(As per recent Japanese legislation, all gains on cryptocurrencies must be reported, even across crypto to crypto trades.)

I got into a bit of a debate over on Reddit,

where someone said Steemit is impractical, because it doesn’t make complying with the mess of vague legal regulations and red tape the government here in Japan has recently put forth, easy or practical.

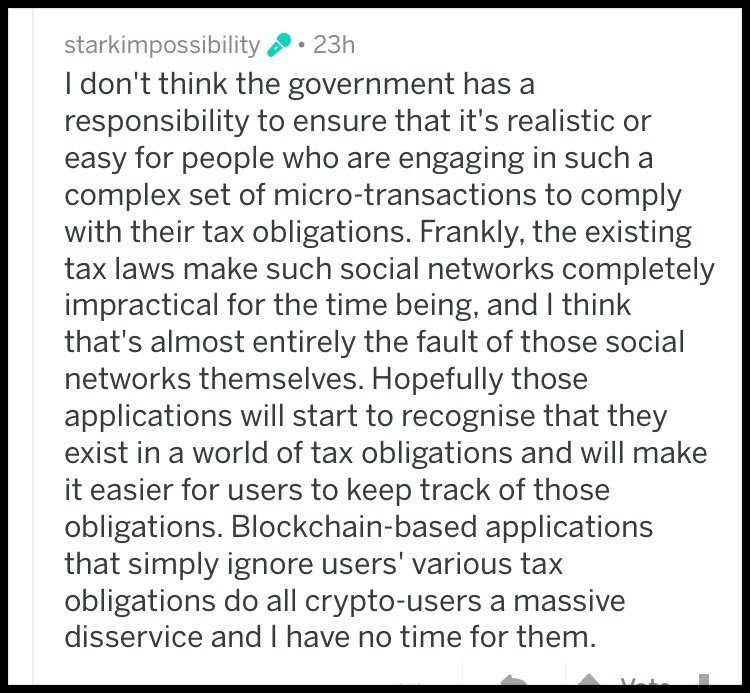

Basically, he is saying that the fault is not to be found in nonsensical laws and impossible regulations dreampt up by bureaucrats in their houses of power, but with platforms like Steemit that don’t, in his view, cater to these vague and ill-defined regulations.

I’ll post screencaps of the thread now. My final comment containing the scenario to be answered was too long to capture, so I will just post the text. If you can clearly and concisely answer the scenario put forth, I’ll send you 1 SBD.

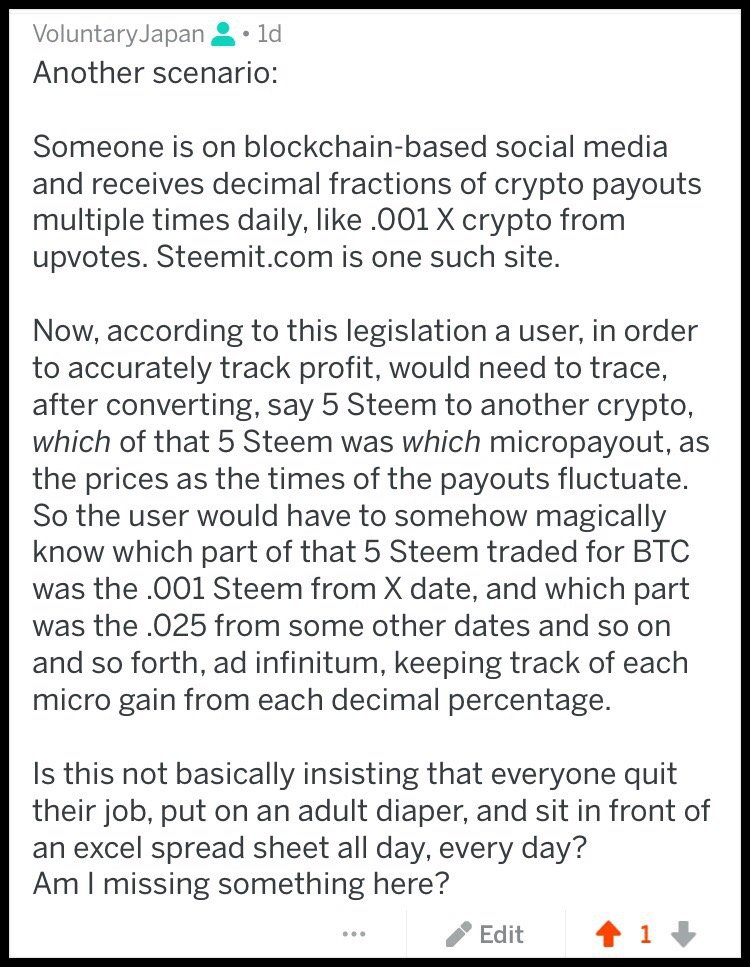

My initial comment:

His response, claiming Steemit is “impractical.”

I wonder how the boot polish tastes in his mouth, or if he understands why Bitcoin was created in the first place? Anyway, forget just for a second that taxation is legalized extortion..and let’s see whether these new regulations can even realistically be followed, regardless.

The final scenario I presented this user, after he insisted that blockchain-based SMS platforms on Steemit are “impractical,” was this, proving that the legislation makes even Bitcoin trading “impractical”:

You buy .02 BTC at X date for X price

You buy .03 BTC at later Y date for Y price

You buy .05 BTC at still later Z date for Z price

You now have 0.1 BTC

One day, you decide to trade .07 of this 0.1 BTC for some XMR. The XMR then rises in value, prior to you exchanging it for fiat, effectively “cashing it out.”

When it comes time to report your income and gains as per the Japanese crypto legislation, you will need to parse the data and be able to clearly tell how much each respective decimal of your initial BTC purchases gained. The problem is, which of the first three decimal amounts, and to what proportion, comprise the .07 BTC you traded for XMR of the 0.1 BTC total?

Was it the .02 BTC bought at X date for X price and the .05 bought at Z date for Z price? Or was it .03 of X date’s purchase and .04 of Z date’s purchase? OR, was it some combination of all three? Say, .01 BTC bought at X date/price, .02 bought at Y date/price, and .04 bought at Z date/price?

Each of these scenarios would result in a different price gain amount when factoring the gains from the respective times/prices of acquisition, across the trade to Monero, and finally up to the final exchange/purchase/“cash out.”

So who’s truly being “impractical” here?

Check out the full thread to see my comments in full, which focus on the violent nature of taxation as well as the current tax “law.”

Render unto Ceasar...

*

~KafkA

Graham Smith is a Voluntaryist activist, creator, and peaceful parent residing in Niigata City, Japan. Graham runs the "Voluntary Japan" online initiative with a presence here on Steem, as well as Tube Twitter. (Hit me up so I can stop talking about myself in the third person!)