Introduction

This is the era where the financial world is changing a lot. Age-old problems like inflation need real lasting solutions.

There are attempts to digitize many aspects of our lives, especially in the world of finance and banking. Most notably, the advent of Blockchain technology has enabled us to digitize money via cryptocurrencies such as Bitcoin. There are many attempts on foot to apply Blockchain technology to revolutionise other areas of finance. -Whitepaper

The problem is: Many start-up companies focus on providing services that serve specific customer needs. They have the technology and financial capabilities but very rarely a financial company directly competes with banks and offer a combination of traditional financial products and groundbreaking blockchain-based services.

In addition to traditional banking products, Bankera will be providing innovative solutions for both individual customers and businesses alike, in a low-cost banking

environment. -Whitepaper

Bankera promises to improve cash flow for businesses by extending finance for payment processing against future expected payments, based on historical cash flows and expected payments.

Bankera will also address the age-old problem individual customers have, where their savings don't keep up with inflation. Bankera will create an investment product tied up to a groupf of products and services that automatically compensates for inflation.

Nowday's the financial space is being affected by blockchain-driven changes like the emergence of different kinds of cryptocurrency. The banking game has changed so much. Let’s have a look at Bangkera, the regulated digital bank of the blockchain era. Bankera’s principles are firmly rooted on these three core elements:

Technology

Technology enables all financial operations, making it the main driver of a digital bank.

Licenses

A key asset that ensures the services they will provide are compliant with the highest banking standards.

Capital

They are aiming to raise enough capital in order to meet regulatory requirements and to prevent financial crisis. They aim to satisfy all these requirements to be able to issue a loan or payback deposits as needed. All of this allows bangkera to provide world-class financial services including loans, deposits, payments and investments. They will fully support cryptocurrencies. This means people can get IBAN accounts for business and private clients at bangkera.

They will also provide debit cards and card processing services. Instant settlements are also offered by using a combination of trade financing and payment processing. Customers can also receive loans and get interest from current and savings accounts, and of course, you can still make investments in low-cost equity traded funds. All of their services are aligned with modern financial processes in new types of currency. To expand their services to core banking activities, Bankera is conducting an initial coin offering (ICO) to issue its tokens on the public blockchain.

Why should you get your own banker tokens?

The offering will be a virtual currency tokens known as a “Bankers” (BNK). Funds raised by the Bankera will be given as grant towards the development of Bankera as a project. An endowment will be made by operator of Bankera as a product towards Bankera as a company as part of its obligation toward the grant.

-Whitepaper

According to Bankera, 20% of their net transaction revenues will be exchanged to crypto assets and then, distributed to the holders of banker tokens weekly. Bankera is encouraging everyone to join the blockchain banking revolution by getting a share of banker tokens during their ICO.

Project details

Project Name: Bankera

Company Name: Finalify Ltd. (British Virgin Islands)

Currency Symbol: BNK

Type of project: Blockchain-based digital bank

Basic Company Description: Bankera is currently developing a blockchain platform where they will be offering traditional banking instruments, which will utilize fiat and cryptocurrencies.

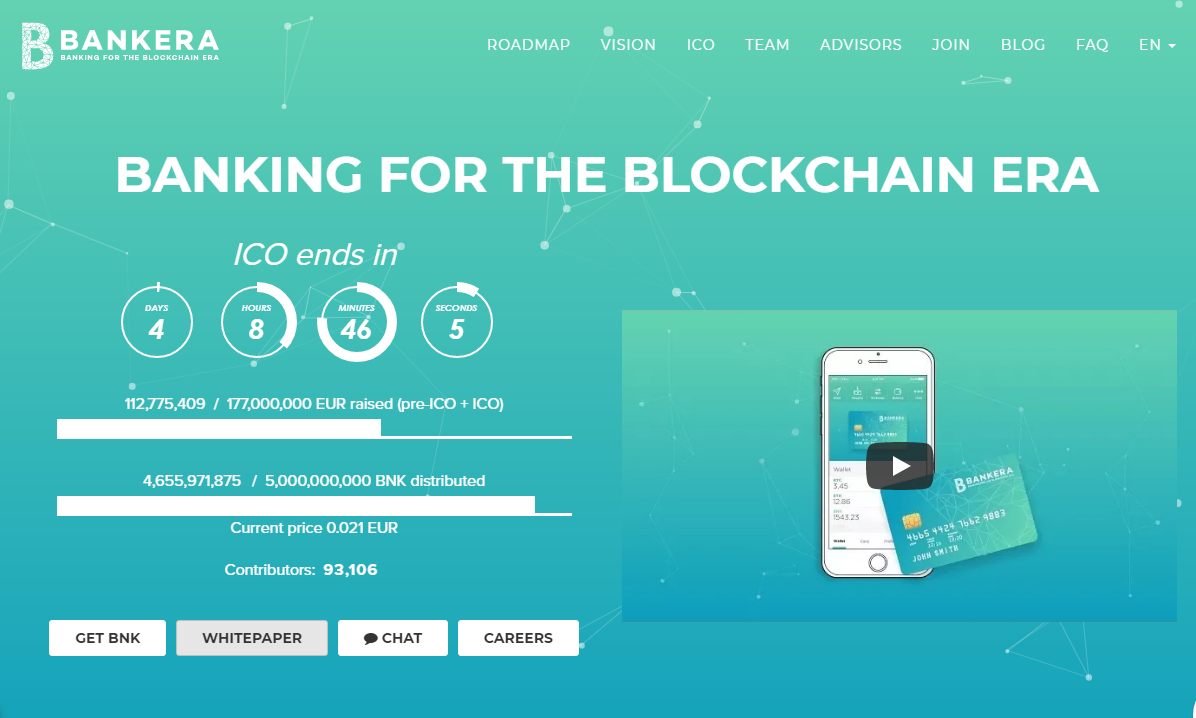

ICO details

ICO start Date: 10/15/2017 [13]

ICO End Date: 11/14/2017 [13]

Duration of Token Sale: 4.3 weeks

Token classification: ERC 20, NEM Mosaic

Total number of available tokens: 25,000,000,000

Tokens available for sale (Pre-Sale + Public ICO): 70% (10% Pre-Sale, 30% - Public ICO, 30% - SCO)

Source

Team

Staff: 7 people

Advisors and partners: 9 people

GitHub: n/a

Social media

Twitter: Posts: 392, followers: 3127

Telegram: Posts: 23, members: 1700

Medium: Posts: 7, followers: 142

Reddit: Followers: 43

LinkedIn: Followers: 264

Facebook: Followers: 15,456

YouTube: Posts: 7, subscribers: 1122

Source

Technological Details:

Bankera's infrastructure partner (SpectroCoin) provides various bitcoin-related services: the creation of virtual wallets, a virtual currency exchange, and assistance in the use, purchase or sale of currency. The team has announced the 10 process solutions are implemented on the platform, with the use of the following process solutions and cryptocurrencies:

Disclaimer:

The information presented are not to be considered financial advice. This is not an advertisement but rather information sharing. Please conduct your own research before joining any ICO. Thanks.

Please upvote, resteem and follow me, thank you.