We have a very good news coming from Japanese Bitcoin exchange called Bitflyer. Bitflyer has been granted operational license now in the UK.

BitFlyer, the sixth largest exchange by bitcoin trading volume claims to be the first bitcoin exchange to be regulated in Japan. It’s a Tokyo-based crypto exchange which was just issued a payment institutional license to operate in the European Union. The exchange reported the good news on Monday, January 22. The license was granted to the exchange by the Luxembourg regulator and it will give the right to Bitflyer to operate in Europe. According to news reports, it is one of the most compliant virtual currency exchanges in the world.

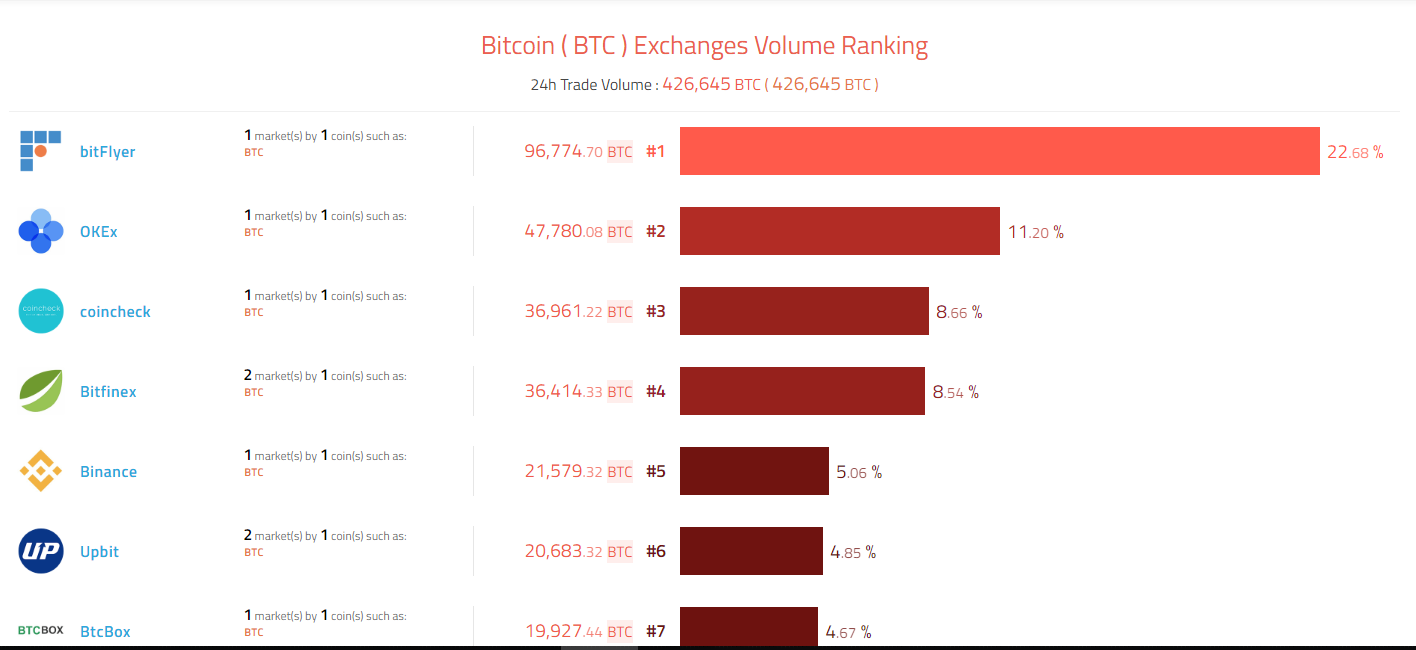

The exchange also expanded to the U.S. last year and, now, it's got a license in Europe. According to Coinhills, Bitflyer is the biggest bitcoin exchange according to volume. It's making up to 22.3% of the trade. This volume is expected to further increase as they start to market their services in the EU.

In an announcement, Andy Bryant, COO of the new European branch of the exchange, said:

"Through our web interface or API, traders can get up and running quickly and benefit from some of the most robust systems, highest speeds and an interface designed with their specific needs in mind."

Luxembourg's Minister of Finance Pierre Gramegna was quoted as saying, "We're delighted that one of the most successful Japanese startups chose Luxembourg as their EU platform."

