When to sell something you love is arguably one of the hardest things to figure out when investing, even more so with speculative investments in cryptocurrency. No one really knows what's going to happen in just five or ten years because most of this space is brand new.

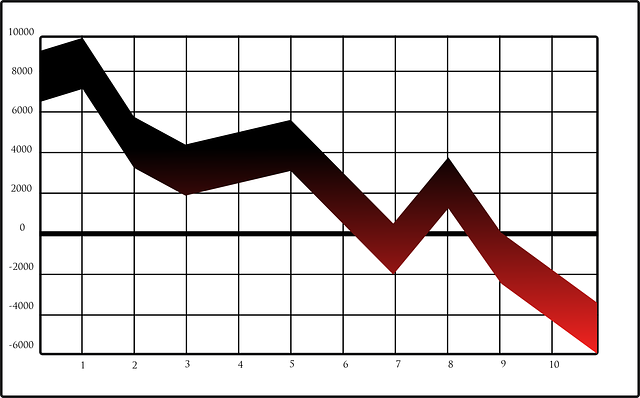

As I've been watching the correction today and thinking about experienced traders taking profits, I've been asking myself:

"Why haven't you sold anything yet? Why are you just watching the value of your portfolio go down?"

So I started to have a little internal dialogue about this which I thought you might enjoy also. It goes something like this:

- Do I need to pay off any debt right now?

- Do I need fiat currency for anything right now or within the next year or so?

- Not really. I still cut myself a check from my company every two weeks, and I've built up a liquid emergency fund my wife and I are happy with.

- If I sell now, will I lock in a loss?

- Thankfully, no. I feel like this is always a bad move unless...

- Is the crypto currency I'm considering selling soon to be a dead coin? Is the dev team gone or is it about to be delisted from major exchanges?

- In this case, yes, I should cut my losses and sell.

- Would I ever consider buying the cryptocurrencies I have now at higher prices?

- I think this is a really good, really important question. Would I buy bitcoin (as an example) at, say, $5,000? If I truly believed it would go up to $10k, $50k, $100k or more, than yeah, sure I would buy. When I ask this question of my current favorite cryptocurrencies (Bitcoin, BitShares, and STEEM), I still think they are undervalued in the long term so yes, I would continue to buy them in the future at higher prices. The same might be said for other currencies I hold and like such Ethereum, PIVX, Stratis, Waves, DigiByte, MaidSafe, Swarm City Token, LBRY Credits and others. I think they have potential, though it may take quite some time before it's fully realized. If I sold now, it seems silly to just buy again later at higher prices.

- Am I dedicated to selling now and then buying back later at a lower price, trying to catch the falling knife?

- This, I think, is the strongest argument for selling during a market correction (assuming you don't need the money and are long cryptocurrency, which I certainly am). Why not sell high and buy low? It sounds great, but... I'm just not that great at telling the future or timing the market. When bitcoin went from $1,200 down to $250 in 2014, I didn't sell. At one point I sold some, but then it started to go up again, and I bought right back in. I was too emotionally connected. I think cryptocurrency is the future, and I don't want to be on the sidelines trying to buy back in at higher prices later. At the same time, if I had sold at the top and bought near the bottom, I'd have a heck of a lot more cryptocurrency than I do right now. This is a strong argument to sell and then re-buy later.

That last point is the one I'm wrestling with right now. It involves risk, time, effort, attention, and some stress. Is it worth it? If selling and re-buying could increase my holdings by 10%, 30%, 50% or more, is it worth it?

For me, this most recent bull run shows me things can go up very, very quickly. Anything less than 50% after this run doesn't seem like much of a gain. There's also the concept of "shaking out weak hands" to consider. Often times whales will destroy a market, punishing the price using their extensive currency holdings until everyone who isn't invested long term sells. Then they scoop it all up cheap and enjoy new all time highs with more than they started with.

My portfolio today is already seeing some bounces back up...

...but are those just dead cat bounces?

Where are you with this internal dialogue?

When markets bounce around, do you sell or hold and why?

This is not financial advice, it's just a conversation.

This post was created with ChainBB for the ChainBB Cryptocurrency Forum which @jesta recently created. Portions of the payouts will automatically support that project.

Luke Stokes is a father, husband, business owner, programmer, voluntaryist, and blockchain enthusiast. He wants to help create a world we all want to live in.