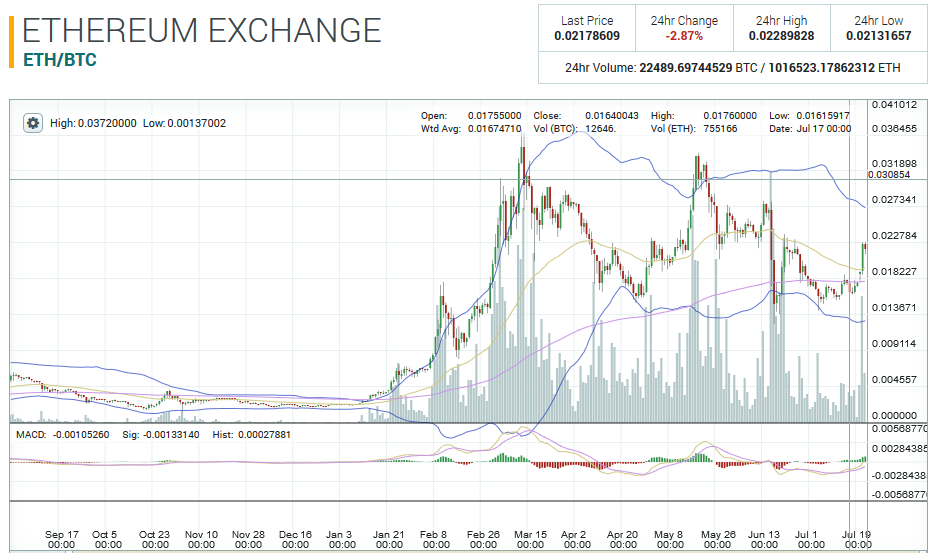

Ethereum has already seen parabolic price movement in the first half of 2016, although recent current events with The DAO project getting hacked and the need for Ethereum to hard fork has put a lot of pressure on the team both from investors as well as miners. However in my opinion the overall success of Ethereum lays in the hands of those outside of the crypto currency space that wouldn't even understand what a hardfork is, or for that matter care about The DAO project. In my opinion the true success of Ethereum will rely in the adoption of the technology from big players such as Microsoft (MSFT), big banks like J.P. Morgan (JPM) and others such a Google (GOOG) and Amazon (AMZN).

If we look at the historic price of Ethereum we see that it's currently valued at roughly 3/5th of it's all time high (.037 ETH/BTC). The DAO hack/hard fork situation caused a 50% drop in price but since that event in mid June Ethereum has recovered nicely.

As an example, a x5 return of Ethereum's current price would put it's valuation at $5.85 billion, still roughly 1/2 that of bitcoin and I personally don't see that as too far a stretch given Ethereum's potential for corporate adoption. The main advantage I see between Ethereum over bitcoin are the ability for American corporations to adopt the Ethereum technology in a way that cannot (or choose not to) do for bitcoin.

Ethereum comes in as the runner-up on my list today for their strong development team, strategic relationships with corporations and the technology behind DAPPs & smart contracts.

#1. MaidSafeCoin (MAID)

Coming in at #1 on my list today is MaidSafeCoin (or MaidSafe for short) as the altcoin with the most potential to go parabolic. Best described as internet 2.0 MaidSafeCoin is part of the SAFE Network which has been a project in development dating back to 2006. The overall goal of the SAFE Network is to create a new, decentralized internet - which, if accomplished could have the most potential for world adoption among all the projects in crypto currency today.

Part of the naysayers against MaidSafe argue that it's too large of a project to tackle and that some of the technology promised behind delivering an internet 2.0 isn't possible. In addition investors worry that the conversion from MaidSafeCoin to what will be the SAFEcoin upon launch of the SAFE Network will dilute the overall value. However regardless of the speculation there is no doubt in my mind that when the time comes for the SAFE Network to go live the market will react with a strong force and we will see a similar trend to that in early 2016.

If we look at MaidSafeCoin's price charts going back over the last two years we see there was already parabolic movement in 2016 around mid February. That movement was on speculation that the alpha version of their SAFE Network client was soon to be released but as the development team continuously delay the release, the market has since applied downward selling pressure. Currently MaidSafe is sitting at less than 1/2 of that previous high in March and as the development team approaches the release of the alpha - there is only so much time left before investors begin to jump in again.

As an example, a x10 return on current prices (0.00012 MAID/BTC) would put the price at .0012 (MAID/BTC) which would be roughly x3 greater than it's previous all time high of .000293 with a market cap of $360 million. I believe if MaidSafeCoin and the SAFE network are able to deliver on their word a $billion+ market cap is will justified and could be easily obtained.