Source

BitFlyer officially started in the U.S. last November, after receiving approval from regulators including the New York State Department of Financial Services.

This milestone gives a very positive outlook on the future of the virtual currencies, particularly bitcoin. Many can tell that EU is an environment conducive for the development of such a platform and cryptocurrencies, in general, because there is political will and the ministry of finance services said that cryptocurrencies are here to stay.

Cryptovest.com has also posted an article saying that Japan claims global leadership in cryptocurrency space. Japan snatched the top spot in the cryptocurrencies space by acquiring the proper legal provisions for crypto trading.

The japanese government has been really supportive of cryptocurrencies. In my previous post, a bank gets ahead of the game by releasing its own coin and making it easier for residents of Japan to get involved with cryptocurrencies.

On the other hand, we have seen a lot of resistance from other countries like China which seems to have declared war against cryptocurrencies, banning bitcoin mining and closing down exchanges in the past, making it really impossible for people of China to get involved in crypto-trading. Indonesian bank has announced that cryptocurrencies are not ‘proper’ forms of payment while the Indian government speaking about it you know, closing down exchanges and so forth. -But really, this is interesting to see that japan is backing it up. The land of the rising sun has now become the land of cryptocurrencies, having emerged as the top global player in the cryptocurrency market according to the Japanese Times, based on the data from Coinhills.com.

The Japanese currency, the Yen accounts for 56.2% of bitcoin as of January 15th. The us dollar was a distant second with only 28.4%, while all other currencies accounted for 15.4 percent So, we can see that the Japanese yen contribute a large proportion: More than half of the current market with relation to bitcoin. Is it really interesting to see. In the next coming months, We can expect to see this number increase but only time will tell.

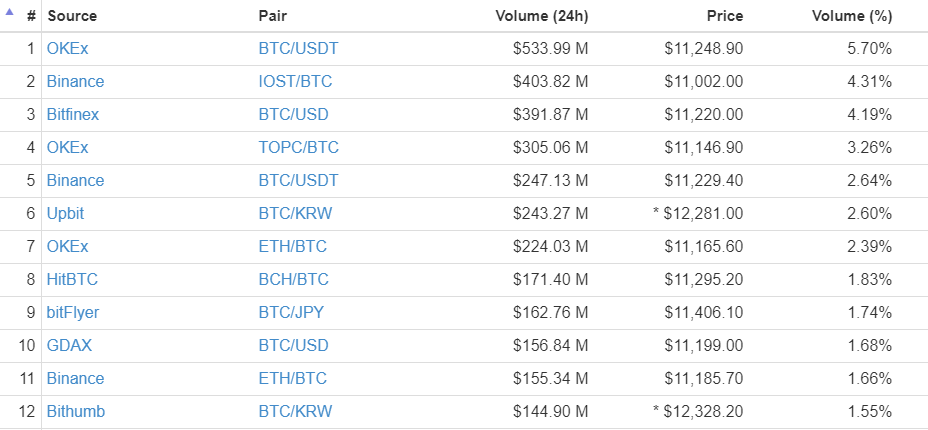

Data from coinmarketcap also shows that Bitflyer is the world's ninth-largest exchange based on volume with more than one hundred and sixty-four million trading in the last 24 hours at the time of this writing. And bitcoin is the dominant choice for Bitflyer users having account for $287M for that 24 hour trading. -That is the same amount that is traded on Coinbase. That’s right. This as a massive deal right now. It’s really interesting and awesome news to see that Bitflyer is making its way to Europe. In other news, according to geekwire, cryptocurrencies may have its ups and downs but the blockchain stuff is on the rise. We have started to see a lot of stocks personalities/companies changing their name by artistically adding digital money to their names. Even Kodak, which was once a dead company is somehow coming back by saying that it is going to create a new ICO. So far, we have seen a lot of good stuff right now but also, many take advantage of the emerging technology just adding ‘blockchain’, or something like ‘crypto-related’, or even bitcoin in its name and suddenly, their stocks just skyrocket. Personally, I think this is not the best thing to do right now because they kind of just making a hype out of blockchain but this is not what many of them are all about.

Please upvote, resteem and follow me, thank you.